Summary

- Nvidia rounded off the Magnificent 7 earnings season today after US markets closed.

- The company reported record quarterly revenue of $39.3 billion, up 12% from Q3 and up 78% from a year ago.

- Earnings per share came in at $0.89, up 14% from the previous quarter and up 82% from a year ago.

- Both metrics beat analysts' consensus estimates ($38.08 billion for revenue and $0.85 for EPS).

- After some initial volatility, the share price has risen so far in after-hours trading.

- Over the past couple of months, Chinese AI start-up DeepSeek has dented Nvidia’s share price, as its AI LLM (large language model) is less dependent on advanced GPUs.

The team at MoneyWeek is reporting live. Scroll for the latest news and analysis.

| Nvidia shares | Magnificent 7 stocks | DeepSeek’s shake-up | Tech and AI stocks to watch |

Good morning, and welcome to MoneyWeek’s live blog covering Nvidia’s earnings.

The big release is two days away, but we’re bringing all the analysis and updates ahead of time, as there’s plenty for investors to wrap their heads around before Nvidia’s earnings announcement.

Keep checking in for the latest analysis, predictions and reactions from what has become the stock market’s marquee quarterly event.

When does Nvidia announce earnings?

Nvidia’s earnings are scheduled to be announced on Wednesday 26 February, after markets close in the US.

US markets close at 4pm Eastern time zone (ET), so 9pm in the UK. It is hosting a conference call to discuss the results at 5pm ET – 10pm UK.

Normally, all we’d be able to say is that the results will be published at some time during that hour channel. Nvidia has however confirmed it will happen at approximately 1.20 pm Pacific time zone: 5.20pm ET / 9.20pm in the UK.

What is DeepSeek, and why does it matter for Nvidia’s earnings?

One of the key topics that Nvidia (NASDAQ:NVDA) CEO Jensen Huang is likely to address when he speaks to investors and analysts on Wednesday is DeepSeek, the Chinese AI start-up that has turned stock market assumptions about AI on its head.

In brief, DeepSeek released a large language model whose performance matches or exceeds that of ChatGPT – at a fraction of the training cost and, crucially for Nvidia, compute requirements.

Nvidia’s market cap fell $600 billion in a single day following what Silicon Valley venture capitalist Marc Andreessen called AI’s “Sputnik moment”; the biggest single-day loss in stock market history.

So, not only is Nvidia going to need to post strong results for the quarter that ended in December. It will also need to reassure markets that its business can withstand a disruption to the massive chip demand that, it had been assumed, will accompany AI adoption over the long term.

More competition for Nvidia

DeepSeek isn’t the only disruptive threat looming over Nvidia’s earnings release.

Last week, MoneyWeek’s sister site Tech Radar reported that SambaNova Systems, an AI startup founded by former Sun/Oracle employees, claims to have achieved the fastest deployment of the DeepSeek-R1 large language model (LLM) to date.

SambaNova claims to have reduced the hardware requirement to achieve 198 tokens per second per user (a measure of LLM efficiency) from 40 racks of 320 Nvidia GPUs to just 16 custom-built chips.

SambaNova is the fastest platform running DeepSeek,” said Rodrigo Liang, CEO and co-founder of SambaNova. “This will increase to 5X faster than the latest GPU speed on a single rack - and by year-end, we will offer 100X capacity for DeepSeek-R1.”

Big tech spending raises pressure on Nvidia

Increased competition has piled the pressure on Nvidia ahead of its earnings release. Investors have come to expect big things from the semiconductor giant, and if the rest of big tech earnings season so far is anything to go by, then the pressure will be on the company to post positive outlook numbers despite the DeepSeek uncertainty.

The challenge is that Nvidia’s biggest customers – the so-called cloud ‘hypscalers’ like Microsoft (NASDAQ:MSFT) and Amazon (NASDAQ:AMZN) – have outlined robust spending plans despite DeepSeek seeming to suggest that AI can be done cheaper.

“Recent signals, including massive investment plans from the big tech giants, suggest Nvidia’s cutting-edge chips remain in hot demand,” says Matt Britzman, senior equity analyst, Hargreaves Lansdown.

Other semiconductor companies, such as Arm (NASDAQ:ARM) and Qualcomm (NASDAQ:QCOM) whose guidance has underwhelmed so far this earnings season have been punished by the market despite beating expectations on headline figures.

Nvidia earnings expectations

We know that Nvidia is swimming upstream in the run-up to its earnings release, and that the markets are likely to be jumpy given the threats that are appearing to its dominance of the AI market.

The reporting period in question, though, predates the emergence of DeepSeek, so it’s worth taking stock of the kind of numbers analysts are looking for, before getting too carried away with the future implications for Nvidia.

Here’s a summary of what two polls of Wall Street analysts yield in terms of consensus revenue and earnings expectations for Nvidia:

Analyst poll | Expected Q4 earnings per share (EPS) | Expected Q4 revenue |

|---|---|---|

FactSet | $0.85 | $38.08 billion |

London Stock Exchange Group (LSEG) | $0.84 | $38.05 billion |

These numbers, if accurate, imply a year-on-year increase of 61.5% for Nvidia’s quarterly earnings and revenue growth of slightly approximately 72%.

Blackwell key for Nvidia

Investors will be looking especially keenly at how the rollout of Nvidia’s latest chip generation, Blackwell, is coming along.

“The rollout of its latest Blackwell chips will take centre stage where supply constraints held things back a touch in the prior quarter,” says Matt Britzman, senior equity analyst, Hargreaves Lansdown.

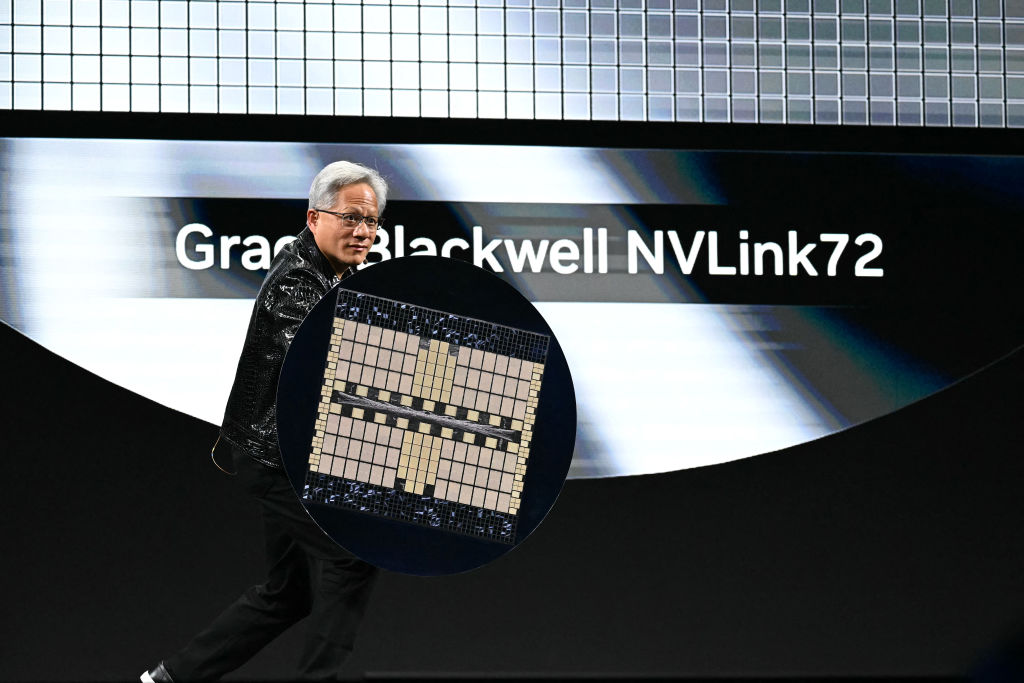

Jensen Huang, CEO of Nvidia, showcases the Grace Blackwell NVLink72 chip at the Consumer Electronics Show (CES) in Las Vegas, Nevada last month.

Related to this will be the margins on Blackwell. With Nvidia shares currently priced for perfection, profits as well as sales need to be strong on its next-generation chips if investors are to maintain their confidence.

“Margins will also be under the spotlight. Costs tied to Blackwell’s ramp-up could put some pressure on gross margins, with any dip below the guided 73.5% mark likely to ruffle a few feathers,” says Britzman.

What does China’s AI boom mean for Nvidia?

Nvidia’s shares nosedived in the wake of DeepSeek’s appearance on the AI scene.

The start-up’s emergence, though, has been a boon to Chinese tech stocks, which have been down in the dumps for several years.

The Year of the Snake looks like it could hold the antidote for the sector’s malaise. The Hang Seng Tech Index, which is composed of Hong Kong’s 30 largest tech companies, has gained nearly 33% in the year to date (that is, since the start of January).

“Investors are re-evaluating the tech gap between China and the US,” says Lale Akoner, global market analyst at investment platform eToro. “China’s AI breakthroughs, particularly DeepSeek’s advancements, are attracting global interest in its AI and semiconductor sectors.”

Akoner goes on to say that US export controls on Nvidia’s most high-tech chips – controls that Nvidia has consistently criticised – has pushed China to develop its own domestic alternatives.

“Companies like Huawei (Ascend), Alibaba (T-Head) and SMIC are aggressively working to fill this gap, she says. “Stronger government backing for private businesses is also boosting sentiment, as Beijing’s September policy pivot reduced downside risks and President Xi Jinping is actively engaging with leaders from Alibaba, Tencent, and BYD.

Why has Scottish Mortgage sold Nvidia shares?

Scottish Mortgage Investment Trust (LON:SMT) reduced its exposure to Nvidia back in November.

Answering questions on the decision last week, Lawrence Burns, investment manager at Baillie Gifford (the trust’s manager), explained in a webinar that Scottish Mortgage has already banked a £1.5 billion profit on its initial investment of just £64 million, thanks to Nvidia’s outsized share price gains, and its remaining stake is still worth £500 million.

He also mentioned that AI companies have highlighted a shift from raw compute driving improved AI performance, “towards more algorithmic changes.

“We thought that would have an impact potentially on the level of demand over the very long run,” he said. Linked to this is a shift in focus among AI developers from training to inference; Nvidia’s competitive advantage is massively in the former, and less so in the latter.

Can Nvidia survive reduced AI costs?

Nvidia’s share price plummeted in the aftermath of DeepSeek’s appearance.

It has rallied since, but the stock, which has gained almost 480% over the past two years, has flatlined so far in 2025.

That stutter could be unwarranted. It’s based on an assumption among investors that reduced compute requirements for the top-performing AI models means less demand for chips, but that doesn’t necessarily follow.

“For Nvidia there’s an argument that even if the cost of compute comes down rapidly, it just means more companies will have access and the ability to create AI products and the overall aggregate demand for Nvidia’s product can actually still grow in that environment,” says Matt Britzman, senior equity analyst, Hargreaves Lansdown. “In economics it’s known as the Jevons Paradox.

“I think it is also important to look at the sentiment on the field, when we take Meta, Microsoft and now Alphabet everyone is still pushing capex higher – there’s a slim chance they all have it wrong, but I don’t think we’re at a stage yet where compute buildout is going to materially dip.”

Good morning, and welcome back to our live blog on Nvidia's upcoming earnings release.

Plenty more analysis and previews to come today, ahead of the big release tomorrow evening. Stay with us here for all the latest.

More on Chinese AI

Given DeepSeek, the precarious geopolitical outlook and ratcheting sanctions regime and the revival of investor interest in Chinese tech stocks, China is likely to dominate the discourse around Nvidia’s earnings one way or another.

On that note, news broke overnight that Huawei has improved its AI chip production volume. The FT reports that the yield of its latest AI chips – the percentage of chips made on its production line – has increased to almost 40%, double the equivalent figure from a year ago.

“If Chinese companies shift reliance away from Nvidia's GPUs, it could erode Nvidia’s China market share,” says Lale Akoner, global market analyst at eToro. “It is already under pressure due to US export controls.”

If falling market share in China hurting a Magnificent Seven stock sounds familiar to you, it should: Apple and Tesla have both lost ground to local competitors in the world’s biggest smartphone and electric vehicle market.

Nvidia’s broadening lineup

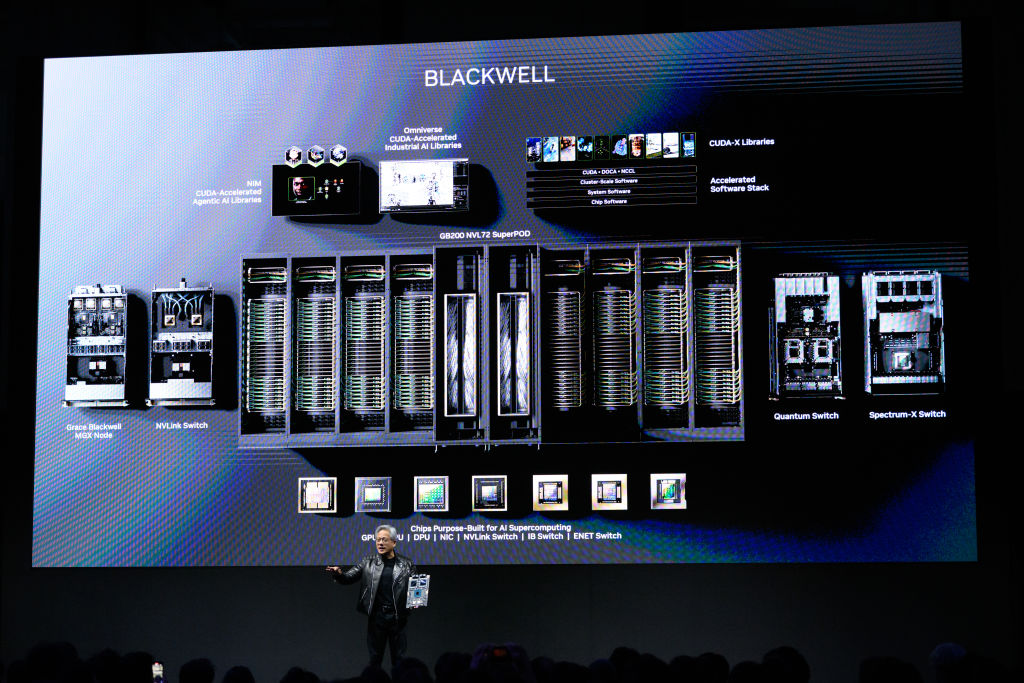

Competition is brewing for Nvidia’s core GPU market. It had significant first-mover advantage here, but broadening its offering is going to be a key factor in its ability to withstand competition that will inevitably arise over the longer term.

“Nvidia is expanding its lineup with new chips like Spectrum-X and H200, set to ramp up in the first half of the year,” Kate Leaman, chief market analyst, AvaTrade, tells MoneyWeek. “AI-powered PCs are gaining traction. Even the self-driving tech market is seeing growth, adding yet another revenue stream.”

Self-driving car technology is one of a number of potential growth segments for Nvidia.

Investors will likely look for an update on all of these when Nvidia announces earnings, as well as its foray into robotics.

“CEO Jensen Huang sees a multi-trillion-dollar market emerging” in self-driving and robotics, according to Matt Britzman, senior equity analyst, Hargreaves Lansdown.

Blackwell in demand

Despite Nvidia’s broadening product lineup, Blackwell’s rollout is likely to garner significant attention from analysts and investors. The supply/demand dynamic is going to be a hot topic on Wednesday’s earnings call.

While investors will be sensitive to any perception of weakening demand, they’ll also be paying close attention to Nvidia’s supply of the new chips.

“Even though execs assured Wall Street that they expect to exceed “several billion dollars” in Blackwell revenue in the fourth quarter, there are caveats,” says Josh Gilbert, market analyst at eToro. “We know the company is basically at its production capacity and is struggling to meet demand – and where there’s unfulfilled demand, there is potential for competitors.”

Once again, investors need to bear in mind that Nvidia’s meteoric rise over the last two and a half years has been based on a landscape in which it has an effective monopoly on chips powerful enough to build and train the best AI models. Anything that undermines this, even implicitly, makes the massive growth expectations built into Nvidia’s valuation that much harder to achieve.

Nvidia’s share price steady ahead of earnings

While the AI boom has propelled Nvidia to being one of the world’s most valuable companies, the stock has suffered an uncharacteristic wobble during this year’s big tech earnings season.

The stock closed yesterday (24 February) 3% down through 2025 to date. The biggest drop, by far, came on 27 January, when DeepSeek’s appearance wiped $600 billion off Nvidia’s market cap in a single day.

That said, the stock has made a partial recovery since then; between 27 January and 24 February, it gained 10%.

For various reasons, as we’re discussing, it could take a mammoth earnings report on Wednesday to reinvigorate the kind of enthusiasm that investors have shown towards Nvidia’s stock for the last two years.

The bear case for Nvidia: are earnings multiples justified?

It might seem, reading through the blog, that we’re focusing a lot on what could go wrong for Nvidia when it announces earnings. In part, that’s because its stellar stock market rise over the last two years or so has been largely predicated on everything seemingly going right. Perfection is more or less priced in (the post-DeepSeek dip notwithstanding), so the factors that could move the dial are, in general, the ones where something could go wrong.

That’s not necessarily a bearish stance. If you want to see a real Nvidia bear, David Bahnsen, chief investment officer of The Bahnsen Group, is worth a look.

Banhsen told Yahoo Finance that most of the bullish outlooks for Nvidia are based on “forward estimates that are wildly speculative”.

“The fact of the matter is that it’s [trading at] 58 times [earnings] on a trailing-12 [month] basis,” he continued, “which is how people have always looked at earnings multiples; not on what they expect it will do, but on what it has done.” He stated that Nvidia’s trailing price to earnings (P/E) ratio doesn’t compare favourably to “other AI companies, let alone S&P names”.

Instrument | P/E ratio (trailing 12 months) |

|---|---|

Nvidia | 51.44 |

Apple | 39.35 |

Microsoft | 32.55 |

Amazon | 38.46 |

Alphabet | 22.28 |

Meta | 28.00 |

Tesla | 162.02 |

S&P 500* | 25.82 |

Source: stockanalysis.com, *Birinyi Associates via Wall Street Journal as of 21 February

Besides Tesla, which is trading far more on expectations of its future robotaxi business than anything it currently does, Nvidia’s P/E ratio is the highest in the Magnificent Seven, and nearly double the S&P 500 average.

Bahnsen doesn’t think it’s correct to view Nvidia as having monopolised AI chips, either.

“No-one in their right mind thinks Nvidia’s a monopoly,” he said. “There’s tons of competition. But all of the earnings multiple estimates are based on them never having competition.

“They’re running at a 56% net margin when some competitors are at 12% and 15%. I’m sorry; there’s downward pressure coming on these margins, and the P/E does not yet reflect it.”

Nvidia’s share price falling day before earnings

The Nvidia bears are out in force today. At time of writing, the stock is down around 2.6% so far this session (though see the ticker below for up-to-date info).

More quotes from David Bahnsen, chief investment officer of The Bahnsen Group, in his articulation of the bear case for Nvidia to Yahoo Finance:

"The question is, why the stock hasn't made a new high when the entire market is up substantially... The beauty of the technology story in America for years and years is that these margins come down over time. You do not get to expand in infinity when there’s real competitors.”

There’s also a mathematical difficulty in Nvidia’s market cap increasing any further beyond its current level.

“To grow 10%, which is not that big a deal, you have to add a $300 billion market cap to what you already have,” Bahnsen points out. “Basically, add the size of a massive amount of the American economy, just to get another 10%.

“That’s the issue they’re up against; the law of large numbers.”

Nvidia drags Nasdaq negative

Nvidia’s share price also fell yesterday, dragging the Nasdaq 100 into negative territory for the year. At time of writing, the tech-heavy index, which has been a powerful driver of stock market value growth over recent years, is down around 0.9% year to date.

Richard Hunter, head of markets at Interactive Investor, attributes this to Nvidia’s struggles, as well as those of Palantir, which fell 10% on 24 February and is down around 30% over the last five days.

Hunter also draws attention to Warren Buffett’s apparent shunning of the stock market following Berkshire Hathaway’s results.

“While the numbers were strong enough to propel a share price gain of over 4% [for Berkshire Hathaway], concerned investors noted a lack of new equity investment and an astonishing cash pile of $334 billion as being indicators that the market for value stocks is currently limited given generally lofty valuations,” said Hunter.

Can Nvidia’s earnings keep outperforming?

The simple reason why expectations for Nvidia’s results are so high is that, in short, it keeps over-delivering in its earnings releases.

“Nvidia has beaten consensus estimates and raised guidance for each of the past seven quarters, which helps to explain its stellar share price performance,” explains Russ Mould, investment director at AJ Bell. “Chief executive Jensen Huang set a higher bar still for the final quarter of this fiscal year as he guided toward further sequential improvement in both the top line and profits, alongside the third-quarter results, although he was a little more cautious on near-term costs.”

Nvidia CEO Jensen Huang has raised expectations ahead of Wednesday's earnings report.

Mould continued: “Whether Mr Huang was just sandbagging the numbers or not, we are about to find out, and it is against that guidance that these fourth-quarter figures will be benchmarked. Analysts will also look for any steer on what the first quarter of the new fiscal year to the end of April may look like.”

Will Nvidia stay on top of AI?

That’s all from us tonight – thanks for following the blog today, and looking forward to picking it back up tomorrow, with all the build-up to Nvidia’s earnings release in the evening.

Before then, let us know what you think about Nvidia’s prospects, given the challenges it’s currently facing.

Goodbye from us in the meantime!

Nvidia’s shares down ahead of earnings

Good morning, and welcome back to our Nvidia earnings live blog. A big day coming up; plenty more analysis and comment, ahead of the big event this evening.

Nvidia’s shares fell 2.8% yesterday, making it three consecutive sessions of decline for the stock ahead of its Q4 earnings release.

We’ll digest the all the reaction to the moves, and bring you the breaking news live tonight as Nvidia announces its much-anticipated results.

What time does Nvidia announce earnings?

Officially, Nvidia’s earnings release is scheduled for after the close of US markets, which happens at 9pm in the UK. Nvidia has indicated that its earnings release will be published around 20 minutes after that.

Here’s a summary table of the major milestones to watch out for today ahead of Nvidia’s earnings. All times are GMT.

What? | When? |

|---|---|

US markets open | 2.30pm |

US markets close | 9pm |

Expected release of Nvidia’s earnings | C. 9.20pm |

Nvidia’s earnings call starts | 10pm |

After-hours trading – in which we’ll see the immediate reaction to Nvidia’s earnings and management’s comments in the call – usually runs for four hours after markets close, so until 1am tomorrow.

Nvidia shares are expected to be highly volatile during this period.

Why does Nvidia’s earnings matter to you?

It’s worth reminding ourselves why Nvidia’s earnings release has become one of the most talked-about events in the stock market.

Because of Nvidia's meteoric rise, and its central position in the AI boom, the company has become a bellwether for the wider market.

“Bulls of US equities more generally will be looking to Nvidia for reassurance,” says Russ Mould, investment director at AJ Bell.

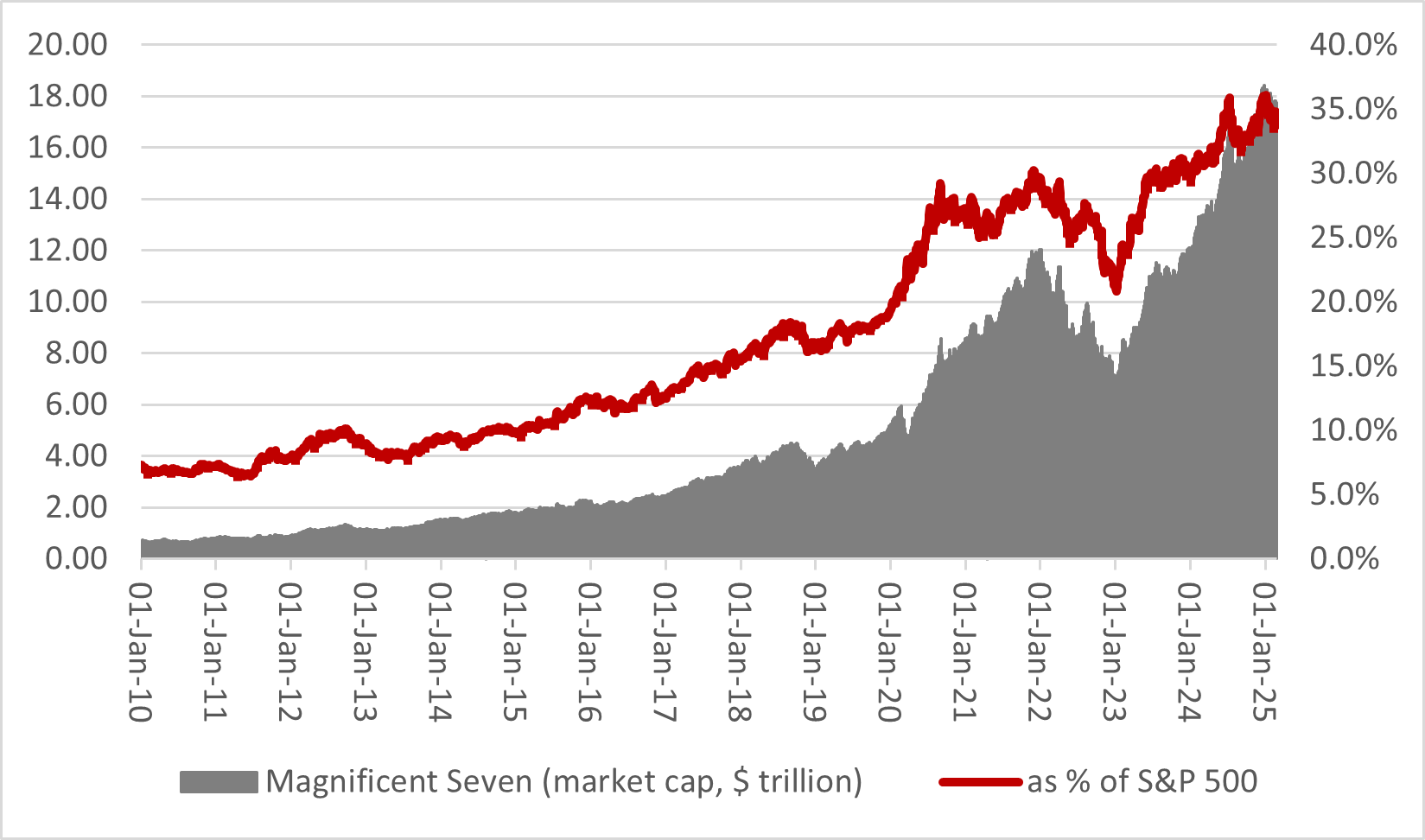

Investor sentiment is only part of the equation, though. Mould highlights that the Magnificent Seven – of which Nvidia is the second-largest stock – constitutes over a third of the S&P 500 index’s market value.

The Magnificent Seven now comprise more than a third of the total S&P 500 index.

“Students of stock market history will remember that similarly lop-sided markets in the late 1960s (US tech stocks), the early 1970s (the Nifty Fifty) and the late 1990s (tech stocks again) all eventually tipped over,” says Mould.

Given the extent to which most portfolios – including any stock market trackers, most stocks and shares ISAs, and pension funds – are long on US stocks, what happens to Nvidia’s earnings and its share price has a direct impact on everyone’s savings and investments, because of the outsize impact it has on the S&P 500.

Could Nvidia’s earnings be US tech’s “defining moment”?

While the S&P 500 and the Dow Jones have both made gains this year, indicating strength for US equities, the tech-dominated Nasdaq 100 – which has led both over the last five years – has fallen 1.5% so far this year.

The US tech sector is “under nervous pressure ahead of the latest update from previous market darling Nvidia”, says Richard Hunter, head of markets at Interactive Investor.

“As such, Nvidia’s results come at what could prove to be a defining moment. Elevated earnings expectations come alongside a punchy valuation,” Hunter continues, adding that the rise of models like DeepSeek “have recently derailed [Nvidia’s] hitherto stellar share price performance in raising questions over whether developments in AI could come more cheaply than has been the case until now”.

Other big tech earnings besides Nvidia announced today

Nvidia’s earnings aren’t the only big tech results being announced today.

Salesforce (NASDAQ:CRM) and Snowflake (NASDAQ:SNOW) are both announcing their results after markets close – that is, around about the same time that Nvidia announces its earnings.

Both are interesting companies in the AI landscape beyond Nvidia. Snowflake’s software is geared towards the management and governance of unstructured data: as such, it’s a key component in the development and training of AI models running on this data.

Salesforce, meanwhile, has been consciously building AI into its software for over a decade now. As a deployer of AI, rather than a producer of its underlying infrastructure, Salesforce is not only well-positioned for a period which many observers think will see greater adoption of AI in enterprise contexts, but it is also – unlike Nvidia – a potential beneficiary of falling production costs for AI models.

In stark contrast to Nvidia, Salesforce’s shares gained on 27 January, following the appearance of DeepSeek, though the stock has declined since and is down 8.5% through 2025 to date.

Nvidia shares up ahead of earnings

Could Nvidia’s shares bring a bit of positive momentum into its earnings release?

Approximately 15 minutes into the final trading session before announcing results, Nvidia’s shares are up around 2.5% – though see the ticker below for up-to-date information.

Will that hold until the end of the session – and how will markets react to Nvidia’s earnings release in after-hours trading?

When does Nvidia competitor Broadcom announce its earnings?

Broadcom (NASDAQ:AVGO) is a key company to watch out for alongside Nvidia, for anyone interested in the broader AI and semiconductor sector. It’s been tipped to join the Magnificent Seven cohort, forming a group of eight that some have dubbed ‘BATMAAN’ (Broadcom, Alphabet, Tesla, Meta, Amazon, Apple, Nvidia).

Broadcom, though, releases its earnings on 6 March – more than a week after Nvidia’s earnings release.

Those two reports between them ought to provide something of a picture of the health of US AI semiconductors.

Blackwell supply and demand in focus for Nvidia

As we highlighted yesterday, the rollout of the next-generation Blackwell chip is likely to be one of the key watch-outs for investors at Nvidia’s earnings call this evening.

“Investors may look out for any comments from Mr Huang on reported delays in the launch of the new Blackwell data centre chipset, owing to teething technical troubles,” says Russ Mould, investment director at AJ Bell. “Production of Blackwell was due to ramp up rapidly, as Nvidia has looked to maintain its technological lead by quickly improving upon the Hopper chipset.”

Despite the company moving fast to boost production, Nvidia’s chief finance officer Colette Kress warned in November’s earnings call that demand for Blackwell chips would outstrip supply for “several quarters”.

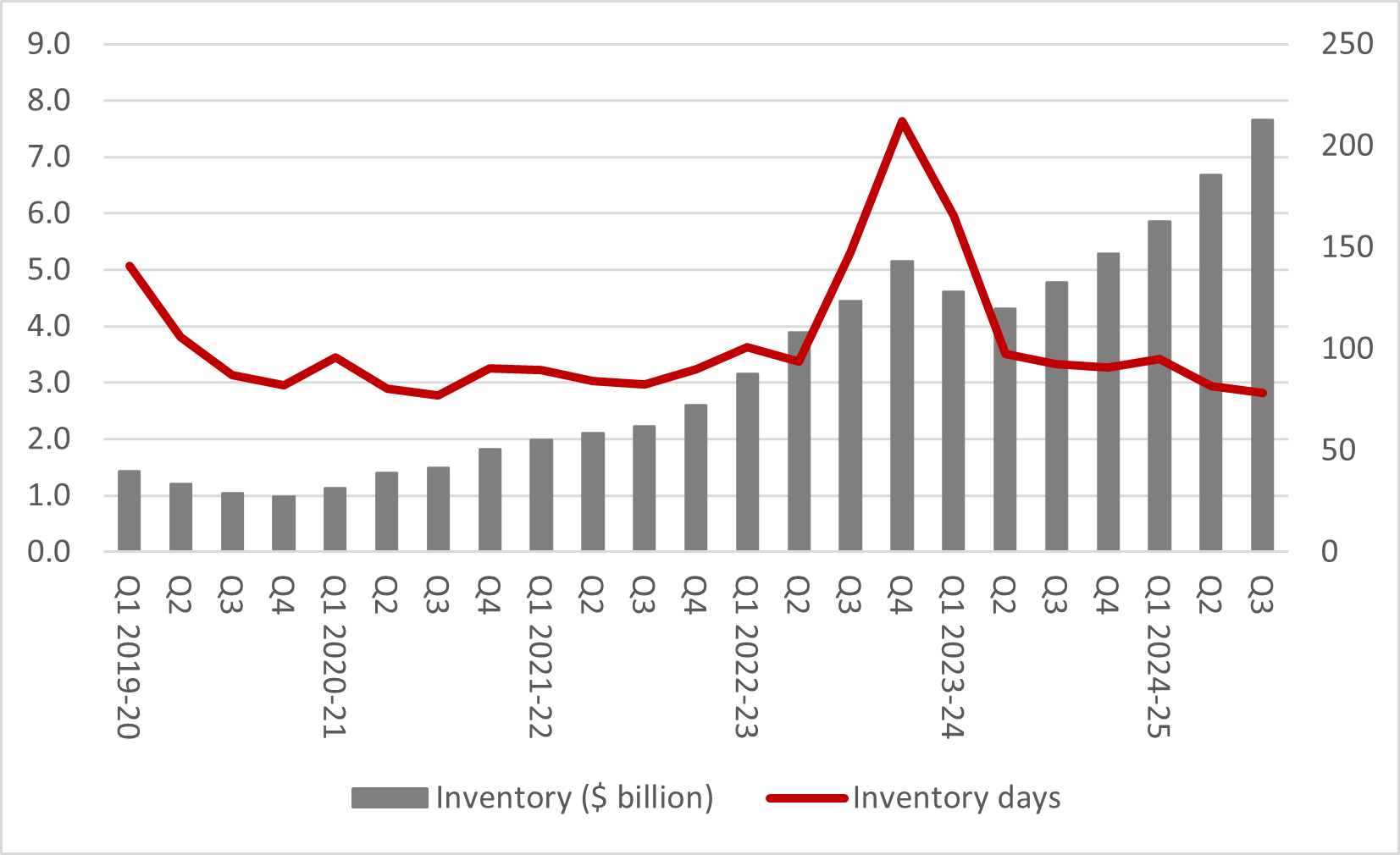

Mould notes, though, that while inventory days are rising, inventory days are coming down.

“The company had to work through an inventory bulge in 2022 and has done a good job since. Inventory may be rising but given the strong sales growth that is hardly a surprise and inventory days are back to pretty normal levels, by historic standards, at around 78 days,” he says.

Nvidia’s earnings guidance in focus

Jay Woods, chief global strategist at Freedom Capital Markets, outlines three big metrics he’s watching when Nvidia announces earnings tonight.

Blackwell revenue. This is expected to come in at $38 billion. Woods envisages a focus on Blackwell’s rollout and poses the question of whether or not Nvidia is able to meet demand.

DeepSeek questions. The implications of cheaper, less compute-heavy generative AI are likely to be front of mind, and Woods asks “will CEO Jensen Huang address this”?

Guidance. There’s two sides to the guidance coin, says Woods.

“First, given the continued capex spending by major customers in Meta, Amazon and Alphabet, can they meet the demand? Secondly, they have a history of upping projections for future earnings. Will this trend continue or are there growth concerns given global competition and inflation concerns at home?”

We’ll find out tonight – we’re around four hours away from Nvidia’s earnings release. As a reminder, that’s expected around 9.20pm tonight.

Nvidia’s shares resurgent ahead of earnings

Nvidia looks set to break its three-day losing streak today, at least in terms of its regular close.

At time of writing, the share price is up 4.6%.

Whether that lasts through to tomorrow morning, though, will depend on the market reaction to tonight’s earnings report, and whether Nvidia can meet the lofty expectations that the world's investors have set for it.

We're going to take a short break, but stay tuned. We'll be back later this evening to bring you the headlines from Nvidia's earnings, as they land.

Less than half an hour to go

Good evening, and welcome back to our Nvidia live blog. The semiconductor giant will publish its earnings after US markets close today. We are expecting the report at around 4.20pm EST (9.20pm GMT).

Just as a recap, here's what analysts are forecasting:

- EPS consensus estimate: $0.85

- Revenue consensus estimate: $38.08 billion

Nvidia's share price is in the green so far today, up almost 3.7% at the time of writing.

Nvidia beats earnings

Nvidia has reported record quarterly revenue of $39.3 billion, up 12% from Q3 and up 78% from a year ago. This beat analysts’ forecasts of $38.08 billion.

The company also posted record full-year revenue of $130.5 billion, up 114% compared to a year ago.

Earnings per share came in at $0.89, up 14% from the previous quarter and up 82% from a year ago. This beat analysts’ forecasts of $0.85.

Jensen Huang: "Demand for Blackwell is amazing"

“Demand for Blackwell is amazing as reasoning AI adds another scaling law – increasing compute for training makes models smarter and increasing compute for long thinking makes the answer smarter,” said Jensen Huang, founder and chief executive of Nvidia.

“We’ve successfully ramped up the massive-scale production of Blackwell AI supercomputers, achieving billions of dollars in sales in its first quarter. AI is advancing at light speed as agentic AI and physical AI set the stage for the next wave of AI to revolutionize the largest industries.”

Record data centre revenue

Nvidia also reported record data centre revenue in the fourth quarter. This came in at $35.6 billion, up 16% from Q3 and up 93% from a year ago.

Full-year data centre revenue rose 142% to a record $115.2 billion. Analysts at Morningstar were expecting it to come in at $114 billion.

"Nvidia’s data centre business has achieved exponential growth already, rising from $3 billion in fiscal 2020 to $15 billion in fiscal 2023 and more than tripling thereafter to $47.5 billion in fiscal 2024," Morningstar said.

Today's figures confirm it has now more than doubled again in the fiscal year 2025.

"Data centre revenue remains supply-constrained and near-term revenue will rise as more supply comes online," Morningstar added.

Nvidia's outlook

As well as publishing its Q4 earnings, Nvidia has issued some forward guidance for Q1 of the 2026 fiscal year.

Revenue is expected to come in at $43.0 billion, plus or minus 2%. This would constitute quarter-on-quarter growth of 9.4%, and year-on-year growth of 65.4%.

This would constitute a slowdown in the rate of growth compared to a year ago, though. In Q1 of the 2025 fiscal year, Nvidia reported quarter-on-quarter growth of 18% and year-on-year growth of 262%.

Rate of revenue growth is slowing

Nvidia's revenues are still growing each quarter – and the company has an impressive track record of beating analysts' expectations. However, the rate of growth is slower than it once was.

The YoY growth rate has slowed for four consecutive quarters and is now at its lowest rate since Q1 2024.

Quarter (fiscal year) | Quarterly revenue | QoQ growth rate | YoY growth rate |

Q4 2025 | $39.3 billion | +12% | +78% |

Q3 2025 | $35.1 billion | +17% | +94% |

Q2 2025 | $30.0 billion | +15% | +122% |

Q1 2025 | $26.0 billion | +18% | +262% |

Q4 2024 | $22.1 billion | +22% | +265% |

Q3 2024 | $18.12 billion | +34% | +206% |

Q2 2024 | $13.51 billion | +88% | +101% |

Q1 2024 | $7.19 billion | +19% | -13% |

Nvidia's share price in after-hours trading

After some initial volatility, Nvidia's share price has continued to rise in after-hours trading. At the time of writing, it is up around 2.4% versus market close.

That concludes our Nvidia coverage for tonight. Thank you for joining us. We will be back tomorrow morning with further insight and analysis.

In the meantime, our US sister site Kiplinger is sharing further commentary on its live blog: Nvidia Earnings: Live Updates and Commentary from Kiplinger

Good morning, and welcome back to our Nvidia earnings blog.

Nvidia shares finished after-hours trading 2.1% up on their regular trading close price, defying the odds with a strong set of results.

Keep following today as we bring you all the market reaction and analysis to Nvidia's earnings beat.

Nvidia’s earnings beat paves the way for further S&P 500 strength

Given the challenges facing the US economy so far this year – Trump’s tariffs, the resultant threat of retaliation, and the inflation all of that fuels – there have been concerns that the AI and technology-led rally in the S&P 500 might be coming to an end.

However, Thomas Matthews, head of Asia Pacific markets at Capital Economics, believes that there is still life in the rally.

For one thing, he writes, “earnings growth overall is still very healthy, and Nvidia’s report emphasised that AI demand is still exceptionally strong”. While predicting that the US economy’s growth will slow under Trump, he doesn’t think this slowdown “or any trade war retaliation would be enough to spoil this rosy picture”.

Secondly, Matthews observes that “the AI rally has shown tentative signs in recent months of broadening out, from the ‘enablers’of AI (like Nvidia) to the ‘users’ of it”.

Finally, he says, valuations could rise even if earnings don’t. “Despite being, at face value, somewhat high, we don’t think they are excessively stretched,” he says.

All that considered, Matthews sees little reason to doubt Capital Economics’ expectation that the index could reach 7,000 by the end of the year.

Can Nvidia maintain growth rates?

We highlighted last night that the pace of Nvidia’s revenue growth, though still rapid, is starting to slow.

Could that be a worry for investors over the long term?

“Nvidia’s valuation remains sky-high, and for good reason. The company has consistently outperformed expectations, but to justify its current stock price, it needs to ensure an annual growth rate of at least 30% for the next decade,” says Kate Leaman, chief market analyst at AvaTrade. “Any sign of slowing momentum – or a shift in AI investment trends – could lead to harsh market reactions.”

That’s not transpired yet, and as Leaman points out, “for now, CEO Jensen Huang is confident that the AI revolution is only just beginning.” She notes, though, that the increased cost of producing its Blackwell chips is putting pressure on its profit margins.

Nvidia's Blackwell chips are driving revenue, but could their increased production costs pressurise earnings growth in the long run?

“While revenue is soaring, analysts are keeping a close eye on whether this margin squeeze could impact the company’s long-term profitability,” says Leaman. For Nvidia to keep beating earnings estimates over the long term, it will need to resist the squeeze on revenue and margins.

What did Jensen Huang say about DeepSeek?

We had expected Nvidia’s CEO Jensen Huang to field a lot of questions about DeepSeek during the earnings call.

Only one question referenced the Chinese start-up directly: Vivek Arya, an analyst at Bank of America, asked in a question about the durability of demand for Nvidia’s products “has DeepSeek and whatever innovations they came up with changed that view in any way?”

Neither Huang nor chief financial officer Colette Kress gave a direct answer to that part of the question. Huang’s response mentioned that “there are many innovative, really exciting start-ups that are still coming online as new opportunities for developing the next breakthroughs in AI… The number of start-ups are still quite vibrant and each one of them needs a fair amount of computing infrastructure.”

In closing remarks, though, Huang mentioned that “DeepSeek-R1 has ignited global enthusiasm.

“It’s an excellent innovation,” he said, “but even more importantly, it has open-sourced a world-class reasoning AI model.”

These, he said, “can consume 100x more compute”. Implicitly, then, he sees no threat from models like DeepSeek; even if the model itself has lower infrastructure requirements than alternatives, under the hood there is still a lot of implied demand for Nvidia’s chips.

Are Nvidia’s earnings expectations becoming more realistic?

Delivering such an impressive earnings beat whilst also shrugging off market concerns about the impact of DeepSeek is an impressive feat from Nvidia.

It almost seems like a turning point, stepping from one phase of the AI boom to the next. “Alll new AI models are using some of the developments shown off by DeepSeek R1 and Nvidia sees this as a positive, with next-gen AI models consuming significantly more compute as they improve reasoning capabilities,” Luke Hunter, investment manager and sector specialist at Evelyn Partners, tells MoneyWeek.

“AI isn’t just about chatbots anymore - it’s expanding into automation, robotics, and industries beyond tech, which will shift demand away from just big cloud providers like Microsoft & Amazon (also called the ‘hyperscalers’), on which Nvidia currently relies.”

As Nvidia’s business broadens, its status as one of the world’s megacaps seems to feel more secure.

“Nvidia’s stock isn’t cheap, trading at 30x next year’s earnings, but expectations are becoming more reasonable (we’re now assuming 30% annual growth, down from 60% not long ago),” says Hunter.

That's all from us tonight, but join us again tomorrow morning for more market reaction to Nvidia's earnings.

The morning after the night before: markets sour on Nvidia's earnings

Good morning, and welcome back to our Nvidia earnings live blog.

The positivity that initially greeted Nvidia’s earnings beat on Wednesday disappeared yesterday: Nvidia’s shares fell 8.5%, as optimism surrounding the AI rally evaporated.

The Nasdaq 100 fell 2.8% – its biggest single-day drop for a month – and the S&P 500 fell 1.6%.

The turnaround, following a bounce in after-hours trading immediately following the earnings release, leaves Nvidia’s shares down 10.5% this year.

Did Trump sour the mood post-Nvidia earnings?

The sharp reversal in Nvidia’s shares yesterday marked “its worst post-earnings drop since November 2018”, says Sam North, market analyst at eToro.

“Despite solid revenue, growth slowed from prior triple-digit rates, and profitability concerns emerged due to lower gross margins tied to Blackwell production costs,” says North. He also attributed the slump to competitive pressure from DeepSeek.

However, the main reason for the fall, according to North, was the tariff updates that US president Donald Trump issued, particularly on Europe. These spooked risk assets in particular, prompting Nvidia and the Nasdaq to slide.

“If Donald Trump had a day off yesterday, I am pretty sure Nvidia would be trading positively now, and if not – nowhere near as low as it currently is,” says North.

Thanks for following the Nvidia earnings live blog here at MoneyWeek.

We're going to wrap up our live coverage of the fallout here, but please see our article on Nvidia's share price movements for a summary of the main events.