Tune out of Japan’s politics – but buy Japanese stocks

Japan's recent general election was devoid of much interest. But the country's stockmarket holds plenty of appeal.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

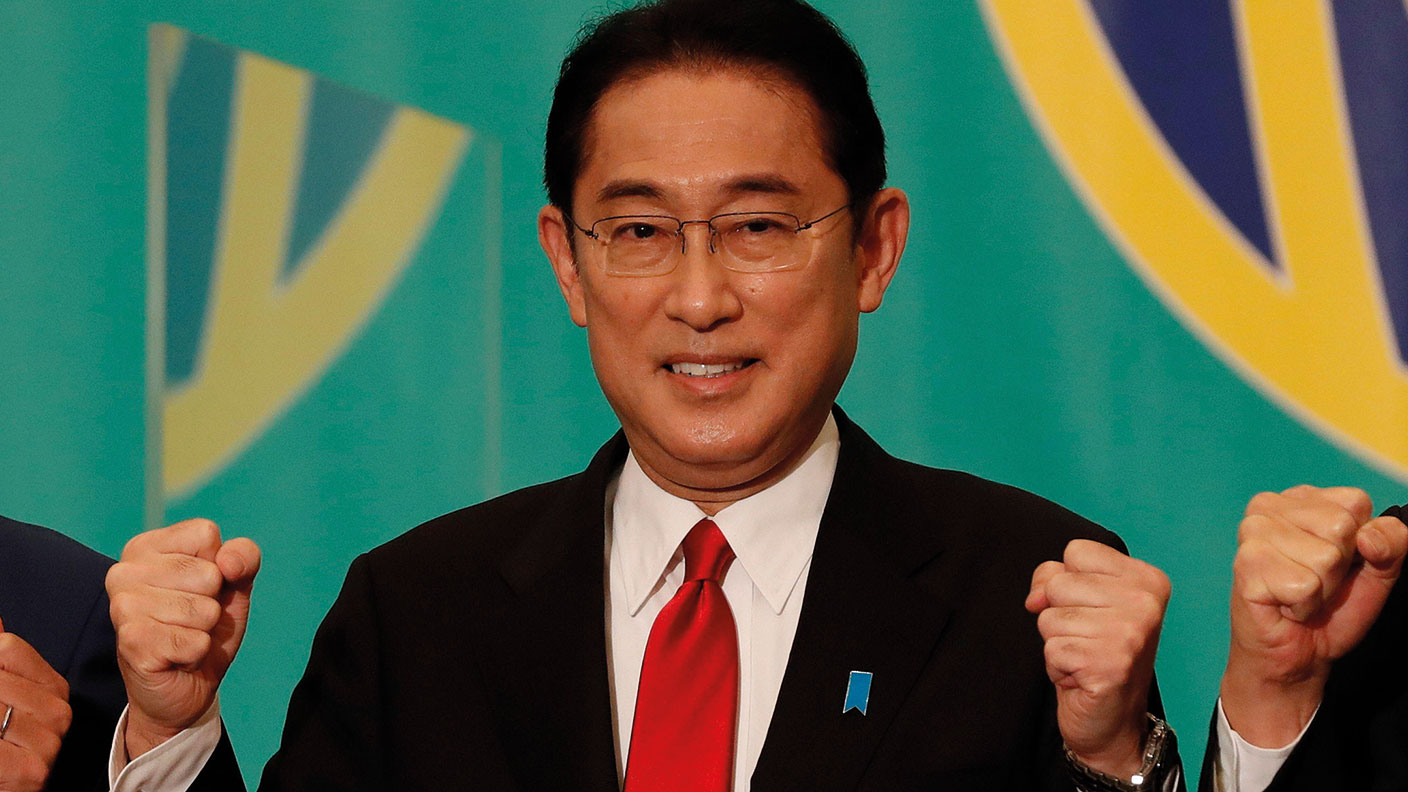

Japanese voters “opted for stability” during a general election on Sunday, says The Economist. The ruling Liberal Democratic Party (LDP) lost seats but retained its majority. It now falls to prime minister Fumio Kishida to put bones on his “fuzzy” pledges to create a “new model of capitalism”.

The Topix stock index rallied by 1.8% on the morning following the vote. Investors were relieved that the election delivered a stable government, rather than the more fractured parliament polls predicted.

Turnout was low as voters were presented with “few meaningful” policy differences, says Naoya Yoshino in Nikkei Asia. “Economically, both sides put forward generous distributive policies [centred] on direct financial benefits to the public.” There was little “real debate” about how to pay for it, nor about how Japan plans to decarbonise its economy. Investors are confused by Kishida, say Gearoid Reidy and Min Jeong Lee on Bloomberg. Some deride him as a dull continuity candidate who will continue the pro-market policy direction initiated by Shinzo Abe in 2012. But others wonder whether his talk about creating a “new capitalism” marks a more decisive break with Abe.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Japanese stocks slumped in the weeks following Kishida’s elevation to the premiership in October, says Mariko Oi for the BBC. His idea that capital-gains tax should rise drew an angry reaction from business, prompting an “embarrassing policy U-turn”. While markets assess Kishida’s inclinations, the stocks continue to appeal.

More shareholder-friendly corporate governance, excellent multinational companies, high vaccination rates and advancing digitalisation mean that investors would now do well to follow the lead of so many Japanese voters and tune out the country’s politics.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how