The options for Britain if we vote for Brexit

If Britain votes to leave the EU, there will be a lot of discussion about our relationship with Europe post-Brexit. But there are several perfectly good paths for us to follow, says Merryn Somerset Webb.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

What's the right model for a post Brexit UK to follow? If we do vote out this will be discussed for several years to come. But the good news is that there are several perfectly good paths for us to follow.

There's full Brexit which would leave us with full control over everything from agriculture to justice and immigration, but dependent on international rules to trade. This, contrary to popular belief, is a perfectly good option for the UK. Plenty of countries outside the single market trade very successfully inside it and there is no reason we shouldn't either.

Norman Lamont looks at this in the Daily Telegraph. One of his key and points is this: the cash we pay into the EU every year comes to the equivalent of about 7% of the value of our exports to the EU. We are effectively paying a 7% tariff to avoid what would otherwise be a 3% tariff at the moment. Which seems a bit silly. Not being in the single market at all really wouldn't be all bad.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Next up, however, there is the obvious and less tricky option of being inside the European EA and the European Free Trade Area (EFTA). Norway, Iceland, Switzerland and Liechtenstein are members (Switzerland is the only one which is in EFTA but not the EEA, but it has a bilateral agreement with the EU which gives a similar result). Iceland's banking crisis aside, all are pretty successful economies.

There's a good explanation of why it could work for us from Phil Hendren writing on medium.com.

It's a simple argument. Being in it would mean that we followed all the rules of the single market as they are now in order to have access to it, and that we make choices about all new laws if we want access to that bit of the market we implement them. If we don't, we don't.

However, we also "regain or cement control" over policy areas such as crime and punishment, foreign policy, defence, international development, agriculture, fisheries, justice, areas of social policy unrelated to the single market. Crucially, we could also regain the ability, as Norway does, to make our own trade deals outside of the EU (the EU is really lousy at making trade deals).

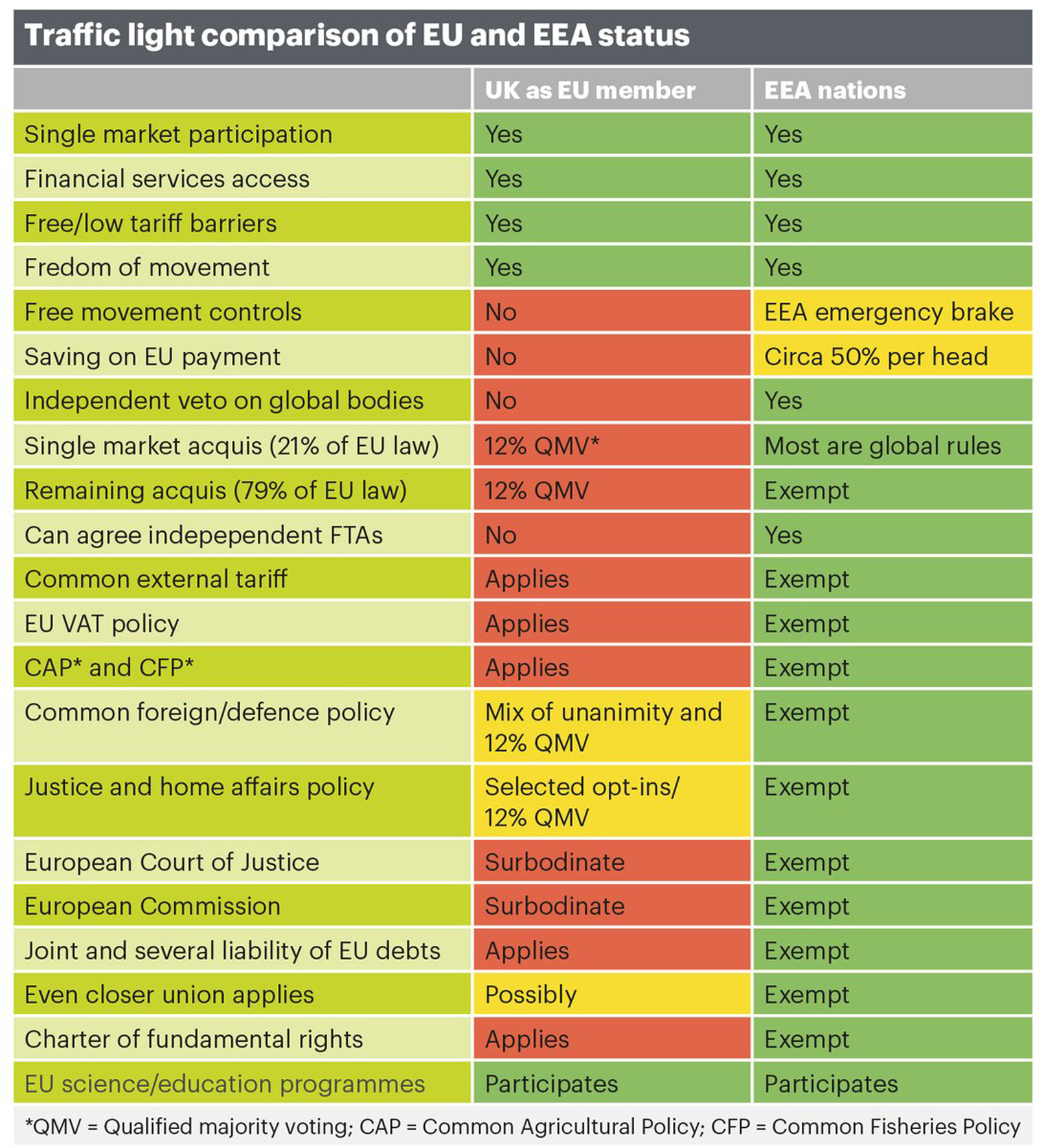

Below is a simple chart from Roland Smith (@WhiteWednesday) on Twitter which runs through the differences between being in the EU and the EEA, which to my mind at least makes it look reasonably attractive. The objections are the usual ones.

First, we would have no say in the rule making. But we have no say in the rule making anywhere else we trade anyway "for example when the EU trades into the USA it follows American rules which it had no say in" and of course we don't get that much of a say at the moment anyway.

And second that we would still have to pay to be in. We would. But as Hendren points out, it's a different kind of paying: not a full contribution to the EU budget but a fee for access to the single market. Think of it like a golf club: when you pay green fees "you never hear anyone say you're contributing to the budget of the Golf course with no say over how they spend it!' yet that is what an EFTA relationship is really. Instead of paying tariffs on everything we export into the market, we pay a flat fee per year and play as much golf as we like." There is also a contribution to reduce "social and economic disparities in Europe" under the EEA, but nonetheless, the final cost should be much lower than EU membership.

There is, of course, also the matter of the free movement of people: EFTA/EEA membership would mean the four freedoms remain. This might be a deal breaker for some. But given the upsides we aren't sure it should be and there is always the chance that the UK could strike a new/different EEA style deal anyway.

Finally, it is worth pointing out that this could be a remarkably easy transition. In order to join EFTA you have to follow all the rules of the single market. We already do that. So in terms of trading there would be no real change at all in the short term. No economic Armageddon, just a big step back from most of the bits of the EU we aren't mad for.

I've written before about how voting for Brexit won't get you Brexit. It might however get you EFTA/EEA membership and that might be no bad thing. There's a reason why less than 20% of Norwegians say they would like to join the EU.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.

-

Beating inflation takes more luck than skill – but are we about to get lucky?

Beating inflation takes more luck than skill – but are we about to get lucky?Opinion The US Federal Reserve managed to beat inflation in the 1980s. But much of that was down to pure luck. Thankfully, says Merryn Somerset Webb, the Bank of England may be about to get lucky.

-

Rishi Sunak can’t fix all our problems – so why try?

Rishi Sunak can’t fix all our problems – so why try?Opinion Rishi Sunak’s Spring Statement is an attempt to plaster over problems the chancellor can’t fix. So should he even bother trying, asks Merryn Somerset Webb?

-

Young people are becoming a scarce resource – we should value them more highly

Young people are becoming a scarce resource – we should value them more highlyOpinion In the last two years adults have been bizarrely unkind to children and young people. That doesn’t bode well for the future, says Merryn Somerset Webb.

-

Ask for a pay rise – everyone else is

Ask for a pay rise – everyone else isOpinion As inflation bites and the labour market remains tight, many of the nation's employees are asking for a pay rise. Merryn Somerset Webb explains why you should do that too.

-

Why central banks should stick to controlling inflation

Why central banks should stick to controlling inflationOpinion The world’s central bankers are stepping out of their traditional roles and becoming much more political. That’s a mistake, says Merryn Somerset Webb.

-

How St Ives became St Tropez as the recovery drives prices sky high

How St Ives became St Tropez as the recovery drives prices sky highOpinion Merryn Somerset Webb finds herself at the epicentre of Britain’s V-shaped recovery as pent-up demand flows straight into Cornwall’s restaurants and beaches.

-

The real problem of Universal Basic Income (UBI)

The real problem of Universal Basic Income (UBI)Merryn's Blog April employment numbers showed 75 per cent fewer people in the US returned to employment compared to expectations. Merryn Somerset-Webb explains how excessive government support is causing a shortage of labour.

-

Why an ageing population is not necessarily the disaster many people think it is

Why an ageing population is not necessarily the disaster many people think it isOpinion We’ve got used to the idea that an ageing population is a bad thing. But that’s not necessarily true, says Merryn Somerset Webb.