Could gold really go as high as $6,000? It's possible

Gold's soaring price has striking parallels with a similar rise in the 1970s, when it touched $850 an ounce. And if history were to repeat itself, gold could peak at over $6,000 an ounce this time around, says Dominic Frisby. Here’s why.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

On January 21, 1980, after a decade of Western economies stumbling from one economic crisis to another, gold spiked to a high of $850 an ounce at the London PM fixing. That price wouldn't be seen again for another 28 years.

One man, Jim Sinclair, sold all his gold the very next day, netting some $15m ($40m in today's dollars). How did he manage to time the market so perfectly? "I think I just got sober one day before everyone else," was his explanation in a 2002 interview.

But mathematician Tom Fischer of Heriot-Watt University reckons he had a model to base his decision on. Today, I want to take a look at that model, alongside a recent report from Socit Gnrale on gold, and see what they suggest about just how high gold could go this time around...

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

After the Bretton-Woods agreement at the end of World War II, the US dollar was supposed to be interchangeable with gold at a rate of $35 an ounce. However, in the 1960s the French became concerned that, to pay for their new welfare state and the Vietnam war, the Americans had allowed many more dollars to be issued than they had gold to back them. The French were, rightly, concerned about the impact this would have on the value of their US dollar reserves, so they began exchanging them for gold. The central banks of Belgium, the Netherlands, Germany and even Britain in 1970 followed suit, ushering in gold's great bull market of the 1970s, during which it rose from $35 an ounce at the collapse of Bretton Woods in 1971, to $850 in 1980.

Today China is the one expressing concerns about the weak dollar. China has increased its gold holdings. Russia has followed suit and last month India bought 200 tons from the International Monetary Fund (IMF). Some have suggested that this purchase marks the top of the market, just as Gordon Brown's sale marked the bottom. But already gold is almost 10% higher.

Dylan Grice of Socit Gnrale writes: "Gold feels frothy today, but the Indian purchase of IMF gold eerily parallels the French purchases of the late 1960s. And ill policy winds are blowing in its favour. With the precious metals consultancy GFMS estimating that central banks will be net buyers of gold for the first time since 1988, have the Indians just sounded the same starting gun the French did in 1965?"

How one man picked the top of the gold market in 1980

In 1980, at $850 an ounce, the market value of the 260m ounces of gold said to be held in Fort Knox (there has been no independent audit since the Eisehower era) reached $221bn. Yet only some $160bn paper dollars were in issue. American gold was actually worth 140% of American paper. So low was confidence in modern fiat money, that the free market had effectively put the US back onto a gold standard. One Zurich banker declared, "The US Treasury is once again solvent, thanks to the high price of gold." Was that what caused Sinclair to sell?

With central banks today printing money like mad, they run the risk of a similar destruction of confidence. So if gold was forced up to a price that reflects the number of US dollars in issue, what price would it be then?

- Why UK property prices are going to fall 50%

- When it will be time to get back in and buy up half price property

Grice reckons around $6,300 an ounce. With 260m ounces of gold held by the US and the Fed's monetary base currently $1.7 trillion (and printing), I make it a mite higher at $6,538.

To get back to that 140% high of 1980, then my O-level maths suggests a figure above $9,000 an ounce assuming no more dollars are printed. But that is the great irony: the more dollars that are printed, the lower confidence in the dollar will fall, and the more likely this extreme scenario becomes. Moreover, the more dollars that are printed, the higher the gold price needed to back them becomes.

According to Fischer, Sinclair's model is slightly different. In March 2009, Sinclair wrote that gold's role "during periods of monetary stress" is to "balance the international balance sheet of the USA".

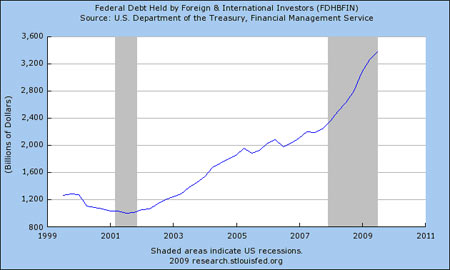

Using the Fischer-Sinclair model (read Fischer's article in full here), there is currently some $3,400bn of Federal debt held by foreign investors (source: US Dept of the Treasury, Financial Management Service). If we divide that by the 260m ounces of gold held by the US, we arrive at a figure of $13,076 per ounce. But, of course, US Federal Debt is rising exponentially, as the chart below shows, so that potential gold price is forever increasing.

Currently, the Americans' 260m ounces of gold at $1,150 an ounce comes to about 17.5% of the Fed's monetary base. The all-time low was in 2001 at about 12%, according to SocGen's Grice. If you prefer the Fischer-Sinclair model, gold amounts to just 8.55% of its external debt.

In any case, there's a long way to go before the amount of gold the US holds in any way reflects the quantity of dollars on issue. Even at $1,150 an ounce Fischer says, "it is no exaggeration to say that the current price of gold is very cheap in terms of money supply".

Gold's top is a long way off

Though it is the path we appear to be on, there is of course absolutely no guarantee whatsoever that the gold price will come to reflect the US Federal Reserve Monetary Base or its external debt. But should it ever exceed it, as it did in 1980, and there are also signs of financial sobriety returning to the establishment, then that will be the time to offload your gold. But any such top should it ever occur is still years away.

As they take on more and more debt, governments and central banks are doing nothing to stop this bull market and everything to inflame it. The longer it goes on (eight years so far) the greater, the more ridiculous and the more out of touch with reality valuations will be at its peak.

There will be more 20% and 30% corrections en route, when people will declare that it was all a bubble, but then gold will creep up again. And it will keep creeping up until governments and central banks properly purge the system and we get back to the next cycle of growth at which point gold will be just about the worst thing you can possibly own.

But that time is a long way off.

Our recommended article for today

There's no bubble in Asia - yet

Many people are worried that the free flow of cheap Western money is blowing bubbles in Asia. But while valuations aren't cheap, they're not in bubble territory. Cris Sholto Heaton explains what's going on, and how it affects investors in Asia.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge