Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Everyone needs a nest-egg for old age. Traditionally this has come from company pension schemes. But as these have closed over the past decade more of us are being forced to provide our own pensions. That means converting a life-time's savings into income by buying an annuity from a life assurer.

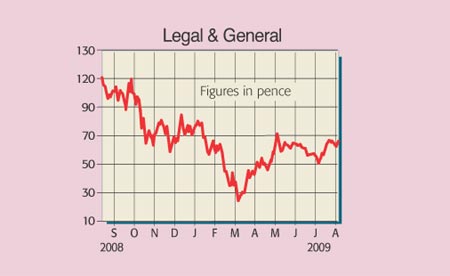

Historically an assurer matched this type of pension obligation easily enough by investing in long-term, income-producing assets, such as gilts and equities. But not anymore. Plunging markets have hit asset values, forcing big UK life assurers such as Legal & General to cut dividends just to maintain their minimum regulatory capital.

There was even speculation in March about a round of emergency rights issues in the sector. Worse, the credit crunch has left families less able to save, hitting the industry's sales of other products such as Sipps, Isas and funds.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

However, following a 60% drop from 2007 highs, Legal & General's stock is now good value for three reasons. Firstly, in spite of the turbulence in the first half of 2009, the firm still generated £333m of cash (compared to £320m for the whole of 2008). This helped it to end June with a net asset value (based on a European economic value, or EEV, which assumes existing policies will run for their full term) of 95p per share.

Legal & General (LSE: LGEN),rated a BUY by The Independent

Secondly, by aggressively cutting costs (including a 10% headcount reduction), the company improved its regulatory capital surplus to £2.2bn. That's roughly double the required minimum. Chief executive Tim Breedon believes this financial ballast is more than sufficient to withstand even a 40% drop in the FTSE 100. So assuming there are no hidden nasties in the balance sheet, Legal & General's future appears secure.

The third attraction is the group's cheap valuation. I rate Legal & General on a 10% discount to its EEV net assets, or about 85p per share. That implies more than 25% upside from current levels. Moreover, the shares trade on a 2009 p/e ratio of less than seven, and pay a none-too-stingy 5% yield, even after the dividend has been cut by 45%.

Accounting at life-assurers is complex and could (but probably won't) lead to future write-downs and profit hits. Legal & General could also be exposed by mortgage protection (salary and critical illness) products, bought when properties are purchased, and life assurance policies that depend on future mortality rates. Future earnings could be hit if the housing market dives again or average life expectancies rise above current forecasts.

Lastly, Legal & General faces regulatory risk from the introduction of proposed new legislation from Europe in 2012. This could require higher capital reserves, potentially hitting returns.

Nonetheless, with a top-notch brand, I believe that Legal & General is well placed to benefit from the long-term need for pension provision. Demand could be further boosted by the gradual withdrawal of generous public-sector schemes. This would increase sales of the company's bread and butter savings and annuity products.

Recommendation: long-term BUY at 65p

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how