What is the yield curve telling us?

Britain's steepening yield curve is just the thing to whip bankers up into a frenzy of excitement. But what is it, and what does it mean for you? Tim Bennett explains.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

There is "nothing bankers like more than a steepening yield curve", says the MarketWatch blog, The Tell'. But why, and what do yield curves tell investors?

Yield curves are a way of comparing the total return (yield) available on similar bonds with different maturities (repayment dates). Let's take, say, three UK government gilts. The first is very short term and due to be bought back by the government in two years' time. In other words, investors will get the face value of the bond back then. The second will not be bought back for ten years, and the third has 30 years to run. The yield on each of these is the total expected annual return, made up of an interest payment (a coupon' in bonds jargon), and a capital gain (or loss, depending on what price you bought the bond at).

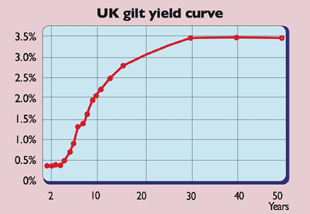

Right now the typical yield on a two-year UK gilt is more like 0.45%, on a ten-year gilt it's just over 2% and on a 30-year gilt it's about 3.45%. Switch to America and the equivalent figures for US Treasuries are 0.32%, 2.25% and 3.4%.If you were to plot these three points for Britain or America on a graph and connect them, you'd have an upward sloping yield curve (see chart right).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In short, the yield rises the further into the future you look. This is usually a sign of economic confidence. Indeed, the bigger the gap between the 30-year and ten-year yield, or the ten-year and two-year yield (also known as the spread'), the steeper the curve and so the greater investor confidence is assumed to be.

If investors expect the economy to grow, then interest rates are also likely to rise (to stop general prices for goods and services lifting off too fast). So anyone buying a 30-year, fixed-income bond from Britain or US governments should expect a higher return in compensation (in the form of a higher yield) than someone buying a ten-year or two-year bond.

In the reverse scenario, when investors are pessimistic, you get an inverted yield curve. This is where short-term yields exceed longer-term ones. That's because investors expect rate cuts as the economy struggles, and so will pay a premium for a bond with a decent long-term fixed income. The result long-term gilt and Treasury prices rise and yields fall, sometimes to below the equivalent yields on shorter-dated bonds.

So why is today's steepening yield curve good for banks? Well, banks make money by borrowing short and lending long. That means they take deposits from firms and individuals and, working on the principle that not all of these will be called in at once, use them to create longer-term loans and mortgages. So the bigger the gap between what they have to pay to savers, and what they can charge to lend over longer periods, the better.

But there's a nasty twist here the more economic confidence builds, the greater the chances that stimulus measures such as money printing (quantitative easing) and the various cheap money programmes, such as Britain's Funding for Lending scheme, will be withdrawn or reversed. In their current fragile state, that could be bad news for banks. That's why we don't fancy the idea of piling into the sector now, even as the yield curve steepens.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tim graduated with a history degree from Cambridge University in 1989 and, after a year of travelling, joined the financial services firm Ernst and Young in 1990, qualifying as a chartered accountant in 1994.

He then moved into financial markets training, designing and running a variety of courses at graduate level and beyond for a range of organisations including the Securities and Investment Institute and UBS. He joined MoneyWeek in 2007.

-

MoneyWeek Talks: The funds to choose in 2026

MoneyWeek Talks: The funds to choose in 2026Podcast Fidelity's Tom Stevenson reveals his top three funds for 2026 for your ISA or self-invested personal pension

-

Three companies with deep economic moats to buy now

Three companies with deep economic moats to buy nowOpinion An economic moat can underpin a company's future returns. Here, Imran Sattar, portfolio manager at Edinburgh Investment Trust, selects three stocks to buy now