Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

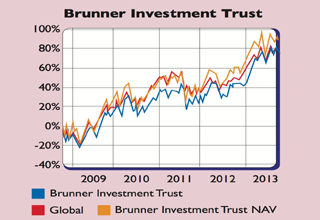

If you agree that developed markets have "regained the fire in their belly and are set to storm ahead" of emerging markets over the next 12 months, writes Kate Morley in the Investors Chronicle, the Brunner Investment Trust (LSE: BUT) may be worth investigating.

Established by the Brunner family in 1927, the trust has a 40-year record of dividend growth. Two managers split responsibility for UK and global equities. On the UK side is Jeremy Thomas, with 17 years' experience under his belt, while Lucy Macdonald, who has 20 years' equity experience, takes care of the global side.

Just 8% of the fund is in emerging markets (with 1% in Latin America and the rest in the Asia Pacific region), according to Trustnet. It is 44.6% invested in Britain, with 21.4% in North America and 11.6% in European equities.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

With "signs of better economic activity" in the developed world, the pair think Europe could "see at least a stabilisation in growth momentum in the second half of the year", while "US growth could surprise on the upside", as long as political agreement is reached on its debt ceiling .

Thomas plans to raise his exposure and buy more banking stocks this year. It has delivered a return of 25.6% over one year and 44.6% over three years. Trading at a 14% discount, and with an ongoing charge of 0.81%, it looks a reasonably cheap way to boost exposure to developed markets.

Contact: 0800-389 4696.

Brunner Investment Trust top ten holdings

| Name of holding | % of assets |

| Royal Dutch Shell | 3.30% |

| GlaxoSmithKline | 3.10% |

| HSBC | 3.10% |

| BP | 2.80% |

| Vodafone | 2.70% |

| Reed Elsevier | 2.00% |

| UBM | 1.50% |

| Tesco | 1.40% |

| Rio Tinto | 1.40% |

| AbbVie Inc | 1.40% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King