Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The yellow metal is slowly clambering out of the pit it fell into last month. Having slumped to $1,350 an ounce in mid-April, it has since regained the $1,450 mark and hovered around this level for a fortnight.

On the plus side, Asian and American buyers have flocked to scoop up some cheap coins or bars, says Emiko Terazono in the FT. The US mint says that sales of American Eagle gold coins reached their second-highest level in a decade last month, eclipsed only by December 2009.

Strong physical demand has put a floor under the gold price, but the "upside seems limited", given investors are still reducing their holdings of paper gold assets, such as exchange-traded funds and futures, says Saxo Bank.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Yet this trend seems likely to reverse in the future as the investment case remains solid. Central banks are keeping monetary policy loose, with the European Central Bank cutting rates and Japan and the US continuing to print. Low real interest rates and printed money will continue to debase currencies and could eventually fuel a sharp jump in inflation.

There is also still ample scope for geopolitical tension and a worsening of the euro crisis. Gold may be in the doldrums for now, but the bull market that began in 2001 doesn't look to be over yet.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

How have central banks evolved in the last century – and are they still fit for purpose?

How have central banks evolved in the last century – and are they still fit for purpose?The rise to power and dominance of the central banks has been a key theme in MoneyWeek in its 25 years. Has their rule been benign?

-

France’s government collapses – could it trigger the next euro crisis?

France’s government collapses – could it trigger the next euro crisis?Briefings France’s government has toppled after losing a vote of no-confidence, plunging the euro zone’s second-largest economy into turmoil. Is this 2012 all over again and should Europe be worried?

-

The junk-bond bubble bursts

The junk-bond bubble burstsNews Yields in the US high-yield bond market (AKA junk bonds) have soared to more than 8% since the start of the year as prices collapse.

-

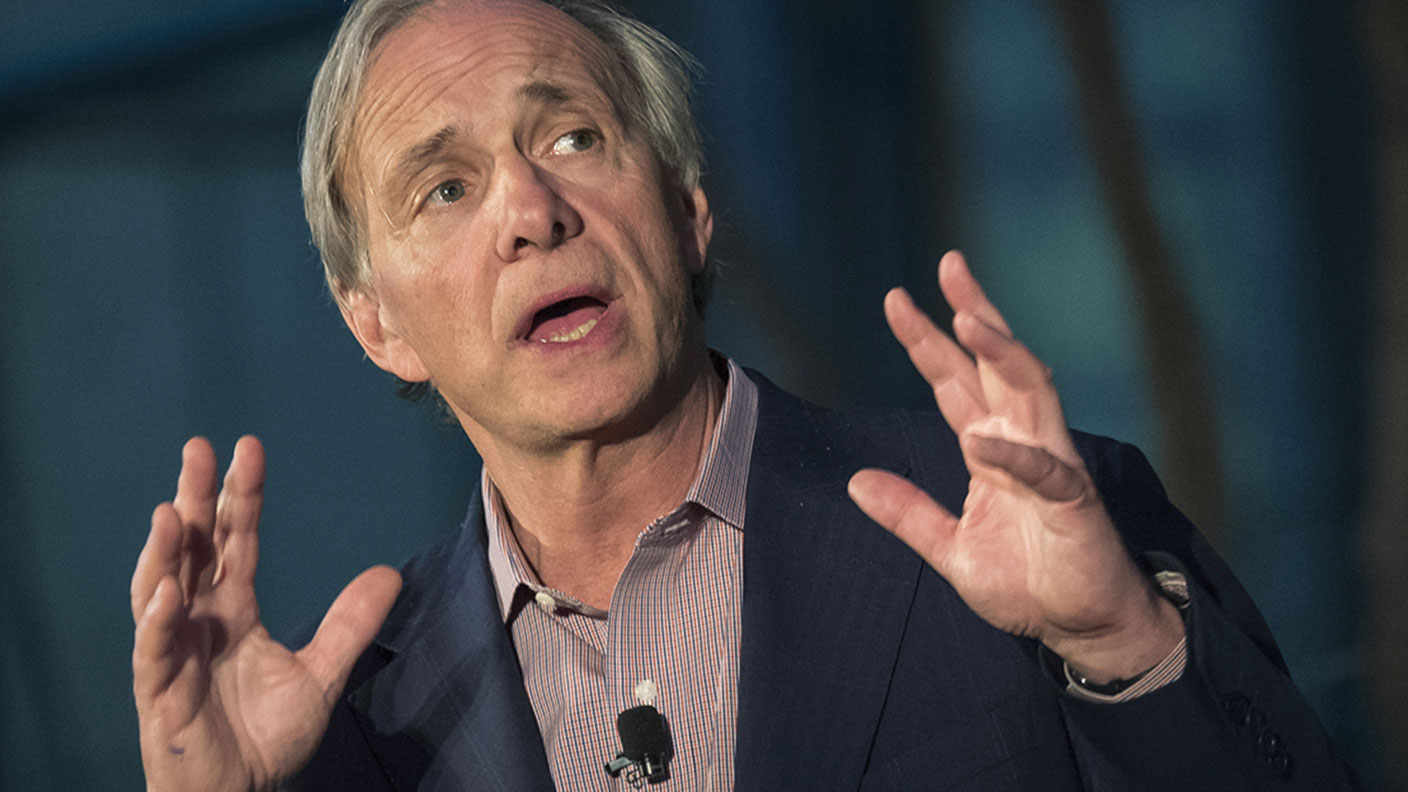

Ray Dalio’s shrewd $10bn bet on the collapse of European stocks

Ray Dalio’s shrewd $10bn bet on the collapse of European stocksOpinion Ray Dalio’s Bridgewater hedge fund is putting its money on a collapse in European stocks. It’s likely to pay off, says Matthew Lynn.

-

French stocks are back in fashion

French stocks are back in fashionNews France’s CAC 40 stockmarket index gained 29% in 2021, making it the world’s best performing major market.

-

Has Italy’s economy turned the corner?

Has Italy’s economy turned the corner?News Italy’s FTSE MIB stockmarket index has returned 23% so far this year, more than double the FTSE 100’s performance over the same period.

-

Overlooked European stocks are a solid bargain

Overlooked European stocks are a solid bargainNews The lack of speculative exuberance in European stocks compared to US markets bodes well for investors seeking less tech-heavy drama and more deep value.

-

Too embarrassed to ask: what are negative interest rates?

Too embarrassed to ask: what are negative interest rates?Videos There’s been a lot of talk from the Bank of England recently about introducing “negative interest rates”. So what on earth are they, and what would they mean for your money?