Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

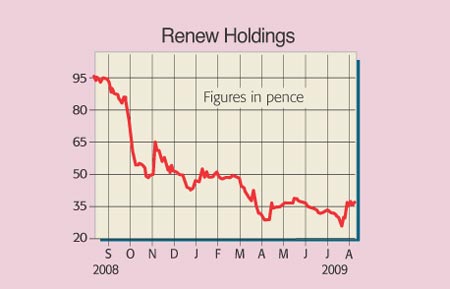

Renew Holdings is a UK construction (60% of sales) and engineering (40%) business specialising in social housing, rail, infrastructure and education. Due to the parlous state of the property market, it's been dragged through the wringer over the past 18 months.

But it has emerged far leaner than before and is hungry to secure new work, especially in the more resilient public sector and regulated private markets. Only three weeks ago it announced that it had won a basket of new contracts (worth £20m) in the land remediation, nuclear and water industries. These helped to boost its order book as at the end of March.

Better still, in the first half, Renew Holdings returned to profitability, declared a 1p dividend (yield 8%) and closed the period with a cash pile of £17.5m (worth 29p per share). So all the signs are that this company will survive the testing times ahead and generate substantial shareholder value.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Renew Holdings plc (Aim: RNWH)

House broker Brewin Dolphin is forecasting 2009 sales and underlying earnings before interest, tax and amortisation of £335m and £5m respectively, along with £298m and £4.5m for 2010. I value the stock on a six-times 2010 multiple, which, after discounting at 12% and adjusting for the cash pile, produces a fair value of over 60p per share.

The main snags for investors are those inherent to the sector: cut-throat competition, poorly priced contracts, customer bankruptcies and/or a severe cut-back in infrastructure investment. The firm has also been included in an ongoing investigation by the Office of Fair Trading into possible price-fixing by around 100 UK contractors. Lastly, the £101m pension scheme needs to be watched, albeit there was only a £0.5m deficit as at the end of March.

Yet with a respected brand and sound balance sheet, Renew looks like a home-run for the more adventurous investor. The chief executive and finance director both recently bought shares.

Recommendation: speculative BUY at 36p (market cap £22m)

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how