Why gold is looking good again in the charts

When attitudes become entrenched, expect the market to spring a surprise, says John C Burford - exactly as has happened in the gold market.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

What a difference a month makes! In 2013, the market had got used to seeing the bears in the control of gold (and silver). By December, gold had matched its previous low of $1,180. Most traders were extremely bearish at these lows at the start of 2014. Even former supporters had turned bearish. The media was full of stories about gold bugs ditching their gold holdings. Even major trading houses were declaring their sub-$1,000 targets for this year.

Of course, this was the ideal setup for the market to spring a nasty surprise on the bears. The bearish case was simple: who needs to own gold when equities are flying? That's where the action is! Buying gold took courage.

When attitudes like this become entrenched, the markets are most likely to spring a surprise and trap those in the herd. And that is exactly what has happened in the gold market.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Most gaps eventually get filled

I couldn't tell whether this was the start of a more substantial rally or just a blip up before the market resumed its bear move. In fact, no-one had an inside tip on this.

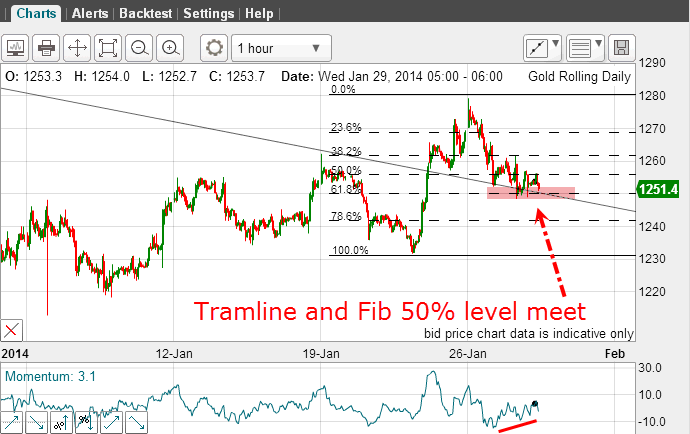

On the face of it, the rally was looking genuine: the market had broken above an important tramline and the bullish sentiment was still fairly low. Here was the position then:

When a tramline is broken, it is usually best to go with it and not try to second-guess whether it will turn out to be genuine or not. And when the market came back to the tramline for a kiss on a strong positive-momentum divergence, it gave a superb signal for a low-risk entry.

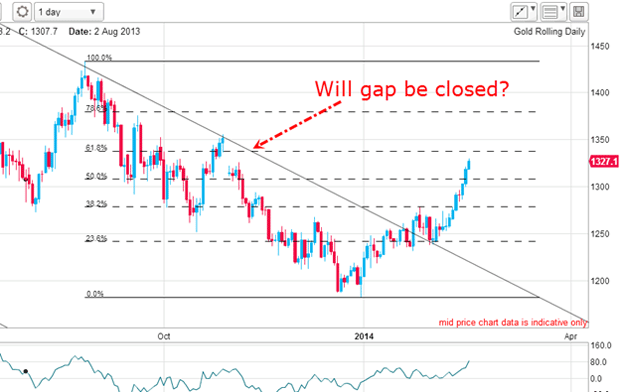

This is the current daily chart and it shows the tramline break clearly. Using my tramline trading rule, the target is the upper line in the $1,400 1,500 region, depending on when the market meets this tramline.

But to get there, the market must negotiate some tricky rapids. Here is one:

There is a very large open gap from November, which was when the market broke suddenly. I have written about gaps previously and the one takeaway from a study of gaps is that most of them eventually get filled.

Gaps act like magnets on a rod of iron. They attract the market back to it, and when it gets close, it suddenly reverses polarity, thereby repelling the market.

Gold is just getting started

And now, the media have noted the rally and I am seeing many articles explaining how to make money playing the gold market. This is all very predictable.

I do not have many golden rules (apologies for the pun) in trading, but I do have this one: when the MSM (mainstream media) note a trend is in place, I start heading for the hills. They are uncanny in their timing at flagging market turns but only to those who understand how markets really work.

This MSM attention usually accompanies heavy public participation. Already, massive funds are flowing back into gold ETFs (exchange-traded funds). And if equities fall off their perch again, gold will almost certainly benefit. The gold story is only just getting back in gear.

When to buy and sell

| (Contracts of 100 Troy ounces) | Row 0 - Cell 1 | Row 0 - Cell 2 | Row 0 - Cell 3 | Open interest: 376,973 | ||||

| Commitments | ||||||||

| 156,786 | 85,585 | 22,664 | 162,156 | 234,810 | 341,606 | 343,059 | 35,367 | 33,914 |

| Changes from 02/04/14 (Change in open interest: 8,694) | ||||||||

| 9,032 | 2,770 | -760 | -3,198 | 3,674 | 5,074 | 5,684 | 3,620 | 3,010 |

| Percent of open in terest for each category of traders | ||||||||

| 41.6 | 22.7 | 6.0 | 43.0 | 62.3 | 90.6 | 91.0 | 9.4 | 9.0 |

| Number of traders in each category (Total traders: 261) | ||||||||

| 105 | 79 | 66 | 50 | 56 | 187 | 173 | Row 8 - Cell 7 | Row 8 - Cell 8 |

The hedge funds (non-commercials) certainly love gold again (despite what they may say in public). They increased their longs much more than their shorts. Their holdings are now about two-to-one long. The small speculators are much more ambivalent towards the rally. That is a good sign for the bulls.

My best guess this morning is that the market will close (or partially close) the gap, then suffer a dip before moving on towards my targets.

Traders who were brave enough to go long close to the $1,200 level and who are using my 'split bet strategy' will be looking to take partial profits around here. Banking great profits when the public are frantically buying is a good policy.

On the small scale, swing traders make their best trades by buying when the public are selling in panic, and selling when they are falling over themselves to buy. In a bull market, that means buying when sell-stops are hit. Many professionals fade the market (trade against the immediate trend) as it falls under a prominent low, where many small traders place their sell-stops.

That is why you often see when a low is breached, the market recovers to move higher again as the public sell-stops are bought by the pros. I expect that to occur up ahead.

But for now, the trend is up.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.