The vote heard around the world, and its effect on the markets

Markets have been in a state of complacency for months. But the Greek referendum could give them a massive shake-up, says John C Burford.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

In 1914, Archduke Franz Ferdinand of Austria was assassinated in Sarajevo. That shot was said to have been "heard around the world", and is credited as being the event that triggered World War I.

A little over a century later, and also in the Balkans, Greece has now voted on the referendum the result of which will start an equally devastating global war. This time, between debt inflation and its deflation.

Could it be a coincidence that this latest financial conflict has also erupted in the Balkans a region notorious for sparking global devastations?

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Now the Greeks have voted, and a clear message has been delivered to the markets: if the EU/Germany wants to save its precious euro project by keeping Greece onside, it had better start talking frankly about debt forgiveness (aka default). That is the only way Greece can stay in the euro, and have a fighting chance of recovering its economy from the depression it is currently in.

In other words, Greece will demand another major haircut' for creditors. Germany, as always, will resist it. That is the very definition of deflation: a reduction in the amount of cash and credit outstanding.

The initial verdict of the markets this morning has been clear. With stocks well down and Treasuries well up (in a flight to safety), they have voted for deflation.

Events will be fast-moving this week with many twists and turns, and markets should remain volatile.

The Dow has made a show of support for deflation

This morning, the Dow opened several hundred pips lower in a show of support for deflation.

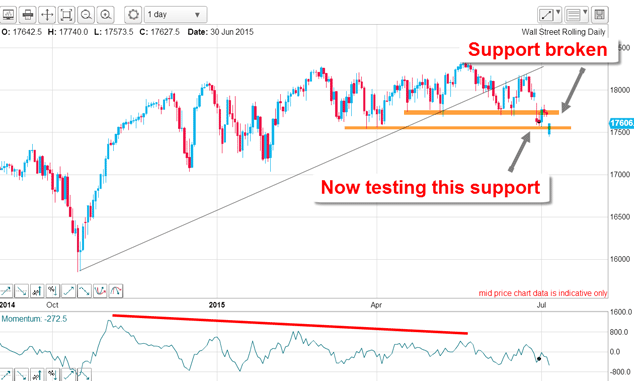

Last time, I had this daily chart of the Dow:

Note that at each new market high, the momentum highs were getting shorter in a large momentum divergence. Last Monday, the market had gapped down to test my shelf of support after planting its final kiss on my lower wedge line.

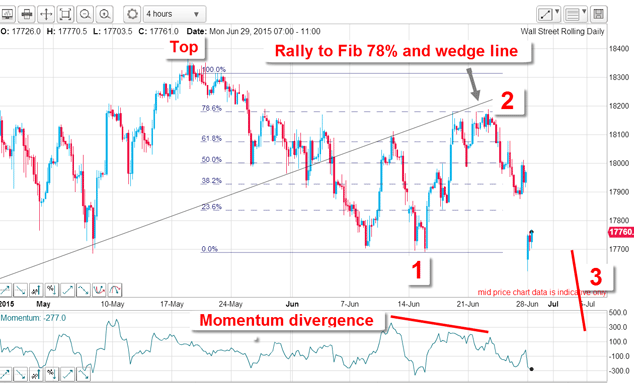

Below is the latest update.

Last time, I suggested that the market was at the start of a large third wave, and action since then has bolstered my belief. This is why: last week, the market broke the higher chart support, rallied back to it, and then this morning fell back to test the next lower support level. The gap down this morning is the second gap lower since the market kissed the wedge line.

A gap is a typical characteristic of a third wave because these are normally long and strong, and an unfilled gap is the most powerful move on any chart.

The initial decline off the 19 May top was metby a rally to the Fibonacci 78% level. I made the case that the low was wave 1 and the rally high was wave 2 of a proposed five wave move down. And last Monday's gap down was corroborating evidence for my wave 3 interpretation.

The trend looks set to continue

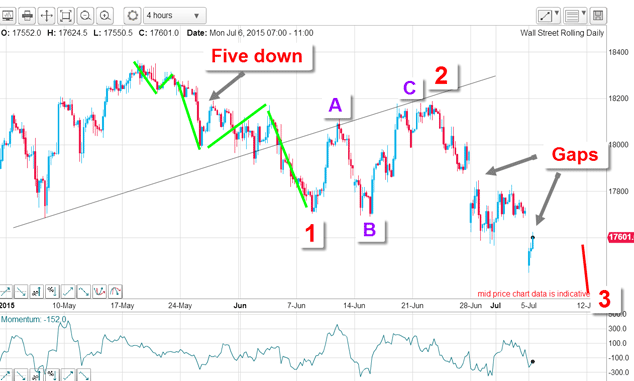

I have moved the wave 1 low from before and that has allowed me to label the wave 2 rally as a textbook A-B-C. The move off the 19 May top is a five down with an extended fifth wave. So now I have a clear signal that the main trend is now down: a five down and a three up.

The two gaps are clearly shown and, if the latest one is not filled very soon, they would qualify as a particular type of gap called breakaway gaps.

Breakaway gaps are found along a trend and usually signify the trend is well established and can be counted on to persist.

So could it be that after years of massive injections of credit inflation by central banks, the tide has turned? There are many clues that this is the case. Crude oil prices are falling again, and gold has yet to turn back up both of which signify that demand for commodities remains weak.

As for sentiment, the Shanghai market is now down over 30% off its high in just a few days. It should not be long before this bearish mood travels around the globe. US markets have been in a state of complacency for many months (see previous charts) and are poised for a massive shake-up.

I am watching the Vix the Fear Index with great interest!

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how