Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Over the past few years, investing in internet gambling has been as risky as taking a punt on the horses. For instance, Sportingbet, a leading online sports betting group, lost 70% of its revenues in 2006 after the US banned the industry.

However, since then the sector has steadily recovered. Faster broadband speeds and growing consumer confidence in making financial transactions online have helped, as has the launch of new products. A decade ago nearly all wagers had to be placed before the start of an event. Now punters can bet on events such as football matches as they happen. At the last count, 'in-play' represented 61% of revenues at Sportingbet's European unit.

Betting via smartphones and tablet PCs is the next big growth area. But that's not all. This whole sector could be a major winner from the credit crisis. For many cash-strapped governments, online gambling could provide a 'get-out-of-jail-free' card. Britain has shown the world that by licensing bookies under strict laws, it's possible to protect the public and boost a nation's depleted coffers. If America was to follow, it is estimated that the Treasury would raise between $4bn and $7bn a year. This is why I think the industry's long-term prospects are attractive. It offers cheap entertainment, together with raising bucket-loads of tax.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Of course, there will be bumps along the road. Greece one of Sportingbet's largest markets (18% of sales) looks set to levy a 6% duty, and impose a temporary black-out period of six months before the new gambling laws come into force. In the short term this will hit results, but further out the Greek market should expand as more advertising dollars are pumped in. And there are also great opportunities in Russia, Canada, South America and South Africa.

Sportingbet (LSE: SBT), rated a BUY by Daniel Stewart

But what about the recession? In Spain and Greece, demand has definitely softened. Yet so far this decline has been offset by growth in Sportingbet's other main territories of Australia, Turkey, Britain and Germany. Overall, amounts wagered in the first half were up 11%. For the year to July 2011, Daniel Stewart is forecasting turnover and earnings per share (EPS) of £219m and 6.5p respectively, plus a 3% dividend yield. Net cash at the end of October stood at a solid £22.4m more than enough to settle the remaining $18m fine relating to the firm's non-prosecution agreement with the US Department of Justice.

I'd value Sportingbet on ten-times earnings before interest, tax and amortisation (EBITA). Adjusting for the pro-forma cash, this delivers an intrinsic worth of around 73p a share. I believe the firm could be snapped up by the likes of Ladbrokes, Sweden's Unibet, or even a large American land-based operator.

So what are the wild cards? If there's a double dip, the group would be hit by rising unemployment and lower consumer spending. And, of course, taxes and laws may be changed. Also, the group's poker and casino activities (accounting for 31% sales) are undergoing a sticky patch. However, the sector has time and has once again made it through times of economic turmoil. Daniel Stewart has a target price 80p. Interims are due out 24 February.

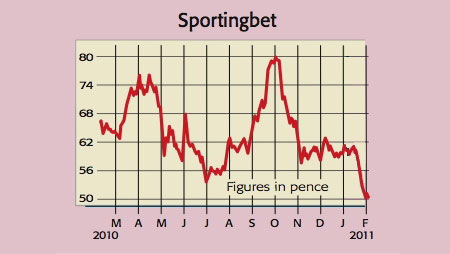

Recommendation: BUY at 51p

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

UK unemployment hits highest level since 2021 – will interest rate cuts follow?

UK unemployment hits highest level since 2021 – will interest rate cuts follow?UK unemployment reached its highest rate in almost five years by the end of 2025. Is AI to blame and will the Bank of England step in with an interest rate cut in March?

-

Did UK inflation fall in January?

Did UK inflation fall in January?After rising in December, analysts expect the next round of UK inflation data to show that disinflation returned in January