I was dead wrong about gold (and that doesn’t matter)

As a swing trader, your primary job isn't to be right all the time, says John C Burford. It's to make money over the long run.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

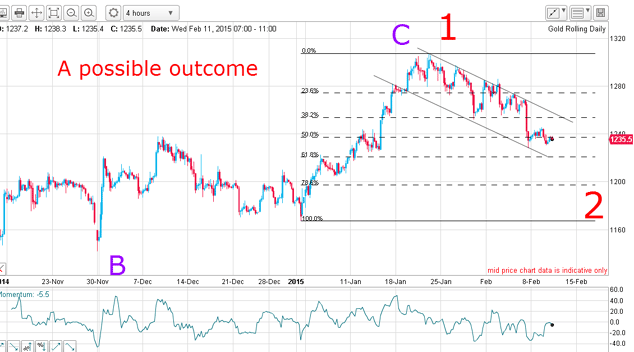

On Friday,I made the bold claim that gold was about to rally. My carefully placed tramlines, Fibonacci and Elliott waves were all pointing in that direction.

I was dead wrong. The market fell hard on Tuesday.

OK, my analysis wasn't correct. That happens. The important thing as a trader is to ensure that when I'm wrong, I don't lose money.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So, today I want to show you how Friday's incorrect call didn't lose me a single penny.

Here's how I saw it back then

When the 62% level was reached last Wednesday, I was waiting. I placed an order to 'go long' gold (ie, bet that gold would rise in value) at this point, and I placed a protective stop just under this level. I placed the protective stop to cover me in the event that I my analysis was wrong, and the price dropped.

So, I was long gold at $1,220 on Wednesday, and for three days, the market did was I was expecting. It rallied to the $1,235 level for a gain of $15.

That small gain was a lot less than I was targeting from this trade. But it was enough for me to use my break-even rule.

My break-even rule works like this: when I post a small gain on one of my positions, I move my protective stop accordingly. This guarantees that I won't have lost any money on my original trade, while still offering me the potential for further gains.

So, how did my gold trade pan out? Well, yesterday the market took a dive and ran through my stop at $1,220. All my hard work on that trade came to nought but the critical point is that I did not lose money.

The best laid plans of mice and men

Not so fast! The market is exhibiting an inverse head and shoulders pattern. The 'neckline' of the head and shoulders, shown below as a green line, indicates to me that gold is likely to rise from this point.

This would line up well with other supportive factors such as the Fibonacci 62% level at the $1,200 level:

At yesterday's low at $1,203, the market has hit the highly supportive meeting of the head and shoulders' neckline (shown in green), the Fibonacci 62% level and the lower tramline (again!).

This is the last chance saloon for my bullish scenario. Either gold rises from here, or I need to throw away my analysis and start again.

But if this level holds, I expect a rapid recovery.

Don't trade through the pain

This is important, because if I was still holding my long position at $1,220 and desperately hoping for the rally, I would be in a weak position emotionally as I stared at a losing trade. You may recognise this painful feeling yourself, dear reader.

You see, if the $1,200 level were to give way in the absence of a protective stop, my loss would be compounded and a very big chunk would be taken out of my trading account. Ouch. I must avoid that at all costs. You must, too.

That is why I use the break even rule.

This whole episode reveals why even your best guess can be wrong, but you can avoid major loss or even any loss at all.

After all, your job as a swing trader is not primarily to be correct in your forecast, but to make money over the long run. Cut your losing trades, and the winners will take care of themselves.

If you can master that skill, you'll be a super trader guaranteed.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?