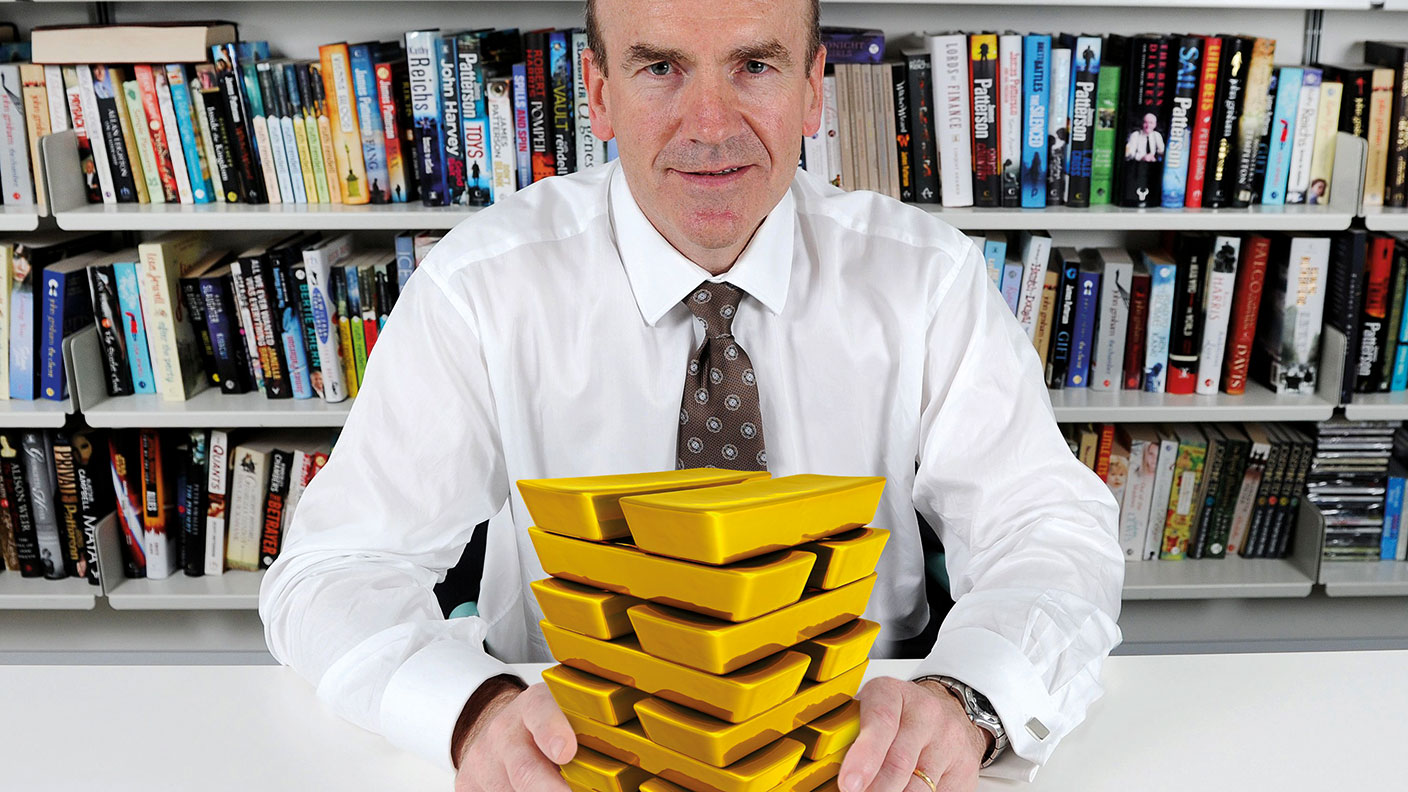

The UK stockmarket is bargain central for private-equity funds

Private-equity giants are snapping up British companies. We should welcome them, says Matthew Lynn.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The Morrisons takeover promises plenty of high-stakes drama (see page 7). The buy-out firm, Clayton, Dubilier & Rice, (CD&R) has already tabled an offer worth almost £9bn once the company’s debt is included. Sir Terry Leahy, the man who ran Tesco during its glory years, is on board as an adviser, and may well make a return to the sector where he made his name. The offer was rejected, but on Monday morning the shares were up more than 30% on the prospect of a takeover battle for the chain.

Welcome the foreign asset-strippers

It is far from alone. Asda has already been bought by the Issa Brothers along with TDR Capital. UDG Healthcare has received a £2.8bn offer, also from CDR. KKR is trying to buy John Laing for £2bn; Carlyle is looking to acquire the inhaler developer Vectura for close on £1bn. In the last month alone there have been nine offers for quoted British companies from the private-equity funds. The UK is turning into one of the most popular markets in the world for making acquisitions.

It’s not hard to understand why. Battered by our departure from the EU, the British stockmarket is one of the cheapest. It trades at about half the level of the main American indices and at a lot less than France or Germany. It is the one place you can still find a bargain. It is also still relatively open at a time when the rest of Europe is turning protectionist. When Canadian firm Couche-Tard contemplated a bid for Carrefour, it was told the supermarket chain was a vital French strategic asset that couldn’t be sold to foreigners. Boris Johnson’s government is a lot more interventionist than any we have seen in the UK for a couple of generations, but it is unlikely to declare Morrisons a strategic national asset (I mean, it’s not Greggs we’re talking about here). If you can find the money, it’s probably yours, and that is not true of many other countries right now. On top of all that, and even with some delays to the end of lockdown, the UK is likely to make a strong recovery from the Covid-19 crisis over the next year.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So there are lots of good reasons the private-equity firms are suddenly so keen on the UK. Expect to see a lot more bids in the months ahead. After all, if Morrisons is worth buying, then so are lots of other companies. If we are being honest, Morrisons is a fairly terrible company. It is the fourth-placed player in a brutally competitive market with a brand that doesn’t mean anything outside of its native Yorkshire. If it can attract a buyout offer, it is safe to say just about every other company in the FTSE 350 is a target.

Two reasons to be cheerful

Plenty of people will oppose this. We will hear lots of complaints about foreign asset-strippers, about jobs lost, about how the UK is the only major country in the world that allows its companies to be traded like casino chips. There is some truth to that. Private-equity firms don’t have a great reputation for building businesses, especially in retailing, and they are often just out to make a quick buck, squeezing costs and suppliers before selling out.

Yet there are two big upsides to this flurry of bids. Firstly, it will be a huge boost for the City at a time when Brexit means it is under threat. That threat was always wildly overstated. There has not been a wholesale move of banks and asset managers to Paris and Frankfurt as many predicted. Even so, life will be tougher without the same level of access to the main European markets, and it will take time to develop new ones in Africa, the Middle East and Asia. In the meantime, a mergers and acquisition boom will generate lots of advisory and trading fees, and that should be more than enough to keep the City humming through a tricky period of reinvention.

Secondly, it is a vote of confidence. There is lots of capital sitting in the big buyout funds. It might as well be deployed in Britain as anywhere else – and the more money gets invested in this country, the more the rest of the world will notice. If the bid for Morrisons is just the start of a wave of takeovers, so much the better.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Matthew Lynn is a columnist for Bloomberg and writes weekly commentary syndicated in papers such as the Daily Telegraph, Die Welt, the Sydney Morning Herald, the South China Morning Post and the Miami Herald. He is also an associate editor of Spectator Business, and a regular contributor to The Spectator. Before that, he worked for the business section of the Sunday Times for ten years.

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices

-

Hints of a private credit crisis rattle investors

Hints of a private credit crisis rattle investorsThere are similarities to 2007 in private credit. Investors shouldn’t panic, but they should be alert to the possibility of a crash.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive