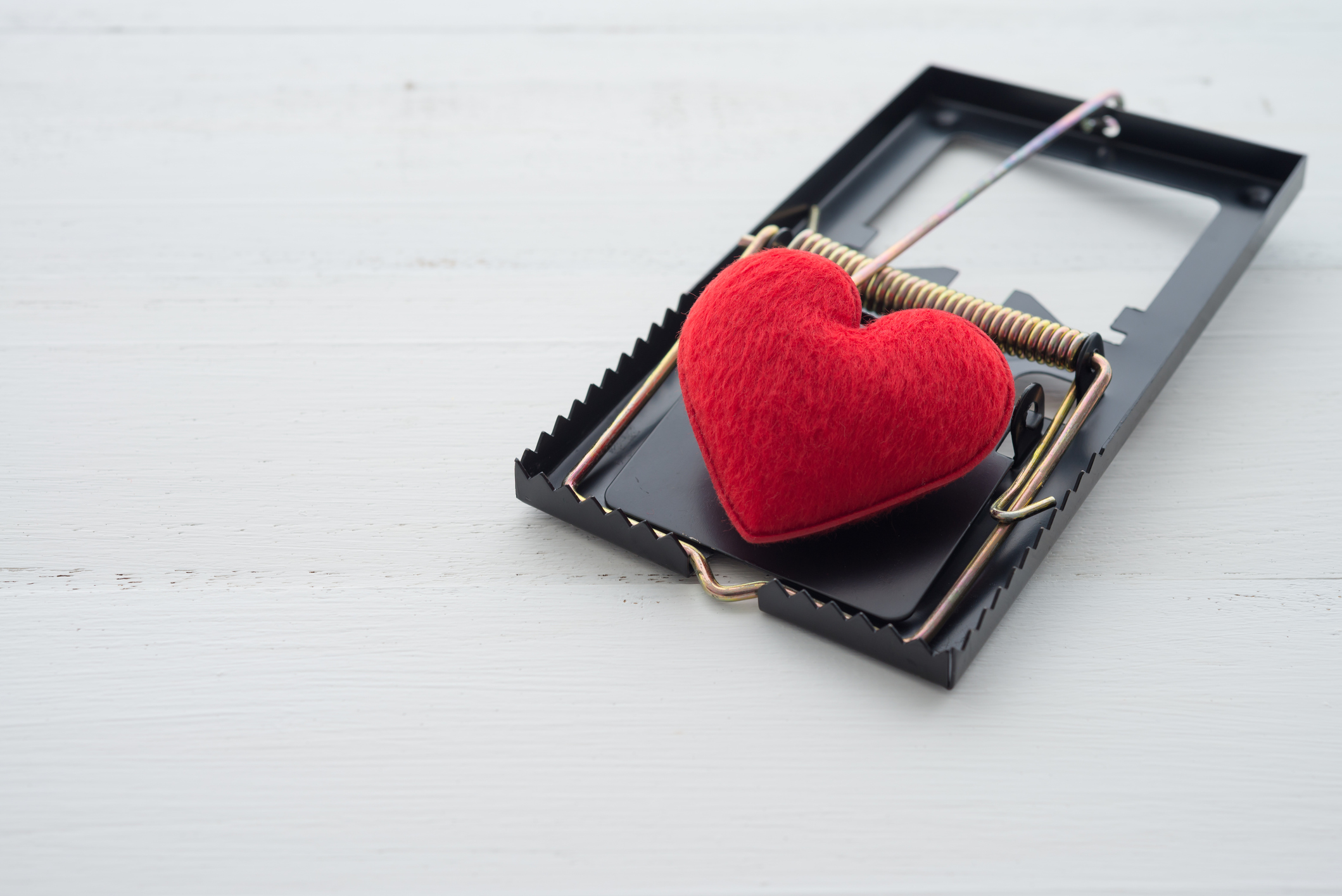

Barclays reports large spike in romance scams - here's how to avoid them

Barclays has reported a whopping 139% increase in the total value of romance scams

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Romance scams increased sharply during May and June, according to data from Barclays, with men losing £3,500 on average and women £8,900.

The UK bank found a 139% increase in the total value of romance scam reports when comparing May and June with the previous two months.

While men account for the majority of romance scam reports received, women typically lose more money, Barclays said.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Kirsty Adams, a fraud and scams expert at the lender, said: "It may be surprising to see that men more often fall victim to romance scams, as stereotypes have often incorrectly painted women as more susceptible.

"This is backed by our additional research, which shows that men are generally more willing than women to transfer money to people they have recently started dating, even if they are yet to meet in person."

What does a romance scam look like?

Romance scammers usually create fake profiles online on social media and dating apps, such as Instagram, Facebook and Tinder.

They trick people into believing that they are in a relationship through false romantic gestures or words. After this, they normally begin asking for money claiming medical or family issues.

There is no limit on how long such scams can last, as it can be anywhere from a few weeks to months.

We look at how to differentiate between a genuine connection and a fraud, and a few things to be wary of.

How to avoid romance scams

What makes romance scams so dangerous is how fraudsters can control the victims’ emotions and make their feelings appear legitimate.

But sometimes, following your gut instinct can be the right thing to do in order to protect yourself.

Here are a few ways to save yourself some emotional and financial damage:

Be cautious of strangers on social media

Avoid accepting friend requests from people you don’t recognise. In the odd case that you do, make sure to thoroughly check their profiles before you begin a conversation.

Carry out a reverse image check

Sometimes, scammers tend to use attractive or stolen photos to create a fake identity. By doing a reverse image search on Google, you can verify if it’s an authentic person or a fake.

Ask questions

Sometimes, if the person seems as if they are too good to be true, it might just be right. A lot of times, scammers tend to stick to asking personal questions, instead of answering them. Try to get the most out of the other person and cross-check that information online, if possible. For example, a school they went to or a friend you have in common.

Never send money

If you’ve only met someone online and they ask you for money, they’re most likely to be a scammer. Don’t share any personal information such as your bank details or passwords that could be exploited.

Notice the tiny details

See if the person avoids showing their face on video calls or suggests meeting in person. It might be because they are catfishing or using someone else’s photos to trick you.

Report suspicious activity

If you suspect you are being targeted by a scammer, report the account or incident online. It’s always better to be safe than sorry.

Liz Ziegler, fraud prevention director at Lloyds Bank, said, “Social media and online dating apps are rife with fake profiles, and it can be hard to tell who is genuine.

“Remember that no good relationship starts off by sending money to someone you haven't met and this should be a big red flag.

"As soon as someone you’re talking to starts asking for money, step back from the situation and never hand anything over.”

What to do if you fall for a scam

If you have sent money to someone you now suspect to be a fraudster, the first thing to do is to speak to your bank, building society or credit card provider. You should do this as quickly as possible; they may be able to stop the payment or refund you the money.

It’s also a good idea to report scams ‒ whether you fall for them or not ‒ to Action Fraud. This is the national fraud and cyber crime reporting centre, which is run by the police.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Chris is a freelance journalist, and was previously an editor and correspondent at the Financial Times as well as the business and money editor at The i Newspaper. He is also the author of the Virgin Money Maker, the personal finance guide published by Virgin Books, and has written for the BBC, The Wall Street Journal, The Independent, South China Morning Post, TimeOut, Barron's and The Guardian. He is a graduate in Economics.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Nationwide promises to protect all its branches from closures until at least 2030

Nationwide promises to protect all its branches from closures until at least 2030The building society has extended its pledge to keep all high street Nationwide and Virgin Money branches open, now until at least 2030.

-

Barclays bank switch: how to get £400 'free' cash by moving accounts

Barclays bank switch: how to get £400 'free' cash by moving accountsBarclays has unveiled a £400 current account switching offer, running alongside its £500 ISA transfer deal. Which accounts are on offer, and are you eligible?

-

Green mortgages: how do they work and how much can you save?

Green mortgages: how do they work and how much can you save?Most high-street lenders now offer some kind of green mortgage deal. We look at who’s eligible, how to apply and the mortgage rates and cashback on offer

-

Thousands of Brits switch to Nationwide, Monzo and NatWest – which banks are least popular?

Thousands of Brits switch to Nationwide, Monzo and NatWest – which banks are least popular?We look at the most and least popular banks and building societies as current account bank switches reach a record high. Is it worth moving your money?

-

Barclays to pay millions in compensation after IT outage chaos

Barclays to pay millions in compensation after IT outage chaosBarclays intends to compensate customers after an IT outage caused payment problems for three days

-

Nationwide, HSBC, Barclays and Virgin Money customers hit by payment issues

Nationwide, HSBC, Barclays and Virgin Money customers hit by payment issuesThe problems have been compounded as Friday is the last day of the month when many people are paid by their employer

-

Best and worst UK banks revealed

Best and worst UK banks revealedWe reveal the best UK banks – and the worst – when it comes to managing your money and good customer service. How does your provider compare?

-

Barclays bank caps in-branch cash deposits for personal banking customers

Barclays bank caps in-branch cash deposits for personal banking customersNews Barclays said the new cash deposit limit was part of a bid to clamp down on financial crimes, like money laundering. But will it affect you?