Nvidia to unveil much-anticipated results – what can you expect?

Nvidia is set to deliver its quarterly results tomorrow, 28 August. After a disappointing earnings season for Big Tech so far, investors will be watching the AI stock closely

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Chipmaker giant Nvidia is set to unveil its quarterly results this week on 28 August. The event will round off earnings season in the world of Big Tech, with other Magnificent Seven tech stocks having already reported over the course of July and August.

Nvidia has delivered sparkling returns for investors in recent years, with the stock up a staggering 163% so far this year. Over the past five years, it is up almost 3,000%. However, investors will be watching the company’s results with particular interest tomorrow, after a disappointing earnings season for Big Tech on the whole.

Investors responded negatively to Amazon, Microsoft and Alphabet (Google’s parent company) earlier this summer when they revealed a sharp rise in capital expenditure in their latest results. All three companies have been investing heavily in their AI capabilities, and some investors are starting to question whether this spending will translate into profits.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

While investors have enjoyed strong returns from Big Tech in recent years, sentiment is starting to turn. The sector experienced a sharp selloff earlier this summer amid concerns that valuations are starting to become unsustainable. Negative market sentiment at the start of August (driven by fears of a US recession) then caused further pain.

Nvidia was caught in the storm, with its share price falling by more than 25% between 10 July and 7 August (not helped by rumours of delays on one of the company’s next generation chips). However, the stock has recovered ground since. At the time of writing, it is only down 6% compared to its 10 July valuation.

Commenting on the forthcoming results, Sam North, market analyst at investment platform eToro, says the bar is high. “The chipmaker needs to deliver once more to avoid disappointing [investors] and to justify its recent rebound from a slump into a three-week rally,” he adds.

We look at what you can expect tomorrow – will Nvidia beat its earnings and can the stock continue to rise?

Nvidia earnings expectations

Nvidia has said it expects its revenue for the quarter to come in at around $28 billion, plus or minus 2%. This would equate to a quarterly rise of 8% and an annual rise of 107%.

Meanwhile, analysts are forecasting a net profit of around $15 billion and a headline earnings per share figure of around $0.63, according to AJ Bell. If this materialises, profits will have more than doubled compared to a year ago, but will be roughly flat quarter-on-quarter. Meanwhile, earnings per share will have risen slightly from $0.61 last quarter.

Despite this, when deciding whether to buy, hold or sell their Nvidia stock, investors will remain focused on the outlook for the company going forward. Key questions will include whether the AI boom can continue and, if so, whether Nvidia will be able to keep up with the demand for its chips.

Earlier this month, a report from tech publication The Information said one of Nvidia’s next generation chips (known as Blackwell) would be delayed by three months or more thanks to a design flaw. The report cited two sources including a Microsoft employee, and added that the delays “could affect customers such as Meta Platforms, Google and Microsoft that have collectively ordered tens of billions of dollars worth of the chips”.

Meanwhile, China could be another important area of focus for investors assessing Nvidia’s growth potential going forward. North says that US sanctions against China are “putting pressure on growth”. He adds: “If China’s access to advanced AI chips is restricted, Nvidia’s market opportunities are limited as well.”

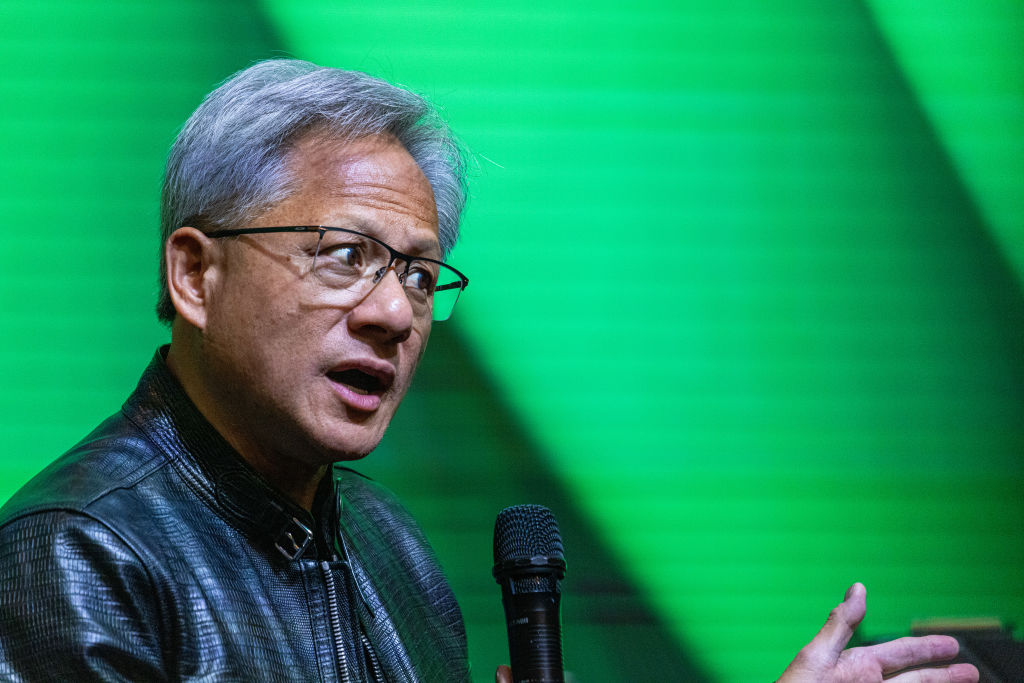

With questions like this in mind, the post-earnings call could be “even more important than the numbers themselves”, according to Matt Britzman, senior equity analyst at Hargreaves Lansdown. He expects chief executive Jensen Huang to update markets on “the medium-term outlook for its new chip lineup and broader commentary on demand for AI services”.

Will Nvidia’s results move markets?

Nvidia is one of the most valuable companies in the world and makes up almost 7% of the S&P 500, based on market weight. What’s more, it is responsible for around a quarter of the index’s returns so far this year, according to Reuters. As a result, this individual stock has the power to move markets. This is part of the reason why investors anticipate its results with such interest.

Good news for Nvidia tomorrow could mean good news for broader market indices, while bad news could see them dip. Britzman comments that “both the S&P 500 and the Nasdaq saw some profit-taking in yesterday’s trading”, as investors tentatively await “the most important results of the season”.

The S&P 500 has posted strong returns so far this year, despite a blip in the second half of July, from which it has now largely recovered. The index is up more than 18% year-to-date. The Nasdaq is up 20% over the same period.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Katie has a background in investment writing and is interested in everything to do with personal finance, politics, and investing. She previously worked at MoneyWeek and Invesco.

-

Japanese stocks rise on Takaichi’s snap election landslide

Japanese stocks rise on Takaichi’s snap election landslideJapan’s new prime minister Sanae Takaichi has won a landslide victory in a snap election, prompting optimism that her pro-growth agenda will benefit Japanese stocks

-

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?Google owner Alphabet is reported to be joining the rare century bond club