How to play the surge in the silver price

Bulls have been watching silver's latest run-up with excitement, says Dominic Frisby. All the ingredients for a long-term upswing are in place, and here’s how investors can take advantage

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It’s time for my annual article in which I put the boot into silver. Why now? Because, according to one of my WhatsApp chats, it’s breaking out. Silver is always supposedly breaking out. It never actually does.

Was there ever a metal with as much potential? Was there ever a metal you could so wholly depend on to let you down? If there is, I’m not aware of it (although during the past 15 years, platinum has been running it close).

But maybe, just maybe, this time is different. Let’s start with a bit of gossip from the front line. I have three friends who are CEOs of silver-mining companies. All three of them, based in Latin America, have reported back with the same story.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Typically, a miner would pay a company (usually a refiner) to take ore off their hands, and then treat and smelt it, so it can be sold. These so-called off-take agreements would usually amount to $120-$180 per tonne of ore. But at present, refiners aren’t charging anything. Somebody is subsidising it all.

Could it be that humongous, commodity-guzzling nation that begins with a C, I wonder? It wants silver for all those solar panels Ed Miliband is buying. This has to be a super-bullish signal. It’s starting to feel as though we are moving into a proper commodities bull market.

Remember 2021 and 2022? Commodities went ballistic during Covid and spiked as Vladimir Putin invaded Ukraine. Then they collapsed. Maybe 2021-2022 was just an appetiser, and a secular bull market in metals is at hand.

The supply and demand numbers have been portending it for long enough. In fact, they have been signalling it for so long, many of us have come to believe it would never happen. The case for investing in silver is as follows.

Firstly, we are in an age of currency debasement, so you want to own hard assets. In such an inflationary environment, the monetary metals, gold and silver, perform best. Silver has been accepted as money for millennia.

Silver as a monetary metal

Gold’s role was always more as a store of value than a medium of exchange. National banks keep it. Institutions keep it. Individuals keep it. Historically, we used silver, copper and nickel for all but high-value transactions.

Silver’s role as a medium of exchange came to an end with the gold rushes of the 19th century. The vast increase in the gold supply, which came as a result of the discoveries in California, Australia, South Africa and Canada, enabled nations to abandon silver. (My book The Secret History of Gold, published in August, delves into the history of the precious metals in more detail.)

In the case of the US, it was the Coinage Act of 1873, or as silver bugs like to call it, the Crime of ’73, that heralded the end of silver as official money. In the UK, largely thanks to the Portuguese discoveries of gold in Minas Gerais, Brazil, the process began a good 150 years earlier.

In these cashless times, there is little chance of silver regaining its role as a medium of exchange.

As a result, looking at gold-to-silver ratios – it now takes about 100 ounces of silver to buy an ounce of gold – and saying we are going back to the historical average of 12 or 15:1 is mistaken.

There may well only be 15 times as much silver in the Earth’s crust as gold (making 15:1 the natural ratio), but without its role as money, this is just not going to happen. Not for any prolonged period. In the last 100 years, we have only touched this 15:1 level once, for a day: Thursday, 27 March, 1980. Two brothers with the surname Hunt were trying to corner the silver market.

There are many reasons to invest in silver; I own physical silver. But expecting it to be monetised again should not be one of them. If the end of the world comes, and we get a collapse in fiat money, you might be glad you own silver, but you will be facing bigger problems, such as Armageddon.

Silver as a crucial industrial metal

Now we have nixed it as money, let’s consider silver’s extraordinarily widespread industrial use. You could write a book about the industrial uses of silver. There are so many, especially in this era of electronics. It might not be a very good book, but it would be long.

From medical equipment to electrical appliances, it’s harder to find products that don’t contain silver than ones that do. Every smartphone has silver in it; every computer; every jet engine; every solar panel. The best batteries contain silver. It’s used in detergent, deodorant, wart treatment, antimicrobial laboratory coats, 3D printing, plastics, jewellery, wood preservation, and water purification. It’s a “picks-and-shovels” play on new technology and the growing middle class of the developing world.

Annual demand for silver stands at around 1.2 billion ounces. Roughly 60% of that demand, 700 million ounces, stems from industry (500 million from the electrical and electronics sectors, with solar panels comprising 50% of demand); 22% from jewellery and silverware; and 18% from investment.

Yearly supply is about one billion ounces (80% from mining, 20% recycling), so the market is in deficit. Hence the rising price. Most silver is produced as a by-product of other mines, especially lead and zinc. At one stage, BHP Billiton was the world’s largest silver producer, and it was all by-product.

In folklore, silver was often associated with both magic and the moon. Its properties are so varied and widespread that there really is something magical about it. Indeed, it has so many industrial uses, it is something of a mystery why the silver price has been so low for so long.

Some blame dark forces, others blame market forces, but since the demonetisation of the late 19th century, the words silver and price suppression have commonly been uttered in the same sentence.

Every time there is a sell-off, the suppression word is uttered. Every time there is a boom, the shorts are being hammered. Conspiracy or not, there is nothing to be done about it, so we just have to accept the market for what it is.

There is, however, a romance to silver. Perhaps that has something to do with its femininity and the moon, (gold, on the other hand, associated with the sun, is considered masculine).

But with its romantic lunar (or lunatic?) associations, it has a tendency to ignite the public imagination, occasionally with explosive results. It did in 1980 when it went to $50 an ounce (oz); it had been $2 just a few years earlier. It did it again in 2011 when it revisited $50 before collapsing.

Silver will at some point revisit $50/oz. At some other point it will get above that figure. The mother of all narratives will take hold, and silver will probably end up going to $100 or even $200/oz. That’s when you will want to have bought some silver stocks.

It will also, at some stage, revisit $15/oz. That’s when you don’t want to be owning silver stocks.

How to invest in silver

Silver has been in a bull market since summer 2022, but it has, broadly speaking, followed rather than led gold. Yet in the last few weeks, all of a sudden, silver has been leading gold. What’s more, silver miners are leading silver. That’s what makes me bullish.

The silver miners really have broken out. I haven’t seen this in a long time. This is why I’m saying it’s starting to feel like a proper metals bull market. So how am I playing this? What are the best ways to invest in silver and profit? Broadly speaking, there are four ways to get exposure to the silver price.

You can buy silver bullion (coins and bars), while a silver exchange-traded fund (ETC) is a second option. You can gain exposure via a spread bet, contract for difference (CFD), or future. Finally, there are silver miners.

If it’s bullion you want, try the Pure Gold Company and tell them I sent you. (They deliver worldwide or you can store with them.) If you have the time and the inclination, you can often pick up antique silver, especially Georgian silver tea sets, on eBay and elsewhere at prices below the spot value of the silver content.

My friends at the Stage Golfing Society recently bought a beautiful silver tureen to use as trophy for a golf tournament. You could melt down the tureen and sell it as bullion and you would get more than what they paid for it. Such arbitrage opportunities are not uncommon with physical silver, if you have the time and inclination to hunt them out.

Exchange-traded funds (ETFs) are simple and cheap. You buy them through your broker just as you would any share. UK investors can buy WisdomTree Physical Silver ETFs (LSE: PHSP). The Invesco Physical Silver ETC (LSE: SLVP) is another option.

There are also two- and three-times leveraged ETFs. Caveat emptor: if you know what you are doing, these can be good vehicles, but the costs can be quite high if you hold them for a long time. WisdomTree has a range, both long and short; LSE: 3LSI is the ticker for the three-times leveraged option.

On the subject of caveat emptor, there is also the CFD and spread-bet option. If the market moves in your favour, they can be very rewarding, but you can also lose a great deal more than your initial stake. Be sure to manage your risk: have an exit if the market goes against you, and keep your position sizes manageable. The most common mistake is to make position sizes too big.

The pick of the silver miners

The simplest way to buy silver mining companies, again, is via an ETF that tracks a basket of them.

Listed in both London and New York, both dollar-denominated, the GlobalX Silver Mining ETF (NYSE: SIL, LSE: SILG) is one option. And if you want to get really spicy, there’s the US-listed Amplify ETF Trust Junior Silver Miners ETF (NYSE: SILJ), which tracks the small caps.

Fresnillo (LSE: FRES) and Hochschild Mining (LSE: HOC) are the two biggest London-listed pure silver plays. My favourite large caps are Silvercrest (Toronto: SIL), Pan American (Toronto: PAAS), Mag Silver (Toronto: MAG); and First Majestic (Toronto: AG; NYSE: AG), run by my friend Keith Neumeyer, for which I have a very soft spot. The group also boasts a bullion shop.

But it is in the small-cap segment that the real opportunity lies. A few weeks ago I wrote about a recycling company, Comstock Lode (NYSE: LODE). This company is starting to move now, I am delighted to say, but there is still a real opportunity here, and it is highly geared to silver.

The company has, essentially, three businesses. A burgeoning biofuels arm, which it is spinning out. (It has managed to raise money for this subsidiary at a valuation of $1 billion, when the market value of Comstock Lode itself is barely $100 million. Yes, you read that right.)

Then it has some mining assets at Comstock Lode, Nevada; hence the name of the group. Comstock Lode enjoyed a huge silver rush in the 1860s. It was where Mark Twain famously lost his shirt. Some 225 million ounces of silver have been mined in the region, along with between six and eight million ounces of gold. Lode has six million proven ounces of silver in the ground, and 600,000 oz of gold. At $50/oz for the gold and $3/oz for the silver, this is also worth $50 million.

Comstock owns $100 million of Nevada real estate (this is data-centre country). And, finally, it has a burgeoning recycling business in Nevada, recycling solar panels. The demonstration facility is up and running and going great guns. The group is focusing on securing the equipment and money to construct the next facility.

The US is about to be hit with 33 million photovoltaic (PV) solar panels by 2030 – one million tonnes – and ten times that by 2050, as the panels in the first batch come to the end of their life. Around 90% of panels are dumped in landfill, but California has now banned them from landfills, so they have to be transported and buried out of state. Lode’s recycling plants are just across the border.

Lode needs to build three plants, which will cost $36 million. By 2030, it will be able to process ten million panels per year, or 300,000 tonnes. For every tonne it processes, it makes $600, with an 85% margin. So, assuming flawless execution, that’s $180 million in annual earnings. They still need financing, and that will either come from debt or equity (there are multiple solutions).

There is a lot of silver in a solar panel. Just ask the Chinese. So Lode is going to be producing a lot of silver. If it gets its solar-panel recycling business working, it will become the biggest silver producer in Nevada, perhaps even the entire US.

There is also Sierra Madre Silver and Gold (TSX Venture Exchange: SM), which I have mentioned in MoneyWeek before. This stock has been creeping up for some time, and now stands at around $0.70. It was in the $0.40s this time last year.

Sierra Madre has gone from development story to producing mine, processing about 500 tonnes of ore each day (t/day). It should produce 60,000 oz of silver equivalent per month next quarter. It has made this transition ahead of schedule and beaten expectations in doing so. The stock has almost tripled since the lows of 2024, when it hit C$0.25. It now has a market value of around C$100 million.

The company now needs to improve its operations. Its costs are quite high at $29/oz. CEO Alex Langer thinks he can get them down by $4-$5 with some equipment purchases (renting is expensive). There is some improvement work on the crushers to be done. Processing should increase to between 600 t/day and 800 t/day. With some improved equipment, this can get to 1,500.

A stock with room to rocket

They might need to raise a bit of money to do that and accelerate the process; it will take longer to get there from cash flow. When I spoke to Langer a fortnight ago, he had just come from a meeting with potential investors in Palo Alto, so I expect this was being discussed. But if they can get to 1,000 t/day, this should also help costs come down.

Then, probably early next year, we could see some exploratory drilling of the outer zones, which will make the whole company much more alluring.

If they can get the stock to a US$100 million market-cap stock, they qualify for inclusion in the Global X Silver Mining ETF, which could turbocharge liquidity and trigger institutional buying.

In short, this is a producing mine with exploration upside. It’s cheap and it is starting to make good money. A number of analysts have placed targets of C$1.10-C$1.30 on the stock. These are all quite realisable if the silver price holds. I see plenty of upside left in this one. I’m a happy holder.

Dominic Frisby writes the investment newsletter The Flying Frisby.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Silver has seen a record streak – will it continue?

Silver has seen a record streak – will it continue?Opinion The outlook for silver remains bullish despite recent huge price rises, says ByteTree’s Charlie Morris

-

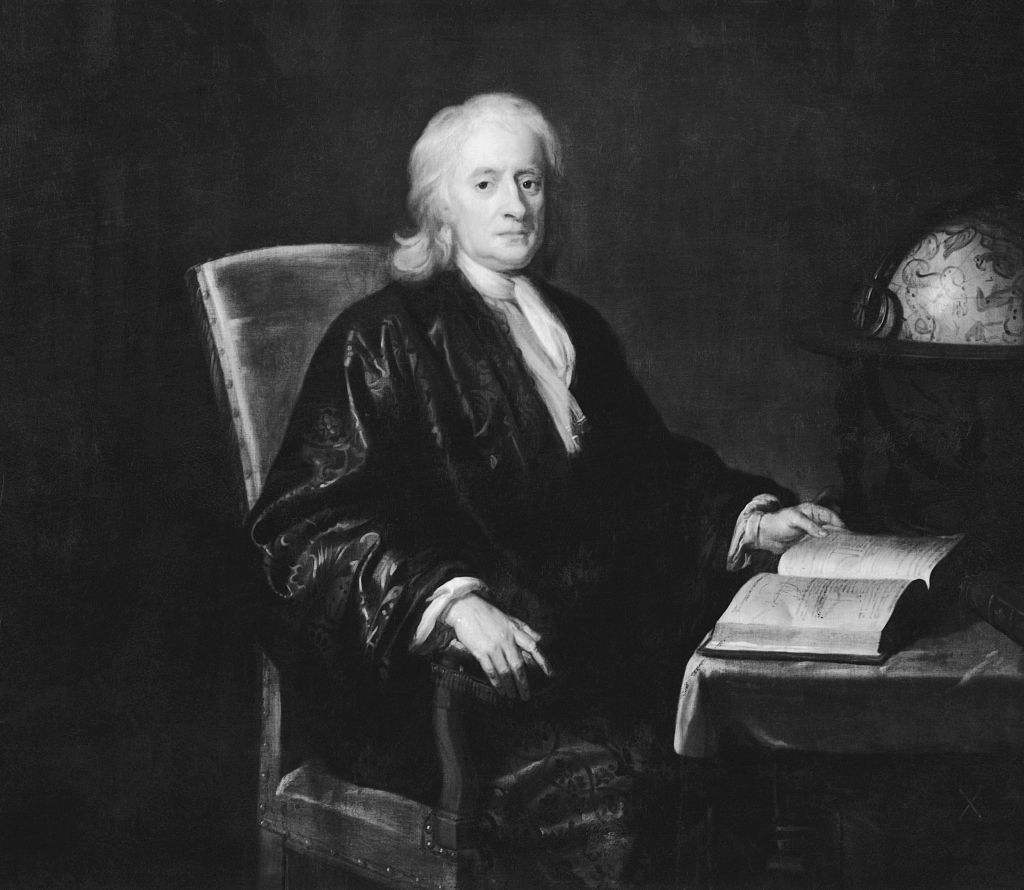

Isaac Newton's golden legacy – how the English polymath created the gold standard by accident

Isaac Newton's golden legacy – how the English polymath created the gold standard by accidentIsaac Newton brought about a new global economic era by accident, says Dominic Frisby

-

Investors need to get ready for an age of uncertainty and upheaval

Investors need to get ready for an age of uncertainty and upheavalTectonic geopolitical and economic shifts are underway. Investors need to consider a range of tools when positioning portfolios to accommodate these changes

-

How to invest in undervalued gold miners

How to invest in undervalued gold minersThe surge in gold and other precious metals has transformed the economics of the companies that mine them. Investors should cash in, says Rupert Hargreaves

-

How to profit from silver’s record rise

How to profit from silver’s record riseSilver often lets investors down, but there may now be room for further gains, says Dominic Frisby

-

Will platinum and palladium rise?

Will platinum and palladium rise?Analysis Platinum and palladium have lagged gold and silver recently, but the outlook is improving. Should you invest?

-

Three gold mining stocks with strong green credentials

Three gold mining stocks with strong green credentialsPersonal View Tom Bailey of HANetf highlights three gold and precious metal miners to consider.

-

Gold or silver: which is the better bet?

Gold or silver: which is the better bet?Should you invest in gold or silver? Or should you own equal amounts of the precious metal?