Markets now are a trader’s paradise

The huge surge volatility has made markets a trader’s paradise. John C Burford. Explains how he’s been playing things.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The huge surge in volatility recently has made themarkets a trader's playground. Daily swings of many hundreds of Dow points have been the norm.

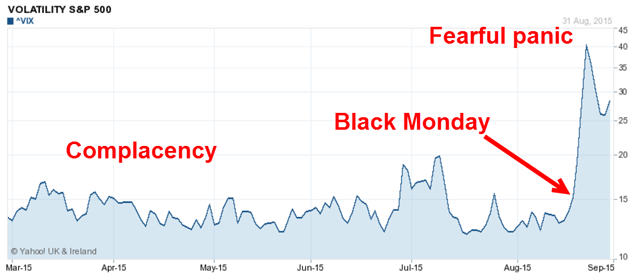

Fear is now stalking the markets. The VIX fear index shows that the market has been roused from its complacent pre-Black Monday slumber to a sudden state of terror:

When markets suddenly switch from a somnolent state of bullishness to a state of fear, that spells opportunity for alert traders especially on the short side. And that is where my tramline methods start paying their way.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But for buy-and-hold investors, the action has been totally out of character (at least since 2009) and is doubtless giving many sleepless nights.

I have been following many of the twists and turns in the Dow in these articlesand highlighting how terrific swing trades were made in the past few days by simply following the signals offered by my tramline method.

Here is another one.

I found the perfect place to short the Dow

I drew a new roadmap for the Dow

I had forecast earlier in the week

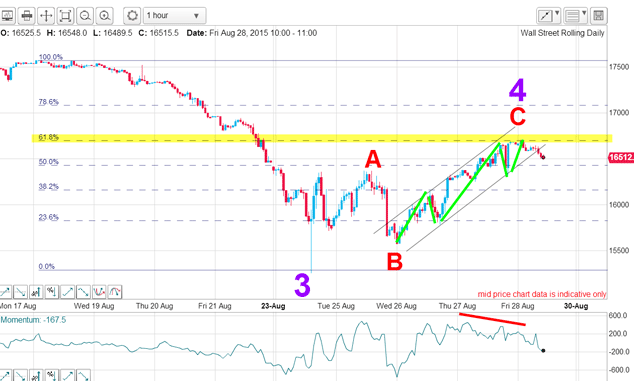

I thought the rally on Tuesday was unlikely to be the final wave 4 top because it was too brief. I felt there was one more rally to a new relief high in store hopefully to the Fibonacci 50% or even 62% retrace of the entire wave down.

As Friday dawned, I noted the lovely five wave pattern to my C wave, which had hit the Fibonacci 62% level on a negative momentum divergence. Bullseye! That was the place to enter new short trades; the odds were high that I had found the wave 4 top and the market would then move down, especially after it broke below the lower tramline, which it did later on Friday.

And on Bank Holiday Monday it pays to be awake at all times! - the market opened down with a very large gap:

On Monday and Tuesday, the market moved down by over 700 points off last week's high and offered a terrific three-day profit if taken.

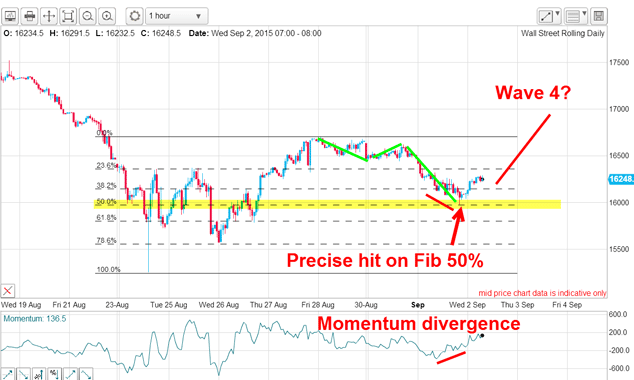

Why would you take the profit there? Well, here's a great reason:

The move down hit the Fibonacci 50% support level on the nose and on a positive momentum divergence to boot! The odds were high that the market would stage a bounce and taking the profit was a prudent play. As I write, we are in that bounce.

Note that I did not use guesswork, or gut feel to make a decision I used the well-established rules and guidelines of my tramline method.

This morning, I have two alternative paths: either the market will go on to make a new wave 4 high, or the rally will top out under the 16,700 area and resume its path along wave 5.

The news really does follow the market

"Early shutdown on cards for 40 North Sea platforms".

As anyone who has studied economics will know, a low price is a cure for a low price. Prices that fall under costs of production inevitably lead to production shut-downs and curtailment of exploration plans and make future supplies tighter. Of course, these seismic shifts in production levels take time to work through. But markets are very good at anticipating these changing dynamics.

Traders must also anticipate these developments. If you are using the news to guide your trades, you are usually too late to catch the turns. It is often a case of shoot first, ask questions later.

But that is what the art of tramline trading is designed to do it offers rules and guidelines that can be followed with scant regard to the current news.

Let's look at yet another great example of the news following the markets. US crude has rallied over $10 in only three days its biggest gain in over 20 years. Overnight on Monday, reports that US crude production was being revised downwards along with OPEC's willingness to discuss output curbs emerged.

Naturally, the 'buy the rumour sell the news' boys were busy taking profits on that. And the market is easing off its highs as early birds are selling to the latecomers who follow the news (and buying at a top).

There is no doubt that the historic swings we are witnessing in many markets are the result of fundamental shifts in investor/trader sentiment and social mood generally. There has been a near-consensus view that with central banks willing and able to pump as much liquidity into propping up asset markets, markets will never collapse.

This view is now being exposed for what it always was a reflection of a bullish mania that has bred historic complacency. And after complacency comes panic.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how