Speculators are massively short the euro – but I think it’s about to turn

Speculators are queueing up to bet against the euro, with bears outnumbering bulls by 33 to one. But the downward trend could be about to reverse, says John C Burford.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I've been writing on the euro all week but there's a good reason. I believe the EUR/USD cross is about to stage a big turnaround.

On Wednesday, I showed my 'line in the sand' if it were broken, I would have a signal that would confirm a reversal from the prevailing downtrend. But with the downtrend still intact, I am unable to act until this happy event occurs.

That allows me time to plan my downside targets which should represent the areas in which to begin looking for such a reversal.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

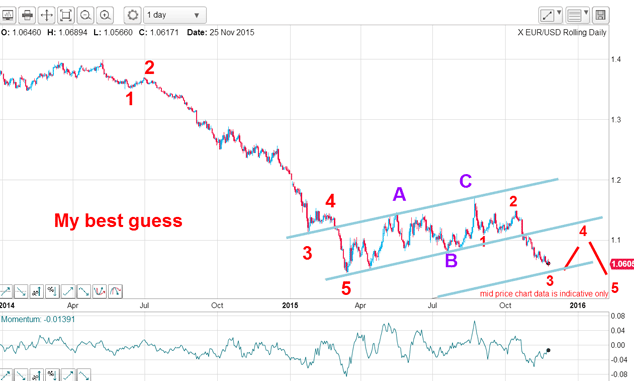

Let's now examine the context on the daily chart after all, it is too easy to be blind to the larger picture when working with just the short-term charts.

Below are my Elliott wave labels that I believe represent the most valid picture (not that there aren't other possibilities). I have a complete five down to the March 1.0460 low followed by a complex A-B-C corrective pattern. Of course, this five down can be part of a larger structure where wave 5 is large wave 3 and that is my ongoing roadmap. From the C wave high, I am counting the latest decline as wave 3 of what should be a five down:

The market is currently approaching T3, the lowest tramline (its exact placement is necessarily a little uncertain). If the market makes it to that line of support, that would terminate wave 3 and lead to a counter-trend rally in wave 4. This is the wave that should squeeze the shorts. And if this scenario plays out, how high would a sharp wave 4 rally be expected to reach? Could it plant a kiss on my centre tramline in the 1.14 area for a rally of some six or eight cents? That would be well worth going for!

Euro bears outnumber bulls 33to one

Not only that, but the Daily Sentiment Index (DSI) has just fallen to a barely-registered 3% euro bulls. In other words, for every euro bull, there are thirty three euro bears lined up against them! So how many more bears can be found to enter the fray and drive the market even lower?

Warning: the DSI is definitely not a trade timing tool!

Sentiment can remain extreme for a long time before a meaningful reversal occurs. In fact, this occurred in the September 2014March 2015 period when the DSI hovered around the 5% level while the market collapsed from the 1.30 level to the 1.0460 low a span of 25 cents.

If you had gone long in September when the DSI first dropped to the 5% level at 1.30, you would have suffered one of the sharpest declines in euro history!

I take an extreme DSI reading as a warning to get ready for a possible reversal, but always use my tramline methods to give me reliable signals. But with the Commitments of Traders data lining up with the DSI, a reversal is surely at hand.

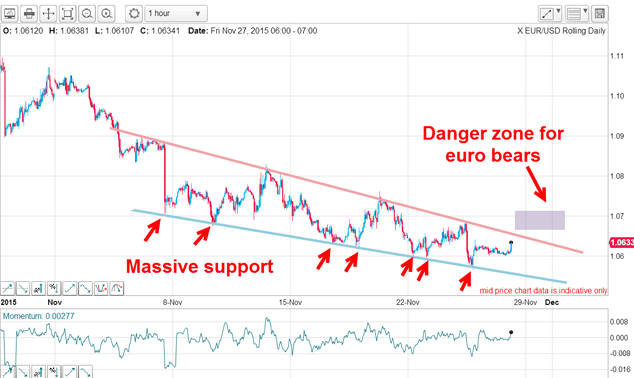

Here is the current hourly chart:

The pattern formed is a lovely down-sloping wedge (or descending triangle) which is a very powerful reversal pattern and will be confirmed provided the market can overcome the resistance of my line in the sand (upper wedge line).

Note that the lower wedge line in blue sports at least seven highly significant and very accurate touch points. It shows there is highly organised support on this line. Isn't that a pretty demonstration that markets have memories?

All I am waiting for is a break of my line in the sand and if it occurs soon, my first target is the Fibonacci 50% level at around the 1.10 area.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how