Shares in focus: Stability and growth from Scottish energy

There's plenty to like about this utilities stock. But do the shares represent good value, and is now the time to buy in? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Where else can you find income like this? Fill your coffers with these shares, says Phil Oakley.

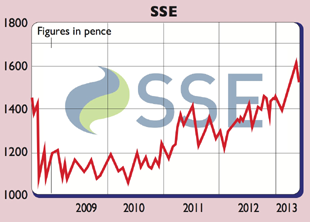

The shares of SSE have proved to be among the most reliable on the British stock market over the last decade or so. Under the leadership of the soon to be departing Ian Marchant, the company has followed a very simple but effective strategy to increase the annual dividend by more than inflation.

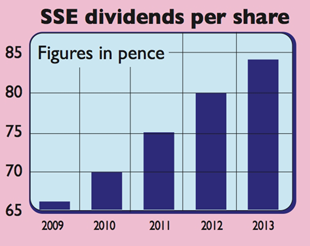

Since Scottish Hydro and Southern Electric got together to form SSE nearly 15 years ago, annual dividends have more than trebled from 25.7 pence per share in 1999 to 84.2 pence in 2013 an average annual rate of growth of 8.8%. The total shareholder return (the combined return from dividends received and changes in the share price) has been a very decent 360% much better than the British stock market as a whole. SSE has benefited from having a balanced portfolio of stable, regulated businesses and market-based ones that have given it an attractive combination of stability and growth.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That said, I wonder whether retiring CEO Ian Marchant, 51, thinks SSE's best days are behind it.

A record of growing dividends

Looking forward, making more money from generating and selling electricity is going to be hard. SSE's retail energy business, which has 9.5 million customers, is busy trying to rebuild its reputation after being found guilty of mis-selling its products. Winning new customers looks unlikely in the short term. On top of that, Ofgem, the industry regulator, wants to break the stranglehold the big energy suppliers have on the market by forcing them to sell more of the electricity they generate to independent retailers.

But there is a potential silver lining here. Britain is running short of electricity capacity and some industry insiders are warning that there is a danger of the lights going out in 2015/2016. This means that SSE's remaining hydroelectric and wind generating assets could make more money. SSE's gas stations should also become more profitable. The real grounds for optimism on SSE's prospects come from its regulated gas and electricity network businesses, which account for roughly half of its total profits.

The electricity transmission grid in the north of Scotland needs lots of money spending on it to connect offshore wind farms and give better electricity supplies to many outer islands. The gas distribution networks in Scotland and the south of England also needs upgrading. This should see SSE's regulated asset bases grow quite nicely. These businesses should be able to make enough money for SSE to keep growing its dividends for the next few years. Both businesses have just begun an eight-year pricing period, so the risk of regulatory interference, which often worries investors, is quite low.

Elsewhere, there's much to like about SSE. Despite being a regulated and asset-intensive business, it has a return on capital employed of 13% (better than Tesco and Sainsbury's). Its finances are in good shape, its debt load is manageable and it has one of the strongest balance sheets of all European utilities. It thus has no problem paying its interest bills.

At 1,525p, the shares offer a prospective dividend yield of 5.8%, which is covered 1.3 times by expected earnings. I think the dividend can keep on growing. With reliable sources of income in short supply, buying shares in SSE and using a growing dividend to buy more looks sensible.

Verdict: buy

SSE (LSE: SSE)

What the analysts say

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

Investing in the energy sector – is the reward worth the risks?

Investing in the energy sector – is the reward worth the risks?The energy sector used to offer predictable returns, but now you need to tread carefully. Is the risk worth it?

-

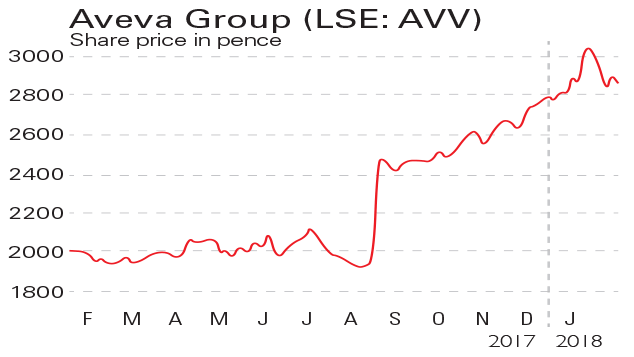

If you’d invested in: Aveva and SSE

If you’d invested in: Aveva and SSEFeatures IT software group Aveva is hoping to become a global powerhouse, while energy supplier SSE is seeing customers leaving in their droves.

-

Sector in the news: The energy companies

Features Public anger has been directed at energy companies in recent days, says Phil Oakley. Yet, these two providers could be worth buying for the long term.