Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

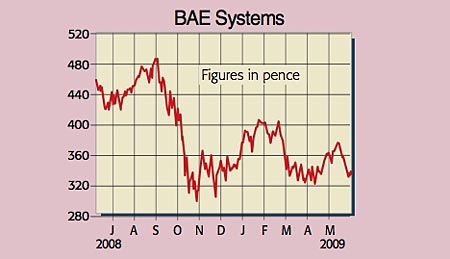

When will the City make up its mind? Before the credit crunch, the Square Mile encouraged firms to borrow up to the hilt. Then sentiment changed and those same firms were pilloried for taking on too much debt. Until recently when fund managers U-turned again, sending the valuations of many cyclical stocks through the roof. So it's hardly surprising the opposite has occurred for safe-havens such as BAE Systems, Europe's largest defence group.

BAE develops electronics and avionics for war-planes, manufactures ammunition and builds submarines and tanks for the armed forces. As it missed out on the 'dash to trash', its shares now languish at near three-year lows. This creates a good entry point for the cautious investor.

And here's why. Firstly, at last month's trading update the board reported it had won over £1bn of new support contracts relating to the Typhoon and Harrier fighter jet programmes. These add to its already substantial £46.5bn order book and provide excellent earnings visibility.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

BAE Systems (LSE: BA), rated BUY by The Daily Telegraph

Secondly, the firm is jam-packed with cutting-edge technologies that will enable it to take advantage of the shift towards covert combat tactics against terrorists and rogue states. These include deploying unmanned aircraft, intelligence gathering and advanced communications systems.

Thirdly, BAE has the political contacts, first-class brand and financial muscle required to weather even the worst economic turbulence. For instance, in 2008 it generated a colossal £1.6bn in operating cash flows on turnover of £18.5bn. It also ended the year with positive net funds (cash minus debt), providing plenty of fire-power to snap-up acquisitions.

Better still, the stock looks cheap for such a science-rich organisation. Analysts are forecasting 2009 sales and underlying earnings per share (EPS) of £20.5bn and 42.3p respectively, rising to £21.8bn and 45.0p in 2010. The shares trade on attractive forward price/earnings ratios of 7.6 and 7.2 respectively, and offer a decent 4.5% dividend yield.

So what are the potential risks? There is an ongoing investigation by the US Department of Justice into the alleged bribery of officials by BAE in connection with the £43bn Al-Yamamah arms deal with Saudi Arabia in 1985.

And America's $667bn military budget could be trimmed from 2011 onwards as the Iraq and Afghanistan wars are wound down.

Most important for BAE would be a renewed American commitment to the F35 Joint-Strike Fighter, which could eventually be the most lucrative programme the firm has yet handled.

The number of F35s to be delivered has doubled from 14 this year to 30 in 2010 at a total cost of $11.2bn. This could be the tip of the iceberg, as the Pentagon has requested 513 planes before 2015.

There are also concerns that the British government could further prune its defence budget. And investors need to keep an eye on foreign-exchange fluctuations (eg, sterling against the US dollar), a £3.4bn pension deficit, and the unwinding of a few old (and possibly onerous) contracts.

Fortunately, these fears appear more than factored into the depressed share price. Given the firm's rock-solid balance sheet, sound prospects and opportunities in emerging regions such as India, the shares are good value. With America still at war and North Korea testing its nuclear arsenal, the City may soon wake up to BAE's qualities.

Recommendation: BUY at 323p

Paul Hill also writes a weekly share-tipping newsletter, Precision Guided Investments

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Paul gained a degree in electrical engineering and went on to qualify as a chartered management accountant. He has extensive corporate finance and investment experience and is a member of the Securities Institute.

Over the past 16 years Paul has held top-level financial management and M&A roles for blue-chip companies such as O2, GKN and Unilever. He is now director of his own capital investment and consultancy firm, PMH Capital Limited.

Paul is an expert at analysing companies in new, fast-growing markets, and is an extremely shrewd stock-picker.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how