Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

As a South African I have long had a particular interest in platinum, even in 1988 prematurely launching the world's first newsletter devoted to investing in it, with an annual subscription that was uniquely priced at one ounce of the metal.

Platinum is much rarer than gold or silver, with characteristics that favour its use in industry in an age increasingly concerned about protecting the environment. Half of world demand is for use in autocatalysts, where it destroys gaseous pollutants in vehicle exhaust fumes.

Compared to the better-known precious metals, there is greater political and geological risk to supplies, as production is largely restricted to a handful of mines in just two countries South Africa and Russia where almost all the world's reserves are concentrated.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

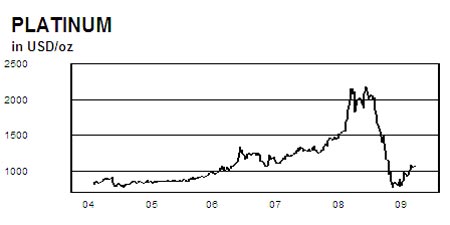

The extraordinary turbulence in investment markets of the past year saw platinum soar to $2,273 an ounce, then collapse to $763, before bouncing back. It is currently trading at about $1,150.

Over the past 12 months platinum, like silver, has seriously underperformed gold. It has averaged $1,319, or about 13% below its average dollar price over the preceding year, whereas gold was 12% higher over the same period.

This can be attributed to the metal's greater exposure to fluctuations in industrial demand, and in particular to purchases by the auto industry, which has been hit hard by global economic collapse.

If you look at five-year figures (see table below), several trends are apparent:

Explosive growth in investment demand. Retail investment (bars and coins) is estimated by the leading independent research consultancy GFMS to have gone from a negligible figure five years ago to 6% of total demand in 2008.

Even more important has been a major change in institutional activity.

Five years ago holders of the metal were disinvesting or depleting their stocks to meet industrial demand at an annual rate of 721,000 oz; last year the opposite was happening to the extent of 265,000 oz a swing in the supply/demand balance of almost a million ounces a year over the period.

GFMS reckons in its latest annual study* that the two ETFs (exchange traded funds) buying and holding physical metal accumulated 102,000 ounces last year, with activity in the OTC (over-the-counter) investment market by other funds probably soaking up most of an additional 162,000 oz surplus supply.

Owners of jewellery are cashing in. Trade in jewellery scrap nearly doubled to 910,000 oz last year, as families and businesses squeezed by the credit crisis sought to raise cash by selling assets, encouraged to do so by high prices from sale of their platinum valuables.

Demand for jewellery is falling. Not only because the wealthy have less to spend on jewellery, but also because of strong competition in recent years from the cheaper alternative, palladium.

The latter has long been used in alloys such as white gold, but was not favoured as a jewellery metal in its own right because it is much lighter than platinum, weighing only half as much for the same volume of metal.

This changed when platinum became so expensive that the jewellery industry, particularly in China, saw the potential for making and marketing much cheaper pieces made of palladium.

That's why over the past five years annual consumption of palladium in jewellery manufacture has soared 237%, while consumption of platinum has fallen 42%.

TABLE.ben-table TABLE {BORDER-BOTTOM: #2b1083 3px solid; BORDER-LEFT: #2b1083 3px solid; FONT: 0.92em/1.23em verdana, arial, sans-serif; BORDER-TOP: #2b1083 3px solid; BORDER-RIGHT: #2b1083 3px solid}TH {TEXT-ALIGN: center; BORDER-LEFT: #a6a6c9 1px solid; PADDING-BOTTOM: 10px; PADDING-LEFT: 5px; PADDING-RIGHT: 5px; BACKGROUND: #2b1083; COLOR: white; FONT-WEIGHT: bold; PADDING-TOP: 10px}TH.first {TEXT-ALIGN: left; BORDER-LEFT: 0px; PADDING-BOTTOM: 5px; PADDING-LEFT: 2px; PADDING-RIGHT: 2px; PADDING-TOP: 5px}TR {BACKGROUND: #fff}TR.alt {BACKGROUND: #f6f5f9}TD {TEXT-ALIGN: center; BORDER-LEFT: #a6a6c9 1px solid; PADDING-BOTTOM: 5px; PADDING-LEFT: 2px; PADDING-RIGHT: 2px; COLOR: #000; PADDING-TOP: 5px}TD.alt {BACKGROUND-COLOR: #f6f5f9}TD.bold {FONT-WEIGHT: bold}TD.first {TEXT-ALIGN: left; BORDER-LEFT: 0px}

Supply and demand fundamentals

| Row 0 - Cell 0 | Platinum | Palladium | ||||

| Supply | Troy ounces (000s) | Row 1 - Cell 2 | Troy ounces (000s) | Row 1 - Cell 4 | ||

| South Africa | 4,696 | 4,671 | -1% | 2,298 | 2,366 | 3% |

| Russia | 834 | 835 | 0% | 2,732 | 2,712 | -1% |

| Canada & US | 281 | 342 | 22% | 889 | 908 | 2% |

| Zimbabwe | 139 | 180 | 29% | 111 | 140 | 26% |

| Total mine supply | 6,026 | 6,151 | 2% | 6,172 | 6,381 | 3% |

| Autocatalyst scrap | 736 | 998 | 36% | 402 | 1,184 | 195% |

| Jewellery scrap | 168 | 910 | 442% | 39 | 195 | 400% |

| Total supply | 6,929 | 8,059 | 16% | 6,614 | 7,759 | 17% |

| Demand | Row 10 - Cell 1 | Row 10 - Cell 2 | Row 10 - Cell 3 | Row 10 - Cell 4 | Row 10 - Cell 5 | Row 10 - Cell 6 |

| Autocatalysts | 3,166 | 3,814 | 20% | 4,115 | 4,416 | 7% |

| Jewellery | 2,831 | 1,646 | -42% | 386 | 1,301 | 237% |

| Electronics | 335 | 378 | 13% | 1015 | 1,347 | 33% |

| Chemicals | 335 | 346 | 3% | 255 | 385 | 51% |

| Dental | Row 15 - Cell 1 | Row 15 - Cell 2 | Row 15 - Cell 3 | 796 | 776 | -3% |

| Other industrial | 975 | 1,157 | 19% | 95 | 91 | -4% |

| Retail investment | 8 | 452 | 5550% | 55 | 84 | 53% |

| Total demand | 7,650 | 7,794 | 2% | 6,718 | 8,399 | 25% |

| Surplus/deficit | -721 | 265 | Row 19 - Cell 3 | -104 | -640 | Row 19 - Cell 6 |

Where do things go from here?

Peter Ryan, GFMS's senior consultant, says the outlook for platinum is "very fragile" because of the collapse in motor vehicle production, which could easily continue to fall, perhaps by another 15% this year.

Jewellery demand should recover, and would do so strongly should the platinum price fall back to the $900 region.

Support from investors, he says, is "ever more critical."

As retail investment demand is price-sensitive, it's likely to ease considerably unless there is a sharp fall the price of the metal. When that happened last year, the Japanese who appreciate platinum more than most - were queueing up to buy tiny bars of the stuff.

However, institutional demand continues to underpin the market. Total holdings by the two ETFs one listed in London, the other in Zurich topped 500,000 oz last month.

GFMS expects platinum to trade in a price range between $900 and $1,375 this year.

Although similar factors are likely to drive palladium, GFMS is a little less optimistic about the metal, as above-ground stocks are equivalent to about one year's demand, compared to just three months' in the case of platinum.

Increased sales by the Russian state are "most likely" this year.

In jewellery, palladium "lacks the dynamism" that platinum enjoys resulting from many years of retail development. There is some evidence that low prices actually depressed retail demand in China, in contrast to the way they boosted demand for platinum in Japan.

Why? My guess is that the Chinese tend to perceive lower prices as an indication of less value, therefore less attractive, while the Japanese view them as a good opportunity to buy on the cheap.

On the other hand, the longer-term trend is for an increasing annual deficit in the palladium supply/demand balance (excluding institutional demand and inventory movements), in contrast to the trend to surplus in platinum.

GFMS forecasts palladium will trade between $170 and $325 this year.

The consultancy says it believes "precious metals in general will continue to attract investors in 2009 against a background of weak stock markets and long-term inflation worries, as they seek shelter in these products for wealth preservation."

Investment conclusions

I broadly agree. My expectation is that prices of all the precious metals will be somewhat sluggish for a few months before their bull markets resume later this year or in 2010, as bad news about defaults in the personal and corporate credit markets signal that the expected economic recovery won't happen soon.

There are few listed mining companies that exploit the PGMs (platinum, palladium and four even rarer metals usually found in the same ores) as their primary products.

Conservative investors will prefer to avoid their political, currency, geological and management risks, and invest in the metals themselves via physical metal (bars and coins), or the easily-traded ETFs, or Perth Mint certificates.

This article was written by Martin Spring in On Target, a private newsletter on investment and global strategy. Email Afrodyn@aol.com to be included on the recipient list.

* The Platinum & Palladium Survey 2009 can be obtained from GFMS at $595 a copy. Contact: Elena Patimova on +44 (0) 20 7478 1777. Email: sales@gfms.co.uk and mention On Target newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how