Uber's switch to profitability is an opportunity for investors

The ride-hailing platform, Uber, has just reported its first operating profit and its future looks bright.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

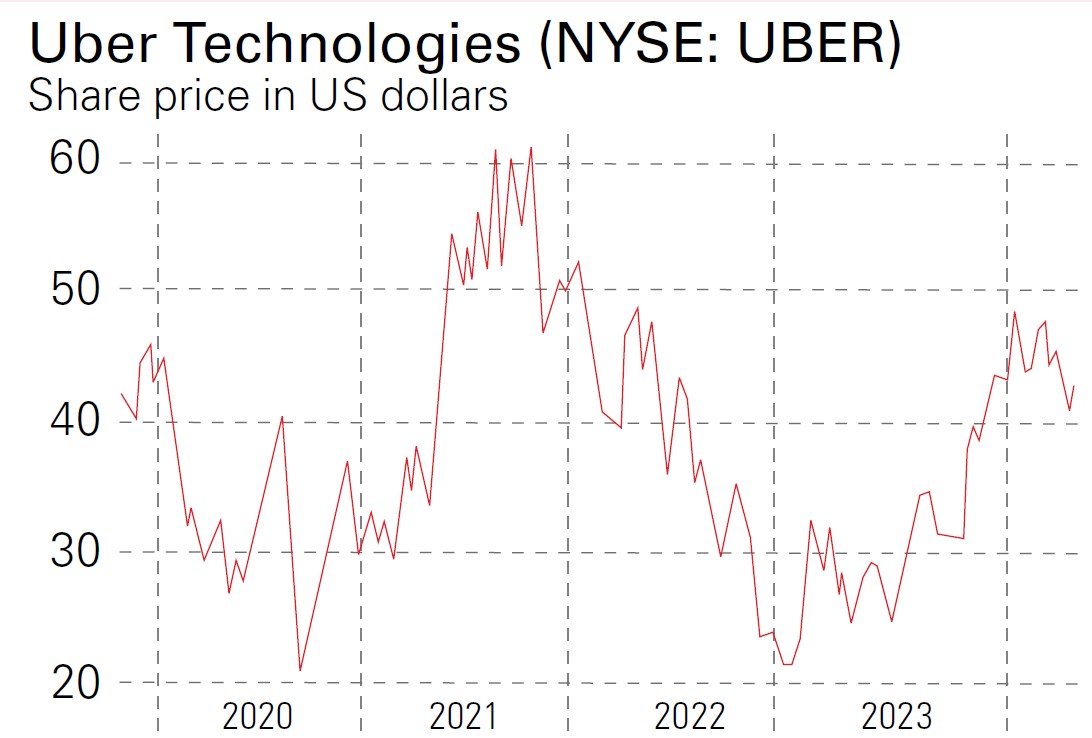

I didn’t buy shares in Uber, the ride-hailing app, when they first floated on the stockmarket in 2019. It was a big, glitzy event, but there were no profits in sight – the company seemed to be arguing with authorities and traditional taxis wherever it was touting for business and employee discrimination and harassment claims were still fresh. Now, though, things look different.

In August 2023 it reported its first-ever quarterly operating profit ($326m) between April and June, alongside the news that it had generated a record-breaking $1.1bn of surplus cash. After four years, Uber’s shares have barely budged but the business has changed a lot. Uber is a so-called “platform” business, which simply means it provides and maintains a digital space where users can come together and interact – in Uber’s case the users are mostly drivers with their own cars and people who want to make a trip. The two are matched and do business together. Uber makes its money by taking a cut of the deal as the middleman.

There’s nothing new in acting as a platform. Plenty of towns have a physical marketplace to facilitate the buying and selling of household goods or livestock, for example – the London Stock Exchange itself was a physical platform business for trading shares. But when the platform is digital, the marketplace potentially becomes as big as the internet itself, and the number of transactions can skyrocket.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Uber's dizzying decade of growth

From its origins in San Francisco in 2010, Uber has demonstrated the speed of growth that digitisation can offer. It has facilitated 42 billion trips since, as it rapidly expanded within a year or two to Chicago, New York, Paris, London and beyond. It is now notching up 25 million journeys every day across 10,500 cities in 70 countries.

Carrying fare-paying passengers remains core to the Uber business, but it has evolved from a digital ride-hailing business to a broader transport operator.

- The Uber Eats brand has become widely recognised as a deliverer of food door-to-door, bringing consumers and restaurants together.

- Uber provides logistics support delivering packages for businesses.

- It is also increasingly running errands for people, ferrying groceries, medications, alcohol and flowers to homes.

Carrying people brings in 42% and almost all of the profits, but delivery and freight now comprise 60% of sales as the group works fast to grab market share. Gross bookings for people-carrying and delivery have been growing at 18% year on year over recent quarters. Analysts expect strong sales growth in the coming years. With even conservative profit-margin assumptions, earnings growth should outstrip the broader markets over the medium term.

People like to talk about “moats”, or enduring competitive advantages, protecting firms from competition. For Uber, one is that the brand is strong and attracts drivers and riders alike, so much so that the name is starting to slip into common language usage – as people “uber” to an event.

Furthermore, the network effects seem especially powerful. Every time Uber gets bigger, the business model gets better. More active users means it gets more drivers and restaurants that want access to them. That in turn means even more active users, as people want apps with the most available drivers and the broadest range of restaurants.

Uber faces competition from smaller rivals such as Lyft. There is regulatory pressure, too, as it fights vested interests, and driverless taxis could have an impact. But with management running a tight financial ship, the switch to profitability gives investors the chance to take advantage of a key turning point.

Uber shares: Potential 35% upside

Uber shares rose briefly after the last earnings announcement back in early August but have since performed broadly in line with the S&P 500 index of large US stocks during a difficult few months for markets.

Macroeconomic concerns about inflation, higher interest rates and the potential for an economic slowdown have frequently overshadowed the fundamental performance of individual companies. Nevertheless, investors took comfort from gross bookings for services (including taxes and additional fees) up 16% to $33.6bn, beating expectations.

Both bookings for rides and deliveries were up on the same period the year before. The 14% rise in overall sales to $9.2bn slightly missed expectations but the company did make its first quarterly operating profit and generated $1.1bn of surplus cash.

Investors were further encouraged when the company – led since 2017 by former Expedia chief executive Dara Khosrowshahi – said gross bookings would rise again in the current quarter to $34bn-$35bn and cash profits would be some 6%-12% higher than previously expected, possibly more than $1bn, on $9.5bn of forecast quarterly sales. News is expected on 7 November.

The shares peaked at roughly $49 after the last earnings release but, despite improved expectations, they’re now trading some 10%- 15% lower at about $43. Bank analysts’ earnings estimates have edged higher plenty of times over the past three months, and Uber has now surprised to the upside in each of the past three quarters.

The consensus recommendation of analysts is “strong buy”, with an average price target of just under $58 for the shares within the next 12 months. The shares may thus offer a potential 35% upside from where they stand today.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton