Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

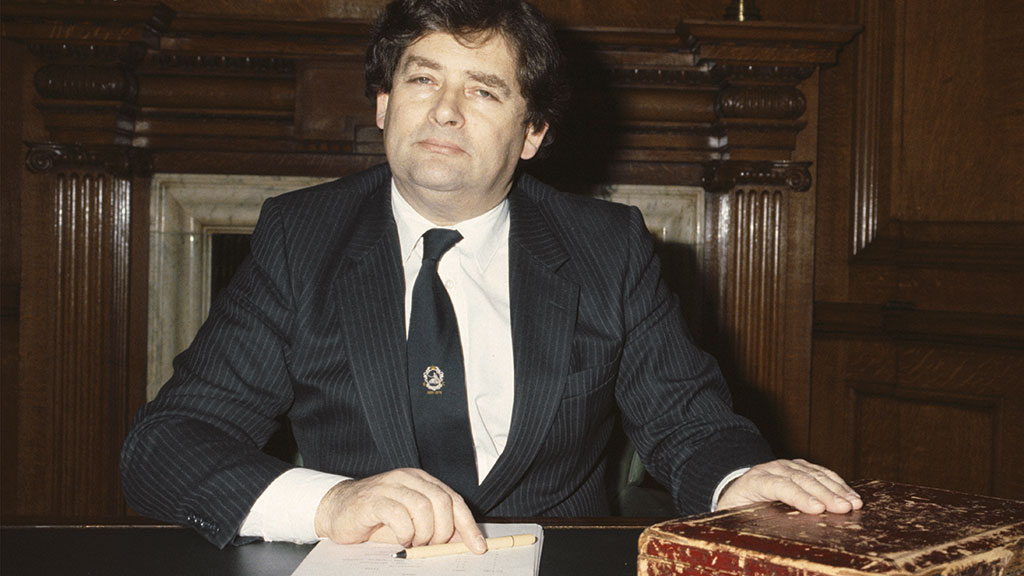

How the Conservative party has changed. When he was chancellor in the 1980s, Nigel Lawson took pride in abolishing at least one tax every year. Now, in the run-up to Rishi Sunak’s first Budget, the press has been filled with presumably well-founded speculation about tax increases.

The prime target for the media pundits is the dwindling array of tax breaks available for pension-fund saving. In 2014, Lib Dem pensions minister Steve Webb persuaded a sceptical George Osborne to free pensions from the stringent restrictions they were subject to. Ever since, Conservative chancellors have been chipping away at tax reliefs on pensions as if to reverse the incentive to save that was then provided.

The lifetime allowance, first introduced in 2006, limited the value of an individual’s pension fund. Above that limit, a penal rate of tax of 55% is applied either on drawdown, at the age of 75, or, for members of defined-benefit (DB) schemes, as the limit is exceeded.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The allowance was progressively reduced from £1.8m in 2011/2012 to £1m five years later. Though it has since been raised to £1.055m, there is no shortage of advocates for slashing it further, even though the current limit is causing significant problems for the NHS, whose senior doctors and surgeons are finding that their net pay from extra shifts is more than swallowed up by the pension tax.

The lifetime allowance is a tax on successful investing

The justification for this limit is to restrict the tax relief on pension contributions but, in reality, it is a tax on investment returns. Pay £30,000 a year into a pension fund for 35 years and you will not be liable for tax at 55% if your investment return is zero, but pay in just £10,000 a year with an investment return of 10% per annum and your tax liability will exceed £900,000. All the benefit you had from the exemption of your fund from income and capital-gains tax will be more than clawed back.

In 2011 the chancellor went further, limiting tax relief on contributions to £50,000 a year, reduced to £40,000 three years later. This might seem generous, and it is for those such as higher-grade civil servants whose pay rises steadily over a lifetime. Those with family commitments or erratic earnings often cannot afford to contribute every year, but do so from windfalls or when they can. They are penalised, as are high earners, whose limit is just £10,000 a year.

The next target of the lobbyists for more taxation is the higher-rate tax relief on pension contributions, on the pretext that higher-rate taxpayers account for more than half the total cost of the tax break.

This ignores the reality that the tax relief is no more than tax deferral. Pensions are a system for converting capital, which is not taxed, into income, which is. Tax at both the standard and higher rate is payable on pension incomes, so stopping full tax relief on pension contributions would amount to double taxation, as would levying capital gains and income tax on pension-fund returns.

How to spread the benefit

There are much better ways to spread the benefit of the tax relief more widely. Auto-enrolment in the expanding National Pension Scheme (NPS) will help, as would raising the threshold for higher-rate tax.

The value of the tax relief to standard-rate taxpayers has come down with the tax rate, but it doesn’t have to be so limited; tax relief could be granted to standard-rate taxpayers at a rate of 25% or 30%. And if people are expected to become more reliant on the NPS and less on the state pension, shouldn’t the rate of employee’s national insurance be cut? It was just 6.5% when Lawson was chancellor, but is now 12%.

The objection is that the government can’t cut taxes because it has to fund monstrously extravagant and pointless infrastructure projects such as HS2. People supposedly want higher taxes to pay for higher government spending, but I don’t believe it, not even when the tax is targeted at the better-off. People realise that governments that start raising taxes on the few soon raise them on the many.

Pension funds are the primary source of long-term savings in an economy, vital to fund the long-term investment on which economic growth depends. Yet the government seems determined to continue chipping away at incentives to save for retirement. Having abolished higher-rate tax relief, will it go on to abolish the current entitlement to withdraw 25% of a pension entitlement tax-free? Will pension funds be sequestered to finance low- or zero-return infrastructure projects favoured by government? Will defined-contribution (DC) schemes suffer the same fate as DB ones? Pension savers need long-term certainty and the economy needs pension savings.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Max has an Economics degree from the University of Cambridge and is a chartered accountant. He worked at Investec Asset Management for 12 years, managing multi-asset funds investing in internally and externally managed funds, including investment trusts. This included a fund of investment trusts which grew to £120m+. Max has managed ten investment trusts (winning many awards) and sat on the boards of three trusts – two directorships are still active.

After 39 years in financial services, including 30 as a professional fund manager, Max took semi-retirement in 2017. Max has been a MoneyWeek columnist since 2016 writing about investment funds and more generally on markets online, plus occasional opinion pieces. He also writes for the Investment Trust Handbook each year and has contributed to The Daily Telegraph and other publications. See here for details of current investments held by Max.

-

Review: Pierre & Vacances – affordable luxury in iconic Flaine

Review: Pierre & Vacances – affordable luxury in iconic FlaineSnow-sure and steeped in rich architectural heritage, Flaine is a unique ski resort which offers something for all of the family.

-

Could you get cheaper loans under ‘significant’ FCA credit proposals?

Could you get cheaper loans under ‘significant’ FCA credit proposals?The Financial Conduct Authority has launched a consultation which could lead to better access to credit for consumers and increase competition across the market, according to experts.

-

Rishi Sunak: MoneyWeek Talks

Rishi Sunak: MoneyWeek TalksPodcast On the MoneyWeek Talks podcast, Rishi Sunak tells Kalpana Fitzpatrick that we need better numeracy skills to improve financial literacy and boost the economy.

-

Is an inheritance tax (IHT) cut on the way?

Is an inheritance tax (IHT) cut on the way?Tax Talk that the government might cut or scrap inheritance tax in its Autumn Statement is rife. We look at how it could be reformed, and what difference it would make.

-

Act now to bag NatWest-owned Ulster Bank's 5.2% easy access savings account

Act now to bag NatWest-owned Ulster Bank's 5.2% easy access savings accountUlster Bank is offering savers the chance to earn 5.2% on their cash savings, but you need to act fast as easy access rates are falling. We have all the details

-

Moneybox raises market-leading cash ISA to 5%

Moneybox raises market-leading cash ISA to 5%Savings and investing app MoneyBox has boosted the rate on its cash ISA again, hiking it from 4.75% to 5% making it one of top rates. We have all the details.

-

October NS&I Premium Bonds winners - check now to see what you won

October NS&I Premium Bonds winners - check now to see what you wonNS&I Premium Bonds holders can check now to see if they have won a prize this month. We explain how to check your premium bonds

-

Government considering cuts to inheritance tax, reports say

Government considering cuts to inheritance tax, reports sayThe Sunday Times reported government officials are considering cuts to inheritance tax ahead of the general election.

-

The best packaged bank accounts

The best packaged bank accountsAdvice Packaged bank accounts can offer great value with useful additional perks – but get it wrong and you could be out of pocket

-

Bank of Baroda closes doors to UK retail banking

Bank of Baroda closes doors to UK retail bankingAfter almost 70 years of operating in the UK, one of India’s largest bank is shutting up shop in the UK retail banking market. We explain everything you need to know if you have savings or a current account with Bank of Baroda