Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I've spent this week poring over the 2009 volume of the International Energy Agency's (IEA) World Energy Outlook - all 698 pages of it. It's the oil industry's version of War and Peace.

And what I've read so far sends shivers down my spine.

Emerging markets to trigger rising demand

Let's start with the good news...

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

According to this year's report, the recession and financial crisis gives us temporary relief from the rising fossil fuel demand. Indeed, 2009 will be the first year since 1981 that global energy use will actually fall.

Unfortunately, that's where the good news ends. From next year, fossil fuel use - and oil in particular - will ramp up again. Consumption is projected to grow by 1% per year through 2030. And you can blame it on skyrocketing demand from emerging market countries.

And it's this resumption of demand - coupled with a possible shortfall in exploration and production - that's a recipe for disaster.

The paradox of oil prices

From the IEA's Outlook: "Any prolonged investment downturn [in oil exploration and production] threatens to constrain capacity growth, eventually risking a shortfall in supply. This could lead to a renewed surge in prices a few years down the line, when demand is likely to be recovering and become a constraint on global economic growth."

This, dear reader, is the paradox of oil prices - and it's playing out right in front of us right now.

During "normal" economic times: rising demand leads to increased investment in exploration and production. The end result is that supplies eventually increase, and prices subsequently drop (or go up less rapidly).

During recessionary periods (like today): unemployment rises. And the unfortunate people without jobs drive less and demand for oil consequently drops. This also causes a supply glut and a subsequent drop in oil prices.

In 2008, we saw a situation where oil prices fell all the way down to $35 before the OPEC cartel managed to cut supplies enough to cause prices to slowly rise. But the damage was already done.

Result: exploration came to a virtual standstill. Rigs were mothballed. Drill ships were anchored - not in thousands of feet of water, but floating idly in harbours across the world.

Today, we've got tight credit markets thrown into the mix. And even with demand returning, investment in new exploration and production will slow. In fact, that's already happening. According to the IEA, 2009 will see a 19% cutback in oil and gas investment. That's $90bn that won't be going into finding more oil and gas or bringing new finds into production.

My friend Rick Rule likes to put it this way: "The cure for high prices is high prices and the cure for low prices is low prices."

Of course the effects of this phenomenon vary widely between companies and a large part of it depends on production costs. Let's take a closer look at what makes up the cost of a barrel of oil.

- Why UK property prices are going to fall 50%

- When it will be time to get back in and buy up half price property

The cost of producing a barrel of oil

Extracting oil out of the ground to the pump at your local gas station is essentially divided into three components:

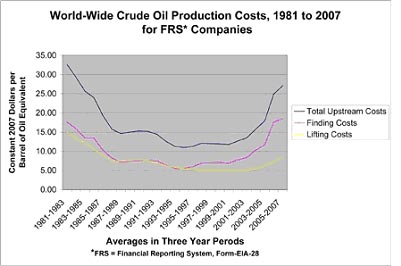

1. Finding costs: These are those costs associated with actually finding an oil deposit, determining its size (and thus its commercial viability) and developing the field. According to data from the Energy Information Administration (EIA) this component can vary widely - from $4.77 a barrel in the Middle East to $49.54 for the US offshore.

2. Lifting costs: These are costs associated with physically bringing the oil to the surface. The characteristics of the reservoir, its depth and the actual consistency of the oil are the main factors affecting the cost of producing the oil. According to the EIA, lifting costs can range anywhere from $3.87 a barrel in Central and South America to $10.00 a barrel in Canada (oil sands).

3. Total upstream costs: This includes transporting the crude, refining it into finished products and transporting and distributing those to end use points.

Today, more oil is coming from deeper and deeper locations, which results in higher finding and lifting costs. You can see this trend in the graph from the EIA.

So what does this mean for investors?

Simply put, with oil prices currently hovering around $80 a barrel - and set to rise - oil companies are beginning to pump money back into finding more oil. That's good news for the companies who drill for it. Here are three that stand to benefit...

Three companies that stand to benefit from rising oil prices

Atwood Oceanics, Inc. (NYSE: ATW) is an international offshore driller. The fact that its shares have soared by 159% since the beginning of 2009 signals a return to exploration and production by the major oil companies. Still, with a P/E ratio just over 9, it offers investors a good opportunity to play the offshore drilling space.

Superior Well Services, Inc. (Nasdaq: SWSI) is engaged in technical pumping and surveying services. It operates from 36 centers across the United States and has a fleet of 1,628 vehicles. It also provides for, and disposes of, fluids used in hydro-fracking of oil and gas wells.

Weatherford International Ltd. (NYSE: WFT) is a larger and more diversified version of Superior. Operating in over 100 countries, Weatherford provides services and equipment used in the drilling, evaluation, completion and production of both oil and natural gas wells. Weatherford shares are up 72% this year.

In summary, with oil prices set to rise over $100 a barrel next year, drillers are benefiting from some of the major oil companies who are once again starting to crank up their exploration and production budgets.

This article was written by Dave Fessler for the daily investment newsletter Investment U

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Inheritance tax investigations net HMRC an extra £246m from bereaved families

Inheritance tax investigations net HMRC an extra £246m from bereaved familiesHMRC embarked on almost 4,000 probes into unpaid inheritance tax in the year to last April, new figures show, in an increasingly tough crackdown on families it thinks have tried to evade their full bill

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.