More textbook Elliott waves in GBP/USD

Elliott wave theory has proven to be a reliable guide to the pound / dollar market, says John C Burford. And its latest forecast couldn't be clearer.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

On Monday, I gave my Elliott wave analysis of GBP/USD and suggested the most likely current wave labels were this:

The most likely reading was that the market on Monday was in the last throes of an A-B-C rally off the recent 1.48 low (the purple wave 2).

And since then the market has fallen over 150 pips. This is the type of fast action I was looking for, as my third-of-a-third forecast called for a rapid move down.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Remember, third waves are usually long and strong. Having two working simultaneously would be very powerful.

But I want to analyse the A-B-C rally. By analysing the C wave I can get further clues as to when it is likely to terminate.

Naturally, the closer I can come to picking the top, the smaller the risk I need to take on my short trade, which is always desirable.

Here is the complete A-B-C rally:

The huge negative-momentum divergence between the A and C wave tops really stands out.

When you see this type of divergence, you know you need to be on the lookout for the end of the C wave. The buying power is drying up.

The fifth wave ending

But there is another clue I did not mention and it is that the C wave sports within it a nice five wave pattern!

The fifth wave was put in as it took out the buy stops just above the 1.54 level, but the rally could not hold and wave 5 made a pigtail on the hourly chart.

And note the five-wave mini-pattern within the third wave another give-away that the count is correct.

Here is a close up of that action:

That indicated that the market had run out of gas (as it always does at fifth wave endings), and the next move was to be down.

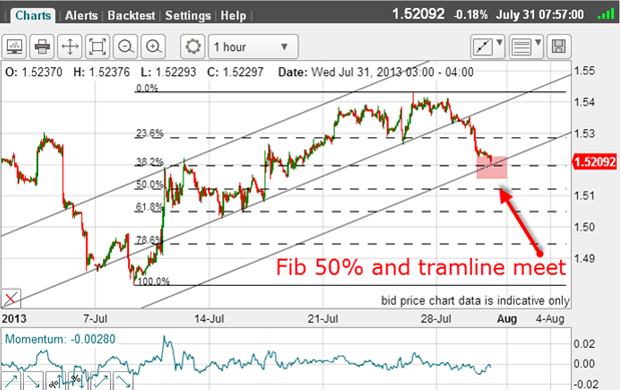

Now, with the market having turned, I can start to look for tramlines, and I do not have to look far:

I drew the centre line in first, taking the lows from 14 July to 28 July as touch points. Note the nice prior pivot point (PPP).

Then, my upper line takes the two highs as touch points, and also has a nice PPP.

Because of this, I have confidence in these tramlines, and now having these in place, I drew in the lower tramline, and also the Fibonacci levels off the 1.48 low.

My ultimate objective

That is an excellent place short-term traders could look to take some profits off the table.

But if we are truly in a third-of-a-third move down, I believe there could be lots more to go for on the downside.

If my Elliott wave labels are correct, my ultimate objective is the 9 July low at the 1.48 area.

So far, the signs are positive that we are truly in third waves, as the move off the 1.54 level appears impulsive and fast.

The key when following your Elliott waves is to constantly monitor the action and check it meets your expectations. And with third waves, that roadmap is very clear there should be a long and strong move.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how