Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If only

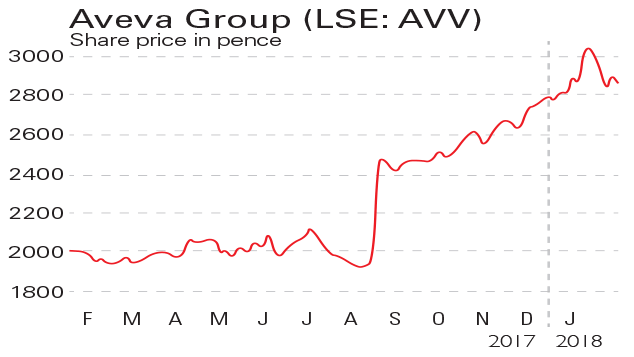

Aveva Group (LSE: AVV) markets and develops IT software and services for engineering companies. In September last year, the Cambridge-based business agreed to merge with French group Schneider Electric in a £3bn move it said would create a global leader in engineering and industrial softwarewith estimated revenues of £657m. In February this year, it announced the appointment of Craig Hayman from US software firm PTC as its new chief executive. Aveva's current boss, James Kidd, will move to a deputy position and become chief financial officer.

Be glad you didn't buy

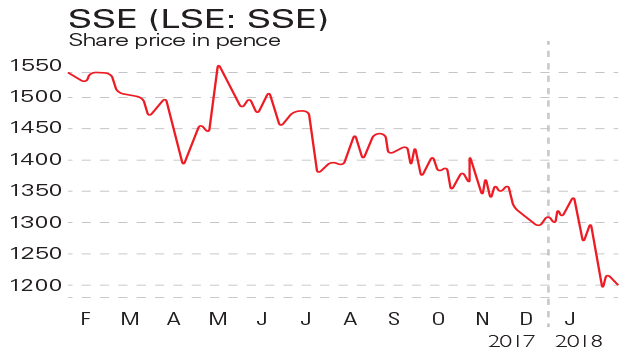

SSE (LSE: SSE)is Britain's second-largest energy supplier. It also supplies phone and broadband as well as boiler cover to UK homes. In November last year, the firm announced plans to merge and spin off its household energy supply and services businesses to German-owned Npower. However, SSE has suffered as customers move in search of cheaper energy bills. In the third quarter, 40,000 customers left, following a loss of 50,000 in the second quarter.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement today (3 March). What can we expect in the speech?

-

Investing in the energy sector – is the reward worth the risks?

Investing in the energy sector – is the reward worth the risks?The energy sector used to offer predictable returns, but now you need to tread carefully. Is the risk worth it?

-

Sector in the news: The energy companies

Features Public anger has been directed at energy companies in recent days, says Phil Oakley. Yet, these two providers could be worth buying for the long term.

-

Shares in focus: Stability and growth from Scottish energy

Shares in focus: Stability and growth from Scottish energyFeatures There's plenty to like about this utilities stock. But do the shares represent good value, and is now the time to buy in? Phil Oakley investigates.