Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Today, I want to take a look at the bigger picture for gold.

As you'll probably know by now, I believe we are in a long-term bull market for gold and silver, so I hold a core position in these metals at all times. Of course I have my short-term trading money as well, to play any opportunities I see along the way. Sometimes I get these calls right and I make money, sometimes I don't.

Looking at the shorter-term picture for gold, I think sentiment is a little too euphoric, that there is too much hot money in the sector and so we are due some kind of shake-out. But I won't be selling any of my core holding. Because in the long-term I think we are going a lot higher. And, short-term, it is too easy to get the call wrong.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So what would make me consider selling my core position? Here are three warning signs that would show that the end of gold's bull market is nigh...

Warning sign no. 1: Central bankers get serious

One common and justifiable criticism of gold is that it pays no interest. In fact, when you factor in storage charges, it actually costs you money to own it. People rightly ask: what is the point of owning something that doesn't earn you any interest?

But now we have reached a stage where cash be it yen, dollars, euros or pounds pays no significant interest either. Once you factor in inflation, even at 2% or so (depending on which measure you use), your cash is costing you money on an annual basis.

Interest is the compensation, if you like, for owning ever-depreciating cash, as opposed to something more tangible. That's why so many people are thinking: "If my cash is earning me no interest, I'll own gold instead". It seems the various cash-rich central banks feel the same way, with India, Russia and China increasing their gold holdings of late. And such is the stress in the banking system, and the desire of the authorities to prop it up whatever the cost, I do not see this environment changing any time soon.

In late 1979 and early 1980, at the peak of the last bull market in gold, after a decade of lurching from one economic crisis to another, policy-makers began to stand-up and be reckoned with. Painful decisions, which needed taking, were finally taken largely with the support of the electorate. Maggie Thatcher rightly or wrongly stood up to the unions. Paul Volcker hiked interest rates to fight inflation and, in doing so, thrust the US into recession. Taxes were slashed to kick-start business; government spending was reined in. A new period of growth was ushered in and the gold price duly collapsed.

I do not see any sign of Barrack Obama, Gordon Brown, his heir apparent, or any other Western leader taking such steps. The time will come, I'm sure perhaps we need a few more economic crises first but we're not there yet. When I see signs of steps in that direction not jawboning, but actual steps that will be a sign to start taking some gold off the table. Gold is not a good asset to own during periods of growth or of economic and credit expansion. In fact it is about the worst thing you can own. The 80s and 90s are proof enough of that. But this is not a period of growth. It is a period of credit stress and gold is about the best asset to own in such an environment.

- Why UK property prices are going to fall 50%

- When it will be time to get back in and buy up half price property

Warning sign no. 2: You can buy a house for 120 ounces of gold

A small, but enlightened group of people chose not to buy property after 2005, as the market edged towards its peak. Many invested in gold instead. Others got out of property close to the peak in some cases right at the peak and put their capital into gold.

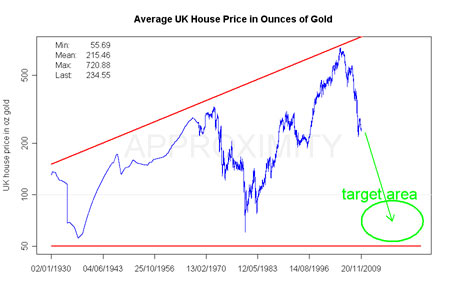

At some stage these people will want to move their capital out of gold and back into property. So an interesting way to value gold is by comparing UK house prices to the gold price. Mathematician Tom Fischer, a lecturer at Heriot-Watt University in Edinburgh, has put together the following chart, showing the ratio between UK housing and gold (https://www.approximity.com).

Gold currently costs about £690 an ounce. The average UK house, according the Nationwide, sits at just above £162,000. That means it takes a sterling equivalent of about 235 ounces to buy the average house.

As you can see from the green circle above, Fischer sees that ratio falling well below 100. I wouldn't disagree with him. But if it nears 120 ounces, I will be 'seriously reconsidering' my core position. That could mean house prices staying where they are and gold rocketing from here. It could also mean gold staying where it is and house prices plunging. I suspect the most likely scenario is somewhere between the two.

Let's say gold appreciates 30% from here to £900 an ounce (very likely, I would say). And average house prices fall 30% to £110,000 (also likely). Then, give or take, you have your ratio of 120. Those who stayed off property and bought gold would have made 30% on both sides.

So 120 ounces of gold and very possibly lower for the average UK house is another of my long-term targets. We could go right back to 55.

Warning sign no. 3: You can buy the Dow for less than five ounces of gold

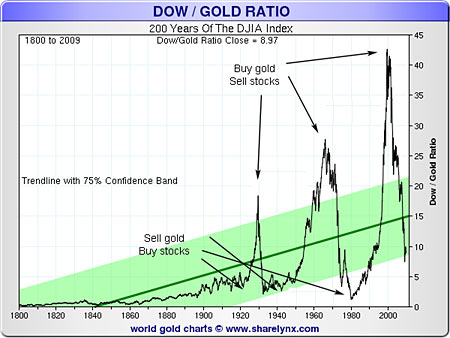

Finally, another ratio I like to look at is how many ounces of gold it takes to buy the Dow Jones Index (you just divide the Dow by the gold price). With gold at $1,150 an ounce and the Dow at 10,300, it currently takes just below nine ounces of gold to buy the Dow. I reckon this ratio will fall below five and could even return to one in extreme circumstances. (Thanks to Nick Laird of Sharelynx for the chart below).

Let's use a ratio of three, for sake of illustration. At a ratio of three, with the Dow unchanged at 10,300, would imply a gold price of $3,433. If the Dow slid to 7,000, that would give suggest a price of $2,333 for gold. Perhaps the Dow could retest 14,000, in which case $4,666 gold becomes a possibility.

These might seem like silly numbers, but this is a bull market and you should never underestimate the insane euphoria generated at the end of a bull market. These ratios between markets help you to keep your head and show what is possible.

I'll be looking at how gold relates to the money supply later this week, and what that suggests for the long-run gold price. Meanwhile, if you want to know more about how to buy gold, then take a look at my cover story in last week's issue of MoneyWeek magazine: A bite from the gold bug is good for your wealth (if you're not already a subscriber, then subscribe to MoneyWeek magazine).

Our recommended article for today

Is the FTSE finally running out of steam?

The stockmarket rally isn't the sign of a new bull market, it's a 'secondary reaction' in a primary bear market. And it could be running out of steam. Here's why.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now