Oracle – the tech stock with a bright future in the cloud

Oracle, the business-database and software expert, can cash in on one of today’s key technology trends

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The fight to dominate, or at least get a slice of the lucrative and fast-growing cloud-computing market is where the real action is in the technology sector. We might think of technology more often as, say, social media, e-commerce, or film and music streaming. But none of this works without the cloud, which is why some of the leading names in the industry are spending big bucks to try to dominate the sector.

The cloud is that vast array of ever-expanding data centres where information is remotely stored, analysed and used by businesses; they find this cheaper and more practical than building their own.

They get access to significant processing power, which means their apps can, for instance, allow every customer to check their bank balances and make payments simultaneously, accommodate millions of active social-media users at once, or allow someone to make a live speech watched by hundreds of virtual conference guests all over the world.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And as there is no limit to what people might want their devices to do in the future, immediate cloud accessibility is key to businesses being able to innovate and scale up rapidly in response to new demand.

Deep pockets required

Building these data centres requires deep pockets, which excludes all but a few participants. In the lead is Amazon, which has invested billions to gain a 32% share of the cloud, according to data provider Synergy Research.

Microsoft is next at 20%, fiercely pursued by Google-owner Alphabet and China’s e-commerce giant Alibaba with 9% and 6% respectively. These high-fliers have, however, created such big cloud-related expectations that their shares have rocketed, putting many investors off.

An alternative way to get exposure to the cloud is through some of the legacy tech companies. These have often been around for decades making money from pre-cloud systems still in use today, while also trying to build a presence in the cloud. Their shares can be much cheaper. Legacy tech is not investing enough to catch up and dominate the cloud, but these companies could build secure niches by selling into their big, global customer bases. When stocks written off by most analysts begin to surprise positively, shareholders can be richly rewarded.

Hidden value

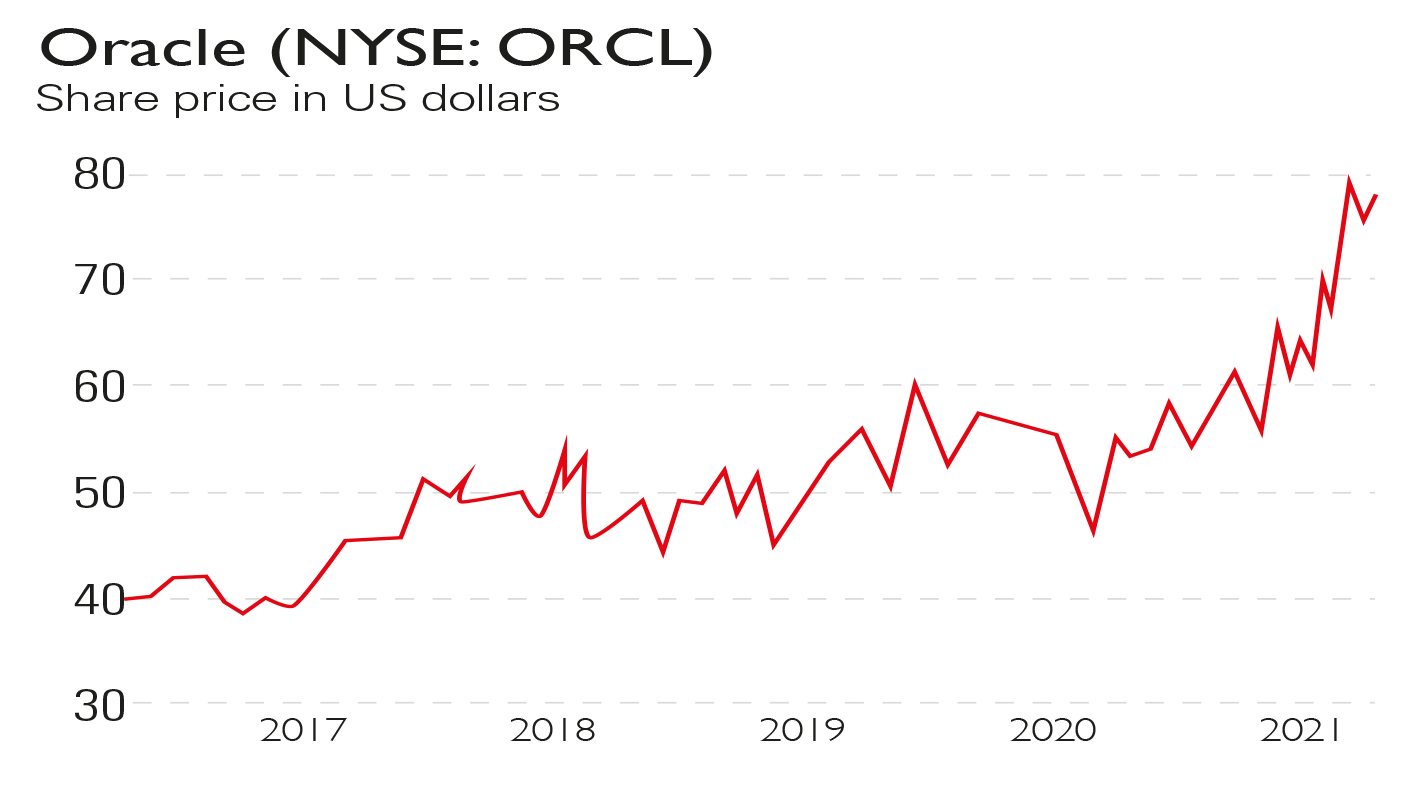

It is, therefore, worth looking at global tech giant Oracle (NYSE: ORCL). The stock is on a discount to the tech sector. Sales growth has been slow for years and earnings per share heavily boosted by share buybacks. It’s a classic “value” stock – one perceived to have unappreciated potential that could be unlocked if investors revised their view of the group’s prospects, or a catalyst highlighted its scope for growth.

That catalyst could be the cloud. Oracle is at the forefront of business database systems, with nearly half a million corporate customers in 175 countries. And it’s a leader in the software solutions that businesses need to work with this data, whether it’s financial control or human-resources management.

Oracle has, therefore, the experience and capability to get businesses onto the cloud, building secure, robust systems and integrating its software to support them. It has been slow to the party and to succeed it needs to make up ground fast.

But it has been winning business from companies as diverse as Latin American McDonald’s franchisee Arcos Dorados, tobacco group Altria, retailer Bed Bath & Beyond and IT group Micro Focus. With only 10%-20% of companies having migrated to the cloud so far, there’s still plenty of untapped opportunity to capitalise upon.

Slick, efficient and globally indispensable

Oracle likes to trumpet the fact that its financial management is so slick that this $220bn company with $40bn in annual sales and 136,000 employees can close its books and report its earnings within just ten days.

It’s quite a feat that perhaps helps understand why the group has come to be widely used by businesses globally. From its beginnings in the 1980s with its focus on databases and software for enterprises, Oracle has built a strong presence with 430,000 corporate customers (it doesn’t sell to individuals).

The key question is how well Oracle shapes up as cloud computing grows and ultimately replaces older, in-house computer networks. If it fails to capitalise on the opportunity, then it will be confirmed as a business in slow decline. Given that the shares are cheap, a punt on success could pay off, but this is not a stock for the risk-averse.

The cloud sector is fiercely competitive. However, Oracle is no newcomer to delivering systems to businesses. It can build its cloud offering around this speciality and accompany it with its broad suite of applications.

The latest quarterly results saw the group beat expectations, but it was cautious about the outlook. Profits rose by 10% year-on-year. It doesn’t break down in detail how much revenue comes from cloud activities, but at the product level, the talk is positive. It lifted sales by 30% in the quarter, for example, for its cloud-based day-to-day planning software for organisations, an area where it is considered the market leader. And its cloud infrastructure offering saw sales rise by over 100%. Some positive noises from analysts have helped the shares rise 17% so far this year, well ahead of the market. But they remain cheap and appealing for patient investors wary of the stratospheric valuations of other tech plays.

Stephen Connolly heads a family investment office and has worked in investment banking and asset management for over 25 years (sc@plainmoney.co.uk).

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Stephen Connolly is the managing director of consultancy Plain Money. He has worked in investment banking and asset management for over 30 years and writes on business and finance topics.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton