Neil Woodford launches investment service with fees of up to £67 a month

W4.0 is an “information and investment strategy research platform” that gives direct access to former star fund manager Neil Woodford’s stockpicking strategies. How will it work exactly?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Former fund manager Neil Woodford has launched an investment strategy service called W4.0 aimed at “thoughtful, independent and long-term” investors.

It comes six years after the collapse of Woodford’s boutique firm Woodford Investment Management, which was forced to close after investors rushed to withdraw their money from the funds, which had large holdings in hard-to-trade shares, triggering one of the UK’s biggest investment scandals.

The Woodford Equity Income Fund was suspended, resulting in about 300,000 people losing money, and a compensation scheme being set up. It also led to thousands of investors suing Hargreaves Lansdown over claims it continued promoting the fund even though it was aware of problems.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Once respected as a star fund manager, Woodford has come back following the scandal with “a new type of information and investment strategy research platform that gives direct access to [his] investment strategies”.

Woodford made his name at Invesco as one of the UK’s best-known retail fund managers before he set up his eponymous firm.

We look at how the new platform will work - and how much it will cost.

What is Neil Woodford’s new investment service?

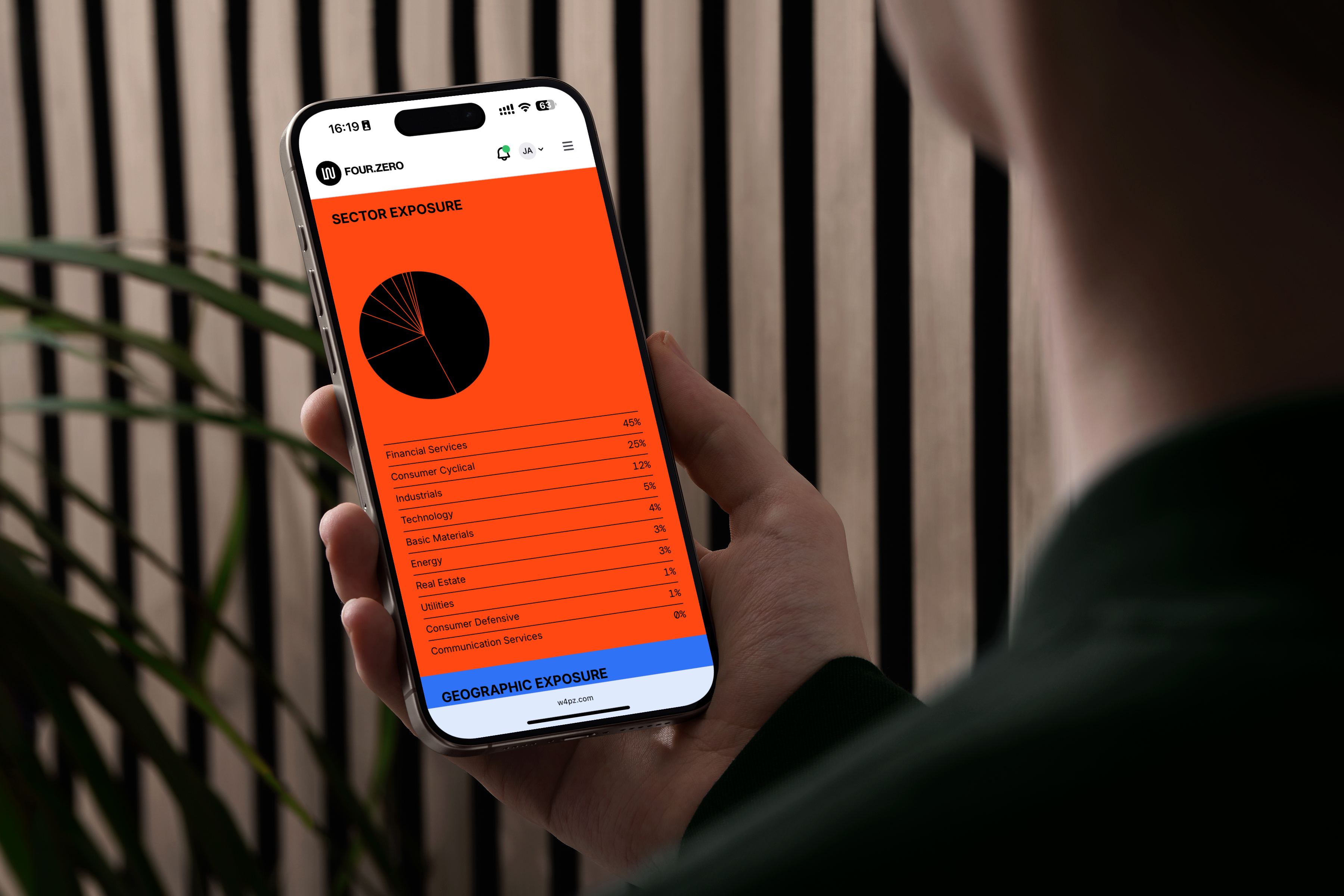

Launched on 6 June, W4.0 offers four investment strategies created by Neil Woodford.

It is not a fund, brokerage or financial adviser. Instead, the service offers stockpicking ideas and market insights - for a fee. If investors want to build their own portfolio based on one of the investment strategies, they will need to buy the holdings through their own broker or investment platform.

Charges range between £50 and £67 a month depending on the plan selected. The more expensive option includes all four W4.0 strategies (rather than just two) as well as access to group Q&A sessions with Woodford. These prices take into account a 33% launch discount.

If paid for annually, the equivalent monthly fees fall to £40 and £54 respectively.

W4.0 is not regulated by the Financial Conduct Authority, as it is not providing financial services and therefore not conducting regulated activity.

The platform appears to be run by a UAE-based company, as emails from W4.0 contain a Dubai PO Box address.

What are the four strategies?

The four strategies at launch are:

- All Rounder - A balanced income-and-growth strategy focused on undervalued, dividend-paying companies — primarily in the UK — with long-term capital appreciation potential

- Income Booster - A high-income equity strategy targeting a 6% dividend income from a carefully selected group of resilient businesses in developed markets

- Unstoppable Trends - A thematic strategy capturing Neil's best ideas for growth across long-term global shifts

- Neil’s Top 40 - A selection of Neil's current favourite stocks from across the other strategies highlighted on W4.0

Subscribers can see the full list of companies in each strategy, monitor performance over time, and receive regular commentary explaining the rationale behind changes.

Further strategies will hopefully be added in future.

According to the website, “W4.0 gives you full transparency into long-term, research-led strategies — showing you exactly what’s in the strategy, why it’s there, and how it performs.

“These are strategies ready to implement, designed so you can build conviction-driven strategies yourself, without paying fund manager fees or losing control.”

W4.0 also includes full access to Woodford Views — an editorial channel covering markets, macroeconomics, and individual companies — as well as educational content and market, sector and company updates “designed to help investors think more clearly”.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ruth is an award-winning financial journalist with more than 15 years' experience of working on national newspapers, websites and specialist magazines.

She is passionate about helping people feel more confident about their finances. She was previously editor of Times Money Mentor, and prior to that was deputy Money editor at The Sunday Times.

A multi-award winning journalist, Ruth started her career on a pensions magazine at the FT Group, and has also worked at Money Observer and Money Advice Service.

Outside of work, she is a mum to two young children, while also serving as a magistrate and an NHS volunteer.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how