Split your money into pots with Zopa's new savings account

A new account from Zopa lets you tailor your savings to your needs by putting your money in separate pots. Ruth Jackson-Kirby explains how it works and if it's worth a look.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Whenever you are looking for a new savings account, you decide what account you need – instant access, notice or fixed-term – and look at the best rates. Then you choose the account with the best rate that meets your access requirements. The problem is that this can leave you with accounts across several different banks and building societies, as you seek out the best rates for money you need to be able to access in a hurry and for money you won’t need for a while.

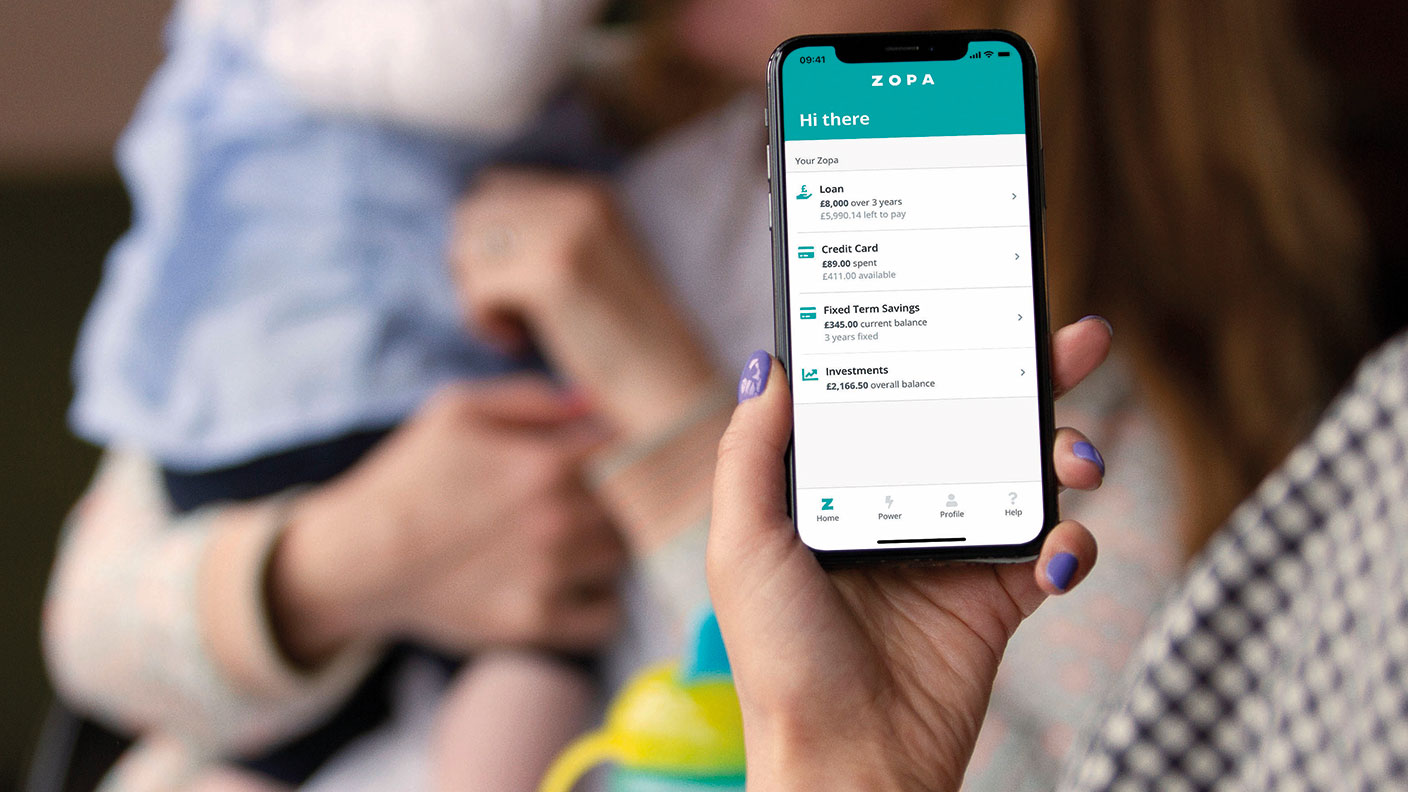

That’s where Zopa’s new savings account could be useful. The Zopa brand was known as a peer-to-peer lender, but it closed that part of its business late last year. It now has a banking licence and is offering loans, credit cards and savings accounts – the latest of which is the Smart Saver. This lets you split your money into smaller pots and choose your own interest rates based on when you’ll need the money.

The idea is you open a Smart Saver account, which pays 0.72% with instant access, via Zopa’s banking app. You can deposit up to £15,000 into the account, set up individual “access pots” and “boosted pots” within your account and shift some of your money into these. You can decide how much interest you get on each pot by choosing a different notice period. The basic 0.72% interest rate Zopa pays on the instant-access pots is second only to Atom Bank, which pays 0.75%, while the boosted pots are best buys when compared with other notice accounts.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

“Zopa’s rates across the boosted pots are the highest paying, for their notice period, in the market. They are therefore very attractive for savers looking to switch savings provider,” says James Blower, head of digital at Moneyfacts.

Opt to give seven days’ notice before you want to access your cash and you can get a rate of 0.75%, rising to 0.85% for 31 days’ notice. The top rate is 1.05% for a 95-day notice period.

The Zopa account could be a great choice if you like to save into small individual pots, as you can benefit from several different interest rates but still see all your balances in one place.

However, there are some drawbacks. It won’t suit anyone with a large amount to deposit – you can only save up to £15,000. With this account Zopa is looking to “attract savers with smaller balances, who will actively use their savings app, rather than savers with larger sums who are solely looking to place one large deposit for a period of time”, says Blower. If you are looking for a home for a larger amount, then Atom Bank allows deposits of up to £100,000.

Second, the Zopa Smart Saver is an app-based account. You can’t operate it without a smartphone. If you prefer online or telephone banking, then Shawbrook Bank's easy access account pays 0.72%. If you want a branch-based account you’ll get 0.6% from a few building societies, including Yorkshire, Newcastle and Buckinghamshire.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ruth Jackson-Kirby is a freelance personal finance journalist with 17 years’ experience, writing about everything from savings accounts and credit cards to pensions, property and pet insurance.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Why it might be time to switch your pension strategy

Why it might be time to switch your pension strategyYour pension strategy may need tweaking – with many pension experts now arguing that 75 should be the pivotal age in your retirement planning.

-

Rachel Reeves is rediscovering the Laffer curve

Rachel Reeves is rediscovering the Laffer curveOpinion If you keep raising taxes, at some point, you start to bring in less revenue. Rachel Reeves has shown the way, says Matthew Lynn

-

ISA reforms will destroy the last relic of the Thatcher era

ISA reforms will destroy the last relic of the Thatcher eraOpinion With the ISA under attack, the Labour government has now started to destroy the last relic of the Thatcher era, returning the economy to the dysfunctional 1970s

-

Investing in forestry: a tax-efficient way to grow your wealth

Investing in forestry: a tax-efficient way to grow your wealthRecord sums are pouring into forestry funds. It makes sense to join the rush, says David Prosser

-

'Expect more policy U-turns from Keir Starmer'

'Expect more policy U-turns from Keir Starmer'Opinion Keir Starmer’s government quickly changes its mind as soon as it runs into any opposition. It isn't hard to work out where the next U-turns will come from

-

Why pension transfers are so tricky

Why pension transfers are so trickyInvestors could lose out when they do a pension transfer, as the process is fraught with risk and requires advice, says David Prosser

-

Modern Monetary Theory and the return of magical thinking

Modern Monetary Theory and the return of magical thinkingThe Modern Monetary Theory is back in fashion again. How worried should we be?

-

The coming collapse in the jobs market

The coming collapse in the jobs marketOpinion Once the Employment Bill becomes law, expect a full-scale collapse in hiring, says Matthew Lynn