How to buy in to Latin America’s e-commerce boom

MercadoLibre is the region’s Amazon, eBay and PayPal all rolled into one.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Investing in e-commerce and payments businesses around the world should keep paying off nicely for years to come as global wealth increases. But the fastest growth in this area is likely to take place in Latin America. Rapidly expanding internet access from a low base, Covid-19-induced lockdowns and shop closures have all provided a big boost. This is borne out by another set of record-breaking results (see below) from the region’s dominant online-retail platform MercadoLibre (Nasdaq: MELI).

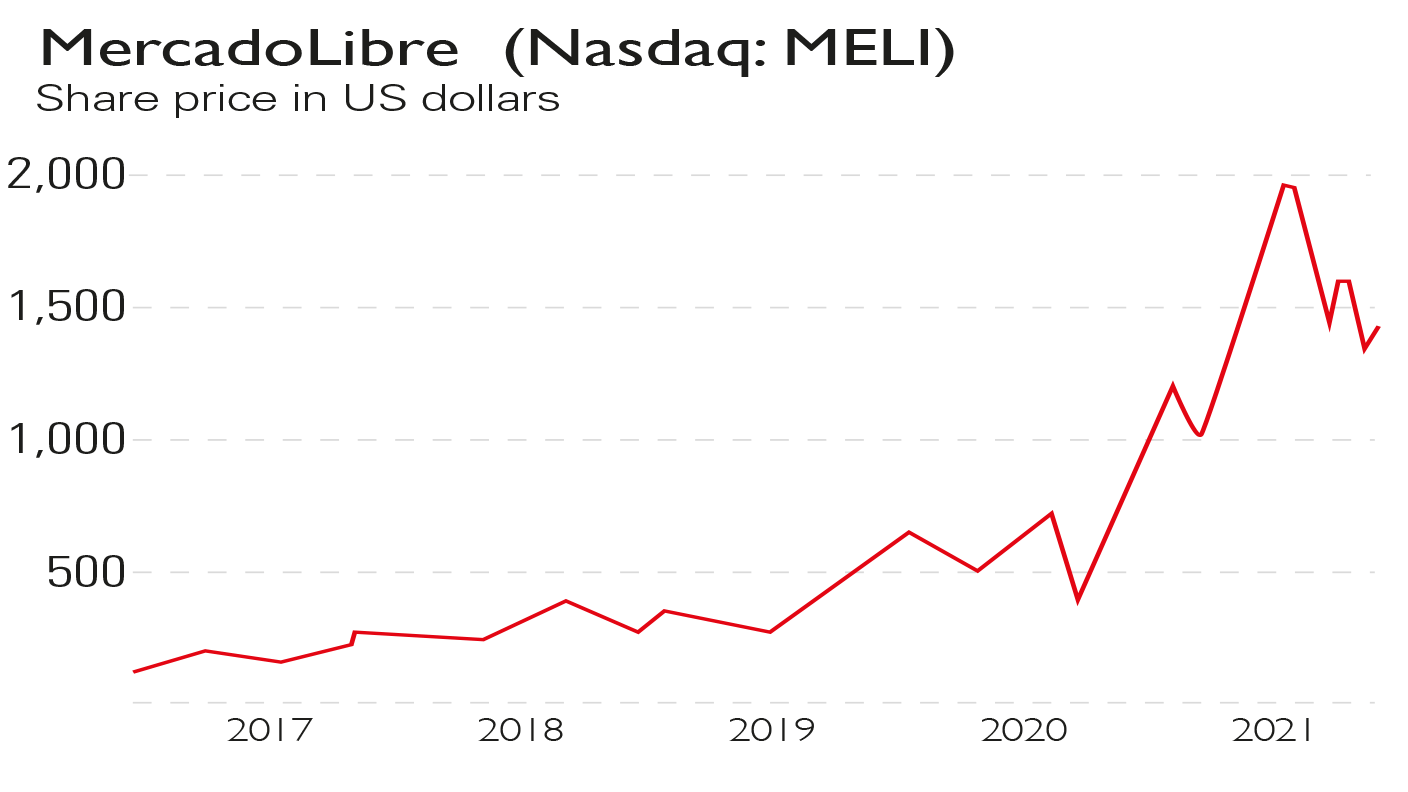

Despite the impressive recent update, however, the shares have slipped by 30% from their peak in January as high-tech growth stocks have faltered globally. The decline has effectively removed their premium as a pandemic success story. For long-term investors this is an opportunity.

Analysts at Morgan Stanley certainly seem to think so. They’re targeting a $2,260 share price, an eye-catching 66% premium to the current $1,370, up on the already punchy 40% average upside predicted by all analysts. The bank said only this week that it remains upbeat after meeting the company’s managers.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

A one-stop shop

The group, whose name literally translates as “free market”, provides e-commerce platforms and solutions alongside payment processing. It is often seen as a kind of Amazon, eBay and Paypal all rolled into one. Its MarketPlace platform allows businesses and individuals to open up their own online shopfronts, selling everything from electronics to clothing directly to visitors.

It carries out payment and settlement transactions for them across all devices via its fast-expanding MercadoPago business. And to glue the whole offering together to make it a one-stop proposition, it also offers credit facilities, advertising, shipping and logistics management.

All this delivered sales of almost $1.4bn in the first quarter, up by 160% on an annual basis. The number of unique active users rose by 62% to 70 million and the volume of items shipped jumped by 131% to 208 million. It’s a familiar story of ongoing momentum: annual revenues have never failed to rise in the last 20 years, producing a stellar 50% yearly compounded growth rate. Sales could treble again by 2023.

No flash in the pan

The strong growth story is, therefore, no flash in the pan but has been building for years. Of course, the pandemic has accelerated e-commerce take-up everywhere. But these shifts aren’t temporary. Those turning online to get through Covid-19 are expected to stay, and they will use it for a broader range of products and services.

It’s a global theme, but Latin America is at an earlier stage of digital transformation and therefore gains more leverage from it as usage accelerates from a lower base. Some estimates suggest e-commerce does not yet even comprise 10% of the economy, much less than in the US or China, underscoring the upside potential. MercadoLibre is already thought to have nearly 30% of the Latin American e-commerce market overall; of a regional population of 650 million, 100 million people are using it. It therefore has a strong base to build on. This may prompt a question: what about Amazon? After all these years, its regional market share is still only 4%.

And the financial services, or fintech, side of the business shouldn’t be discounted. Online sales are helping funnel users towards the platform for transferring money. But the group is now issuing debit cards and offering credit linked to them. It also offers savings accounts, insurance services and an investment platform, all of which it is expanding. What’s more, it has bought cryptocurrency and sees potential in this area. Broader financial services are a significant and welcome step well beyond simple payments – stronger and more durable revenue streams will make this an increasingly significant feature in future.

And so the outlook remains bright. The region certainly presents unique challenges but little has knocked the group back in its 21 years. Take a long-term view and there’s strong scope here for solid, well-managed growth from some of the hottest investment themes in the market.

MercadoLibre: from suburban garage to behemoth

Online retail is growing fast. MercadoLibre’s CEO, Marcos Galperin, reckons the pandemic allowed it to leapfrog three to five years into the future.

As for payments, he sees big potential beyond simple online purchase settlements in everything from mobile-phone payments and banking services to investments, insurance and lending.

It adds up to a bright future for yet another high-growth tech group launched in a suburban garage – this one on Buenos Aires in the 1990s. It is worth $68bn today, with Brazil, Argentina and Mexico its biggest markets. They accounted for almost all of annual revenue in 2020, which was up by 73% over 2019.

First-quarter sales this year of $1.38bn show ongoing strength and suggest it could well reach the $6bn-plus revenue analysts expect for this year overall. That would represent near-60% year-on-year growth. Pre-tax profits in 2020 were $81m, held back near-term by ongoing expenditure on IT and logistics, which are key to fighting off competition.

Returns should grow over the medium term as these investments pay off. The stock isn’t cheap compared to well-established Amazon but doesn’t look expensive against the likes of Shopify or Singapore’s e-commerce group Sea Limited. While emerging markets can be volatile, a small long-term investment in these strong growth themes could pay off nicely for those who like a little more risk.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton