Working from home? Make sure you claim everything you can

People working from home can receive up to £140 a year in tax relief.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

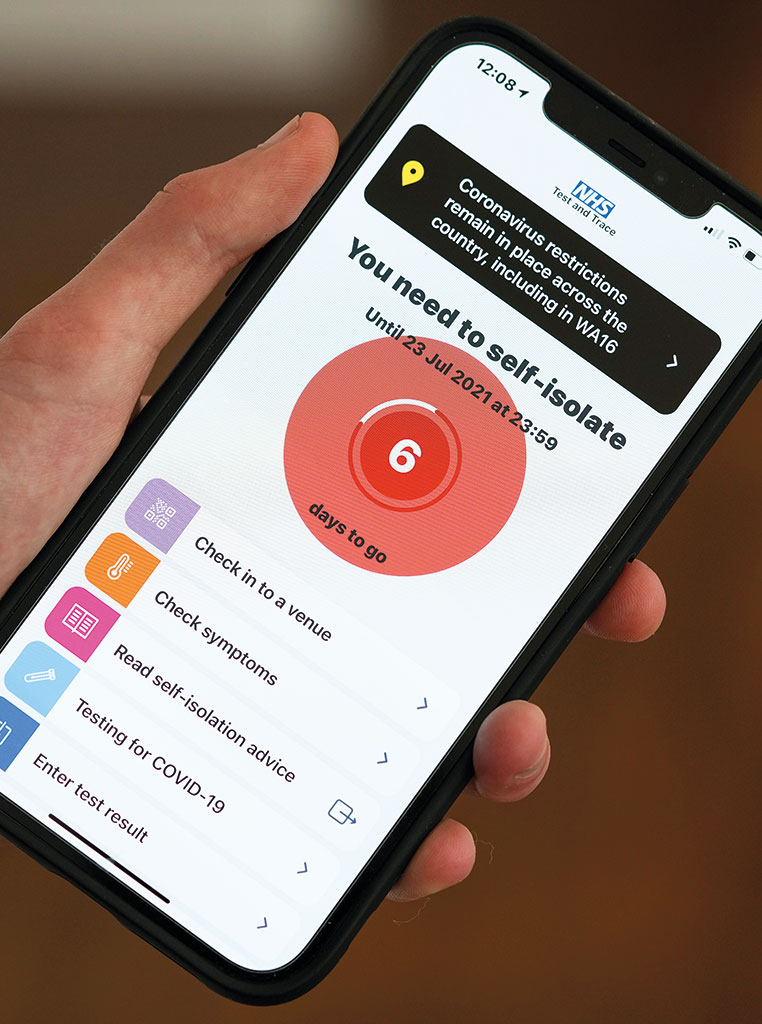

Hundreds of thousands of Britons are self-isolating after being pinged by the NHS Covid-19 app. One silver lining is that those who are working from home (WFH) could be in line to claim up to £140 of tax relief.

Employees have always been allowed to claim back a tax rebate for costs such as higher heating and telephone bills if they are required by their employer to work from home. Claiming used to be a slightly fiddly process that required a P87 form. But stop-start lockdowns have forced the government to simplify the procedure to forestall administrative headaches.

Last October, HMRC launched a specialised microservice that enables taxpayers to claim relief in minutes without submitting evidence of higher bills. It can be accessed via www.gov.uk/tax-relief-for-employees/working-at-home. You will need a government gateway ID to use the service. The portal updates your PAYE tax code so that your employer deducts less tax from your salary each month.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The relief you can claim on without providing evidence of your extra costs is £6 a week. A few companies have already paid it as a tax-free allowance to employees to cover WFH expenses, but as times are hard most have opted not to. If the latter applies to you then you can claim relief on the extra costs you have incurred. Standard-rate taxpayers are eligible for a rebate of £1.20 per week (20% of £6), making £62.40 per year. For higher-rate payers the annual relief is worth £124.80 per year, while additional-rate payers get £140.40. Over two years that means it is possible to receive as much as £280 in relief.

For the 2020-2021 and 2021-2022 tax years it is possible to claim relief for the whole year even if you did not work from home every week. Those who work from home for part of the week are also eligible.

You must have been required to work from home; you are not eligible if you chose to do so. You must also declare that your costs have increased as a result (they almost certainly will have owing to higher energy and water consumption). This is an individual benefit, so couples and flatmates can each make a claim provided they meet the criteria.

Remember to claim again

If you do self-assessment then you are still eligible for the full-year rebate, but cannot claim via the portal: instead you must make the claim when you next fill in your return. Self-employed people are not affected as they already claim for work-related expenses when they do self-assessment. It is possible to backdate a claim by up to four years if you haven’t already made one (note that the weekly flat rate before April 6 2020 was £4). HMRC has already received more than three million claims for the 2020/2021 tax year. If you have already claimed for last year, remember to do so again for the current tax year (which began on 6 April) if you qualify.

Data from the Office for National Statistics shows that 38% of working adults were working from home at least part of the time in late April 2021, but only about 800,000 people have so far claimed for the current year.

If you have incurred significantly more than £6 a week in extra costs it is worth claiming for those too, but you will have to go through the more burdensome process of filling in a P87 form and providing receipts to prove it. Note that if you are an employee then only variable costs are counted; you cannot include a contribution towards rent or mortgage payments.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn

-

Investing in forestry: a tax-efficient way to grow your wealth

Investing in forestry: a tax-efficient way to grow your wealthRecord sums are pouring into forestry funds. It makes sense to join the rush, says David Prosser

-

Two million taxpayers to be hit by £100k tax trap by 2026/27

Two million taxpayers to be hit by £100k tax trap by 2026/27Frozen thresholds mean more people than ever are set to pay an effective income tax rate of 60% as their earnings increase beyond £100,000. We look at why, as well as how you can avoid being caught in the trap.

-

'Expect more policy U-turns from Keir Starmer'

'Expect more policy U-turns from Keir Starmer'Opinion Keir Starmer’s government quickly changes its mind as soon as it runs into any opposition. It isn't hard to work out where the next U-turns will come from

-

13 tax changes in 2026 – which taxes are going up?

13 tax changes in 2026 – which taxes are going up?As 2026 gets underway, we look at what lies ahead in terms of changes to tax rates and allowances this year and how it will affect you.

-

Modern Monetary Theory and the return of magical thinking

Modern Monetary Theory and the return of magical thinkingThe Modern Monetary Theory is back in fashion again. How worried should we be?

-

The coming collapse in the jobs market

The coming collapse in the jobs marketOpinion Once the Employment Bill becomes law, expect a full-scale collapse in hiring, says Matthew Lynn

-

How to limit how much of your Christmas bonus goes to the taxman

How to limit how much of your Christmas bonus goes to the taxmanIt's Christmas bonus season but the boosted pay packet may mean much of your hard-earned reward ends up with HMRC instead of in your pocket