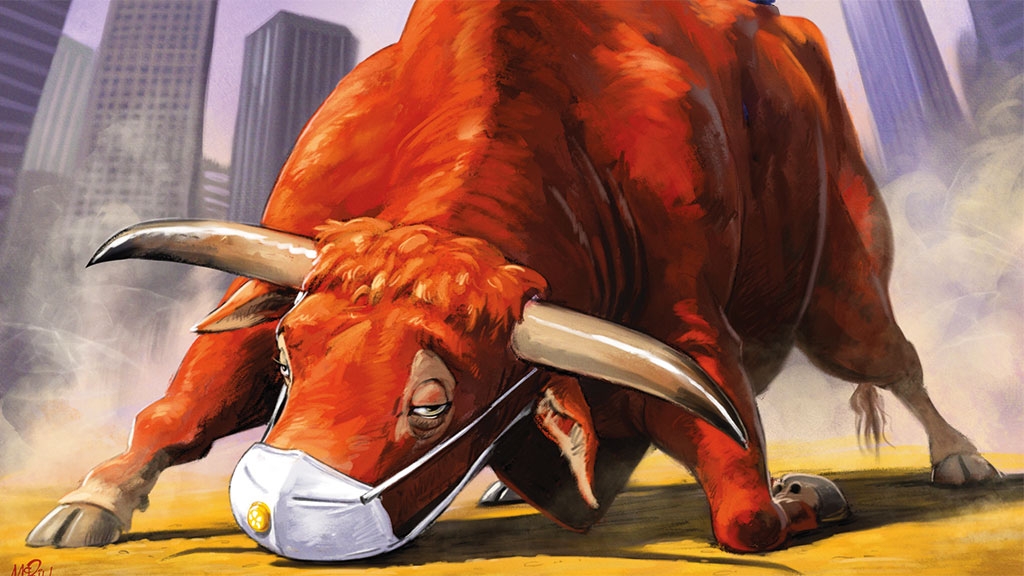

Coronavirus: what happens next?

The immediate impact of the coronavirus outbreak is bad enough, writes John Stepek. But the real risk is that it could change our financial system forever.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If we weren’t already convinced that the coronavirus was a serious threat, we know it for sure now. The Federal Reserve on Tuesday announced an emergency interest-rate cut, slashing the key Fed Funds target range by 0.5 percentage points, to 1%-1.25%. The US central bank will be meeting officially in less than a fortnight, but it decided that it simply couldn’t wait. That’s the first time the Fed has done that since 2008. On every other occasion that we’ve seen an emergency cut (certainly in the last 20 years), we’ve either been in the midst, or on the verge of a major panic in markets. So it’s not an encouraging precedent.

On the one hand, it’s easy to see why the Fed felt nervous. In the last week of February, the S&P 500 fell by 11%, its worst showing since 2008. Meanwhile, the yield on US government bonds (Treasuries) plunged to record lows as investors sought out “safe havens” and bet on a decline in interest rates, which indicates that investors fear a recession is nigh. In some ways the Fed was merely playing “catch up” with markets. On the other hand, the move came as a shock to many – markets fell in the aftermath and, as Jeremy Warner put it in The Daily Telegraph, the instinctive question is: “Does the Fed know something the rest of us do not?” So the question is: is the Fed right to be this worried and what does it mean for investors?

History is of little use here

You might be tempted to look to history for a guide as to what happens now, but as Oliver Jones of Capital Economics points out, it’s not terribly helpful. Bond yields rose (ie, bond prices fell) in the wake of the three previous global pandemics (Spanish flu in 1918, Asian flu in 1957 and Hong Kong flu in 1968). However, that was more to do with incipient inflation than the impact of the outbreaks.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Meanwhile, equities rose after 1918 and fell in the other two instances, but that was mostly about the starting valuations (markets were cheap following World War I and not so cheap on the other occasions). Today, equities are expensive in the US and less expensive everywhere else, while bonds are arguably expensive everywhere, but inflation is low and not showing much sign of perking up. So the financial backdrop is very different.

You can say the same for the “real world” backdrop. When Spanish flu went global in 1918, we didn’t have antibiotics or the degree of medical specialisation we do now. Scientists couldn’t even confirm what was behind the outbreak until many years after it happened. So medical science is far more advanced. As The Atlantic puts it, “we have options that were simply undreamed of a century ago”.

On the other hand, the world is far more globalised, which means the economy is much more vulnerable to disruption in any given part of the supply chain, be it physical or financial. In short, looking at past pandemics is – to put it bluntly – a waste of time.

The good news

It’s clear that the coronavirus has had a massive impact on the Chinese economy. At the weekend we learned that activity in both the services and manufacturing industries hit an all-time low in February and there have been similar figures for Hong Kong. That said, there are signs that China is getting back to work. Satellite imagery – more reliable than official Chinese statistics – shows that pollution levels are rising, indicating that business is picking up again. The amount of nitrogen dioxide in China’s atmosphere at the end of February was still down 20% on the same time last year, but up by around 50% on the middle of the month.

As for corporations themselves, according to The Transcript (which collates information from corporate earnings conversations), companies have also indicated that activity is improving. Warren East, chief executive of engineering giant Rolls-Royce, said that “operations in China are getting back to normal… our key suppliers… are all back at work”. Apple CEO Tim Cook talked about factories reopening and Chinese internet group Baidu noted that “when you’re going on the freeway now, you’re actually seeing traffic jams versus, say, two, three weeks ago, where the roads were pretty empty”.

If – and it is still an “if” – China is getting back to work, then the risk of an ongoing severe supply shock (where there aren’t enough goods and services being produced to meet demand) is lessened somewhat. You can start to visualise the economic shock from coronavirus as being like a harder-hitting version of the Sars pandemic of 2003. It will hit certain sectors particularly violently and lead to a downturn in economic output for a period of time, particularly as it spreads from country to country. For example, here in the UK we’re just at the beginning of a likely wave of conference cancellations and travel bans. But once it passes, it passes and normal service is resumed.

The bad news

The problem is that this shock comes at a time when the global economy is particularly vulnerable. As financial historian Russell Napier points out, while the overall hit to economic activity can’t be quantified yet, “the shock is very deflationary”. That’s because global debt-to-GDP stands at a near-record level of 242%, compared with 211% in 2007. That means that if companies are starved of the cash flow they need, “debt defaults will quickly become an issue”.

That’s the big risk now. As Credit Suisse strategist Zoltan Pozsar points out, “the supply chain is a payment chain in reverse”. To spell that out, just as you can’t build a car without every link in the chain, every company in the supply chain is reliant on cash coming in from others. If one link in this chain breaks down, then there’s the danger of a knock-on effect. I don’t pay you, so you can’t pay someone else, who then can’t pay their own creditors and so on down the line. Before very long, the financial system (which is struggling with liquidity now as it is) could be overwhelmed as companies suddenly need to borrow much larger sums than normal to tide themselves over.

This is something central banks and governments can help with, but it might take time for them to act, during which time a panic is quite possible. As Napier points out, we’ve already suffered two deflationary shocks this century – the tech bust and the 2008 crash. During those, the S&P 500 fell by 49% and 57% respectively. So it’s not something to be taken lightly.

So what’s next?

Many commentators fret that the Fed and central banks generally are “out of ammo”. This strikes us as mistaken, at least if all you care about is asset prices. Central banks – even those whose key interest rates are much closer to 0% than the Fed’s (which is just about all of them, certainly in the developed world) – always have options. For example, at the start of the week the Bank of Japan spent ¥100bn (nearly $950m) on buying equities via exchange traded funds – a record for a single day. As that indicates, we’re already in a world where the radical, in terms of monetary policy, is becoming commonplace.

And on the “fiscal stimulus” front, Hong Kong has announced that it will hand out money to citizens to prop up consumption, Italy has a bail-out plan for companies that lose more than 25% of revenues, and even Republicans in the US are talking about potentially funding coronavirus-related medical bills. So there’s plenty of ammo in reserve – the only real barriers are political ones and those are not very high. Do you think that Donald Trump would have any objections to printing money to hand out to voters ahead of November? I didn’t think so.

But it’s not the US you have to watch, argues Napier. The Fed has more space to cut there (and the eventual impact on mortgage rates will boost Americans’ spending power automatically). Instead, given that interest rates in the eurozone are already as low as they can go and the need to maintain the integrity of the currency is so much more politically important, this is likely to be where we’ll see the shift to “helicopter money” (printing money to spend directly, rather than pumping it into markets) materialise first.

Banks are already being asked to be “forbearing” – basically give companies extra time to pay their debts. This makes sense if it avoids the failure of otherwise healthy companies due to short-term disruption. But as Napier puts it, “the ability of politicians to mandate who should and who should not pay interest expense to commercial banks is a policy that politicians may come to like just a bit too much”. Hand in hand with this shift to money printing would go capital controls, to ensure that the money stays within the eurozone and that the integrity of the euro is protected. As a result, says Napier, the real danger is that coronavirus goes down in history “as the trigger that legitimised a much more aggressive move to financial repression”. We look at how to protect yourself below.

What should you invest in now?

As Kate Burgess in the FT’s Lombard says, “if ever there was a time to delve into gold it is now”. Gold had a sharp fall at the end of last week, as investors sold out to cover losses elsewhere. But as Russell Napier says, even if a bout of deflation hurts the gold price in the near-term (which is not a given in any case), “given such high political uncertainty and the likelihood of ‘helicopter money’, coupled with financial repression, gold remains very much a buy”.

You can invest in gold using an exchange-trade fund (ETF) such as Wisdom Tree Physical Gold Securities (LSE: PHAU), or simply by buying from a bullion dealer. The more adventurous could opt for gold miners – these look relatively cheap compared with the gold price, but do bear in mind that they are equities, not gold substitutes. There are several active funds, or you can track the gold-mining sector passively using trackers from VanEck Vectors (you can track the big miners using the London-listed GDX ETF, or the smaller miners using GDXJ).

As for your wider portfolio, it’s too early to tell how great the damage will be. If China is genuinely recovering and gets better quickly, we might bounce back sharply. If the virus takes hold across the world first, corporate earnings could be hit hard. That said, UK-listed shares in particular are not expensive and have already fallen hard. So review your portfolio for weak spots, but don’t panic sell – and build a watch list of stocks you’d like to buy at lower prices, just in case you get the opportunity.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Is it different this time for Japanese stocks?

Is it different this time for Japanese stocks?Analysis Nikkei 225 Index has jumped 19.8% this year, and there are signs the rally could continue.

-

As China reopens, why pick an income strategy?

As China reopens, why pick an income strategy?Advertisement Feature Yoojeong Oh, Investment Manager, abrdn Asian Income Fund Limited

-

Is Japan the best market to invest in now?

Is Japan the best market to invest in now?Opinion Japan puts Western economies to shame and offers good value for both equity and bond investors, says Max King.

-

The highest yielding S&P 500 Dividend Aristocrats

The highest yielding S&P 500 Dividend AristocratsTips Dividends are a key component of investment returns in the long-term. A portfolio of dividend aristocrats is a great way to build wealth and a sustainable income stream.

-

2023 will be a bumper year for stocks. Here’s how to play the rally

2023 will be a bumper year for stocks. Here’s how to play the rallyTips Dominic Frisby explains why he thinks the market rally could have further to run in 2023 despite macroeconomic headwinds

-

A new dawn for Asian markets?

A new dawn for Asian markets?Advertisement Feature James Thom, Investment Manager, abrdn New Dawn Investment Trust plc

-

China’s post-covid investment boom off to a slow start. Should you still invest in China?

China’s post-covid investment boom off to a slow start. Should you still invest in China?Advice Investors are no longer bullish on the China shop but the gloomy consensus on Beijing’s economy might be unfair. Should you invest in China?

-

Stock market crash? This time it’s (slightly) different

Stock market crash? This time it’s (slightly) differentOpinion The bears expecting a stock market crash have got it wrong, says Max King.