When central bankers go mad

What happens when monetary authorities go mad? The money they control loses value, and there is no way around it.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

What happens when monetary authorities go mad? The money they control loses value. There is no way around this one. So much so, that even Alan Greenspan recognises the problem at least, in the rare moments when, as Tim Price puts it, he speaks like an "honest human being" rather than a "machine for uttering gibberish".

Back in 2005 when replying to a question on social security financing, he said it clearly. We can guarantee "cash benefits as far out and at whatever size you like, but we cannot guarantee their purchasing power". In other words, says Tim, "the central bank can always create money but there is no guarantee it will ever be worth anything".

Greenspan also famously noted in his pre-power days that in the absence of a gold standard something that stops money printing "there is no safe store of value," no way for the average person to protect their wealth from the insidious creep of inflation.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And so it is all proving at the moment. The Fed is printing money with the result that that money is worth less and less. Those in any doubt as to the effect of quantitative easing (QE) more notes makes each note worth less need only look at the collapsing trade-weighted value of the dollar (now at its lowest since the early 1970s). It has fallen further over the last decade than all but a few complete basket case currencies (not that it is not a basket case itself).

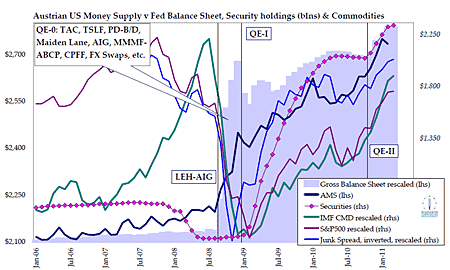

Then look to the chart below courtesy of Sean Corrigan of Diapason. You don't need to understand what all the acronyms mean precisely. Basically there's what Sean calls 'QE0' all the bailout packages that came amid the 2008 banking crisis. Then there's QE1 the first batch of QE. Then QE2, the latest batch.

As you can see, the lines representing various asset classes have all gone up, the more QE the Fed has done. In fact,says Corrigan, the more lines you add to the chart, "the less deniable the causation becomes".

We are of course all gold bugs here so I won't bore you with more reasons to buy it right now. But those looking for further justification can amuse themselves with a new view out from Bullionvault.com that suggests that the current inflation adjusted fair value price for an ounce of gold is $3,800.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton

-

New Federal Reserve chair Kevin Warsh has his work cut out

New Federal Reserve chair Kevin Warsh has his work cut outOpinion Kevin Warsh must make it clear that he, not Trump, is in charge at the Fed. If he doesn't, the US dollar and Treasury bills sell-off will start all over again

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

'Governments are launching an assault on the independence of central banks'

'Governments are launching an assault on the independence of central banks'Opinion Say goodbye to the era of central bank orthodoxy and hello to the new era of central bank dependency, says Jeremy McKeown

-

Do we need central banks, or is it time to privatise money?

Do we need central banks, or is it time to privatise money?Analysis Free banking is one alternative to central banks, but would switching to a radical new system be worth the risk?

-

Will turmoil in the Middle East trigger inflation?

Will turmoil in the Middle East trigger inflation?The risk of an escalating Middle East crisis continues to rise. Markets appear to be dismissing the prospect. Here's how investors can protect themselves.

-

Federal Reserve cuts US interest rates for the first time in more than four years

Federal Reserve cuts US interest rates for the first time in more than four yearsPolicymakers at the US central bank also suggested rates would be cut further before the year is out

-

The Bank of England can’t afford to hike interest rates again

The Bank of England can’t afford to hike interest rates againWith inflation falling, the cost of borrowing rising and the economy heading into an election year, the Bank of England can’t afford to increase interest rates again.