An absurdly cheap healthcare stock to buy now

The pandemic has vastly accelerated the shift towards telehealth, making Cigna a long-term buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

A major problem during Covid-19 has been how to treat patients without having face-to-face meetings in surgeries. Enter telehealth: using technology and the internet to create online health centres.

Although not discussed as much as other pandemic boom sectors such as film streaming, food delivery or virtual offices, telehealth is potentially huge. Annual growth forecasts for the US range from 25% to 35% a year for the next five years, implying an industry worth $200bn-$400bn. McKinsey, a consultancy, estimates that $250bn of US healthcare spend could go virtual if conditions are right – an almost 100-fold leap from the $3bn of annual sales for US telehealth before the virus.

Health-services and insurance companies such as Cigna (NYSE: CI), UnitedHealthcare, Doctor on Demand and Hims & Hers have been responding by investing in the sector, raising money and reporting strong growth that supports the impressive outlook. Cigna’s current deal to buy privately-held telehealth business MDLive, in which it already held a stake, certainly looks astute. It gets one of the biggest US telehealth businesses, which is virtually looking after 60 million people round-the-clock every day and dispensing services ranging from urgent care to psychiatry. Buying the business not only brings Cigna millions more users, but also gives it a platform on which to integrate the purchase with its existing health offerings to provide more comprehensive services. These in turn should attract even more individuals and corporate employees.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Treating patients remotely is not entirely new. Telephone consultations, for example, have been around for years. But it’s always been a small part of medical interaction. Covid-19, as in other areas, has changed this. In the year before the pandemic, telehealth facilitated one in ten medical encounters in the US, according to a survey by researchers at McKinsey. Last year the number had soared to around half. And after a peak in April it has stabilised well above pre-Covid-19 levels.

After the virus

After Covid-19 the extreme circumstances that have had so many people working from home, ordering home deliveries and endlessly streaming television are unlikely to return. But none of these activities has gone away and they are likely to be more common than before the pandemic because habits have changed.

People want more, but not all, of their time working from home, for example; similarly, online shopping isn’t going into reverse but people will still want to visit exciting shops.

It’s the same with health. Patients will want (and need) to see GPs in person again, but others will prefer quick online consultations and immediate prescriptions. In a recent McKinsey survey of consumers, 40% said they’d keep using telehealth – only 11% were using it before Covid-19.

As for clinicians, 58% now take a more favourable view of it. The pandemic’s acceleration of telehealth adoption has given a glimpse of a more efficient healthcare model that answers some of the policy and funding challenges governments worldwide are struggling with.

Telehealth is here to stay and will become more appealing as technology keeps advancing. It’s not just about online surgeries and consultations, but also the proliferation of devices and gadgets to monitor and analyse patients from afar for immediate diagnoses, alerts and surgical interventions.

Health services are set to struggle with backlogs and growing user volumes for years. The enduring need to get costs down, increase medical access and treat patients faster should also underpin the growth of telehealth well beyond Covid-19.

Double digit earnings for half the price

There are two reasons for buying Cigna. First, it is valued at just ten times next year’s earnings – half the valuation of the overall market and far cheaper than leading peers in its sector.

This is despite double-digit earnings growth: in March the company told analysts that it could keep growing earnings by an annual 10%-13% a year over the long term, and next year profit growth would reach the top of that range.

The company also boosted its dividend, which could keep outpacing inflation. The share price does not, therefore, reflect the performance outlook of the core business.

The second reason to add this stock to your portfolio is that Cigna’s effort to build its business in telehealth increases exposure to a high-growth technology sector. The group’s acquisition of MDLive accelerates progress and provides integration and cross-selling opportunities.

At least some of the potential excitement about telehealth should feed through to Cigna’s financial returns and valuation but, again, this is not yet appreciated by the stockmarket.

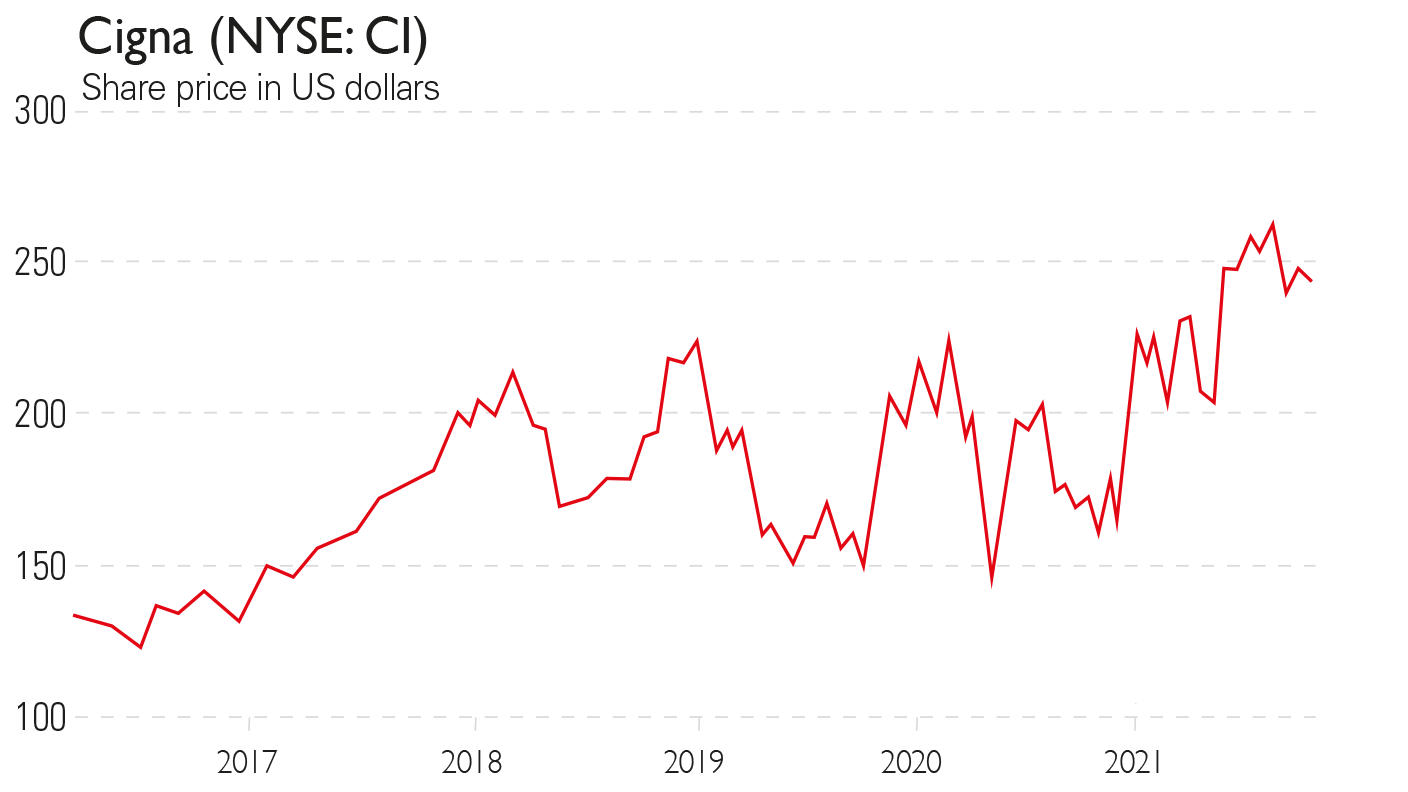

So far this year the shares have lagged the S&P 500, America’s benchmark index.

However, almost all the two dozen or so analysts following Cigna are positive about its future and their consensus expectation is for the shares to rise by 25% from current levels to $295.

This healthcare conglomerate broadly covers three areas: health insurance for employers and government bodies; health services for individuals; and an overseas operation.

Cigna’s first quarter results in May beat expectations with quarterly sales of $41bn. Not only are the industry dynamics working in its favour while Wall Street is taking a positive view, the management’s own tone is upbeat and confident. This is a cheap, well-run business facing a bright future.

Stephen Connolly heads a family investment office, and has worked in investment banking and asset management for nearly 30 years (sc@plainmoney.co.uk)

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton