FTSE 100: when will the other shoe drop?

Are we to believe the soothing words from the pundits that all is right with the stockmarket again? Don't be too sure, says John C Burford.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The dust is starting to settle after the traumatic events of last week, and I am starting to see more reassuring articles that suggest that the shake-out was just a 'technical blip', rather than a fundamental shift in the landscape. Those articles are making my headline indicator' antennae twitch.

Of course, commentators are doing what they always do. Following a shock to the system, most people put it out of their minds and go on as if nothing had happened. It's the same with markets. The vast majority of pundits and financial writers are bullish on the market they are perennial bulls, or perma-bulls as they are often called. In fact, they have to be that way if they want to keep their jobs.

They will find any justification to offer reasons to buy the dips so as to keep investors in the game. To suggest cashing out is to write your own resignation letter. When an investor is out, he or she will probably stay out.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If the market moves up, they will be too frightened to get back in, fearing they will be buying at a top. And if the market moves down, they will congratulate themselves , and let others in the pub know how clever they are; they saw the top coming!

If you like the idea of buying low and selling higher, take a look at this bombed-out share, Glencore:

The market has lost a stunning 75% of its initial public offering price of £5 and it is not difficult to see why, because the company is at the heart of global commodity trading. But unless you believe the world will never need another commodity, this must be an interesting situation for a contrarian investor/trader.

The decline off the March £3 high is remarkable and represents massive unloading by the large funds. But interestingly, S&P has just this week issued a re-rating to negative (translation: get the hell out fast!).

Could this be one of the great contrarian signals of history and point to a big recovery in commodities? We are already seeing the base metals start a recovery, with Dr Copper up 10% from last week's low and we already know what a stunning rally there has been in crude oil.

Yes, the crude oil rally is a stunner and was totally foreseeable, as I have explained in the past. But why did it happen? That is a question puzzling the experts alright.

Did the US government pass a law outlawing alternative energy? Did it pass another law banning cars with fuel consumption better than 12 miles per gallon as a throwback to the glorious days of the 1950s?

Or did Opec announce they are getting out of the oil business and are shutting down all wells immediately because they don't need the money?

No, I don't believe they did.

What happened was that the market found itself at the end of a wave 5 right at the point where sentiment was bearish to the max and perfectly primed for a snap-back rally. And because of the huge pile of short positions held by the big guns, they began covering those shorts in the mother of all short squeezes and produced the four-day surge of over $10.

That's all you need to know everything else is puff and an after-the-fact rationalisation that draws the crowds, but is of little use in helping you make money.

But what about that other shoe?

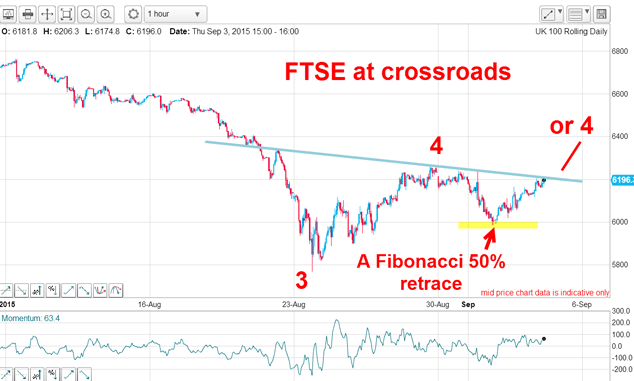

The chart shows the wave 3 Black Monday' plunge and the current relief rally, which is my wave 4. The market gave us a lovely Fibonacci 50% retrace on Tuesday but has since rallied right up to my trendline, which represents resistance.

A solid break above that line would indicate the wave 4 rally was still in development, while a turn-down from here means the wave 4 top is likely in.

In either event, when wave 4 terminates, I expect a wave 5 move down and that will be the other shoe.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

John is is a British-born lapsed PhD physicist, who previously worked for Nasa on the Mars exploration team. He is a former commodity trading advisor with the US Commodities Futures Trading Commission, and worked in a boutique futures house in California in the 1980s.

He was a partner in one of the first futures newsletter advisory services, based in Washington DC, specialising in pork bellies and currencies. John is primarily a chart-reading trader, having cut his trading teeth in the days before PCs.

As well as his work in the financial world, he has launched, run and sold several 'real' businesses producing 'real' products.

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.