Are cash ISAs worth it? Not if you want to beat inflation

High interest rates are undermining the potential of many savings products, but are cash ISAs worth it or can your money be put to work elsewhere?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If you have some spare cash lying around, the lesson of old would be to put it away in some form of savings account, but rampant inflation is undermining the real returns cash ISA customers can achieve. So, are cash ISAs worth it?

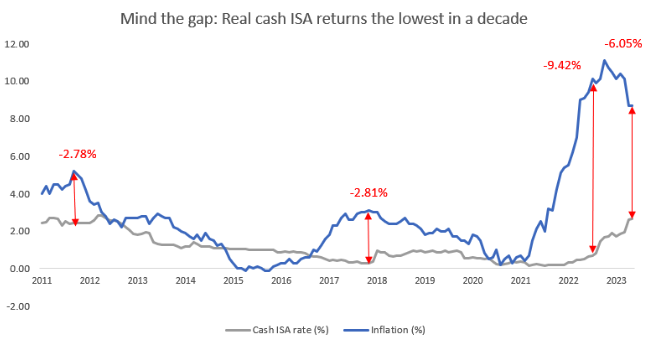

According to analysis from Quilter, cash ISA savers are realising a more than 6% loss on their savings over the last 12 years, due to the gap between savings rates and inflation.

While this still represents a significant loss, the picture has improved from the end of last year when savers were suffering near double-digit losses.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Are cash ISAs worth it?

When CPI inflation hit 11.1% in the 12 months to October 2022, the monthly interest rates available on cash ISA deposits, including unconditional bonuses, stood at just 1.69%, meaning cash ISA savers suffered a real terms loss of 9.41%.

Even in March 2023, savers bore an 8.15% real terms loss.

July 2022 marked the highest loss in over a decade when savers faced a decline of 9.42%.

This was the highest real terms loss on cash ISA savings in over a decade, coming in more than triple the previous highest loss of -2.81% in November 2017.

“Although the picture has improved in certain corners of the market even savers on the very best rates will be realising a real term 3% loss,” says Rachael Griffin, tax and financial planning expert at Quilter.

Cash ISAs have long been an “easy way to save money with comparatively little risk,” she adds, but they still get “ravaged by the impact of inflation.”

But with inflation now hitting 30-year highs and interest rates on cash savings still lacklustre, now may be the time to consider an alternative way to achieve above-inflation returns.

How can I beat inflation?

According to Quilter’s sums, someone who invested £10,000 in a cash ISA in January 2011 would currently have £11,472.09. Adjusted for inflation, this is just £8,041. In contrast, a £10,000 investment in a stocks and shares ISA, held in the IA Global Equity index over the same period would be worth £26,956 or £18,901 after inflation.

And while these figures do not account for charges that may reduce the final sum, they are indicative of the cash erosion many ISA holders face amid the high-inflationary environment.

According to the latest HMRC data, around 11.8 million Adult ISA accounts were subscribed to in 2021 to 2022 of which 920,000 were cash ISAs.

In recent weeks, savings rates have crept up as competition heats up between banks. While many high street banks had to be spurred by the Financial Conduct Authority to up savings rates, other banks have been offering enticing rates.

The best 1-year fixed-rate account currently stands at 6.1%, while a two-year fix will net you 6.15%.

Meanwhile, NS&I today upped rates on its fixed-term products - the interest rates paid on NS&I’s fixed-term Guaranteed Growth Bonds and Guaranteed Income Bonds are increasing to 5.00% for new customers, up from the existing 4.00% and 3.90% respectively.

But are these savings methods enough to beat inflation? Quilter’s Griffin says: “If you won’t be needing the money in the next few years, investing could help make your cash work harder, and has a better chance of delivering an above-inflation level of return over the length of the investment although there are still risks associated investing too.”

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Tom is a journalist and writer with an interest in sustainability, economic policy and pensions, looking into how personal finances can be used to make a positive impact.

He graduated from Goldsmiths, University of London, with a BA in journalism before moving to a financial content agency.

His work has appeared in titles Investment Week and Money Marketing, as well as social media copy for Reuters and Bloomberg in addition to corporate content for financial giants including Mercer, State Street Global Advisors and the PLSA. He has also written for the Financial Times Group.

When not working out of the Future’s Cardiff office, Tom can be found exploring the hills and coasts of South Wales but is sometimes east of the border supporting Bristol Rovers.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how