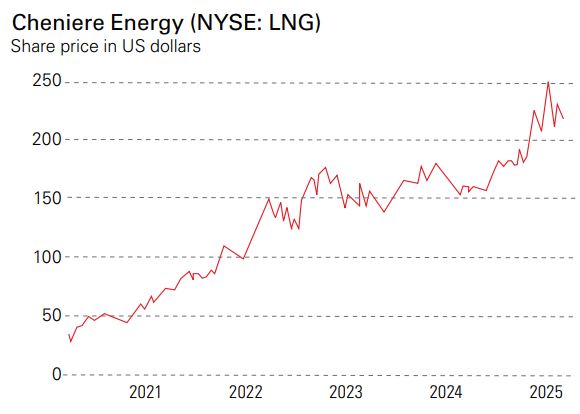

How to play the global LNG boom with Cheniere Energy

Cheniere Energy is expanding to grab a share of a growing market

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Over the past decade, the US has become one of the most influential countries in the global liquefied natural gas (LNG) market. From producing virtually nothing in the early 2010s, in 2022 the country became the world’s largest LNG exporter. By the end of the decade, almost one in every three tankers carrying the fuel will originate in the US, according to BloombergNEF. Production capacity from the country is expected to grow by 60% in the next three years. Companies such as Cheniere Energy (NYSE: LNG) and Venture Global (NYSE: VG) have powered the sector’s growth, investing tens of billions of dollars in the infrastructure required to turn natural gas into the supercooled liquid for export.

Vast LNG facilities – which chill natural gas down to -160˚C, transforming it into a liquid, and then pump it into specialised ships – consume vast amounts of capital and require coordinated efforts by all parties to get from the idea to the production stage. Cheniere’s Sabine Pass (owned by Cheniere Energy Partners LP (NYSE: CQP), a subsidiary of Cheniere Energy*) is the world’s largest liquefaction facility, with a total capacity of about 30 million tonnes a year (total US exports hit 88.3 million tonnes in 2024).

Enormous global demand for LNG fuels Cheniere Energy's boom

The growth in US export capacity has coincided with exploding demand for LNG worldwide. In its liquid form, gas is fairly easy to transport in large quantities and is a relatively cheap and clean fuel. In 2024, global trade in LNG grew by only two million tonnes, mainly due to capacity constraints. More than 170 million tonnes of new LNG supply a year is set to be available by 2030 and this is expected to help support demand growing from 407 million tonnes a year at present to 630 million-718 million tonnes a year by 2040, according to Shell’s global LNG report (Shell is Europe’s largest trader of LNG).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Demand is expected to come from traditional sources, such as heating and power generation, as well as non-traditional sources, such as shipping. The growing order book of LNG-powered vessels will see demand from this market rise to more than 16 million tonnes a year by 2030.

Cheniere’s existing facilities, experience and market position make it one of the best ways to play the LNG boom. Along with Sabine, it also owns the Corpus Christi terminal, and both facilities sell their output into the market on fixed-term contracts, which gives the business a high level of visibility over future cash flows.

At the end of February, the company’s CEO, Jack Fusco, said it plans aggressively to pursue new regulatory permits to expand capacity now that Donald Trump occupies the White House. “We intend to strategically pursue permits to ensure the long-term growth optionality of Sabine Pass and Corpus Christi,” Fusco said. The company wants to more than double its current output, from 45 million tonnes to 90 million tonnes, by building more export terminals at Corpus Christi and Sabine. At Corpus Christi, Cheniere is building the Stage 3 LNG export facility, which is ahead of schedule. Production is expected to begin by the end of the year, and the new addition will eventually boost output by ten million tonnes a year.

Cheniere is banking on the expected completion of the Corpus Christi expansion project to hit its targets for 2025. It says it expects adjusted earnings before interest, taxes, depreciation, and amortisation (Ebitda) of between $6.5 billion and $7 billion, up from $6.2 billion for 2024. Distributable cash flow is expected to come in between $4.1 billion and $4.6 billion, with more than 90% of forecasted operational volumes expected to be sold in relation to long-term agreements.

Gushing cash

“Distributable cash flow” isn’t worth much to investors if it isn’t distributed. But Cheniere is making an effort to do so. It recently published its 20/20 vision, designed to return more cash to shareholders while expanding its LNG platform. The aim is to generate $20 billion of cash by 2026 while the firm grows its distributable cash flow run rate to over $20 per share.

Last year, the company spent a total of $5.4 billion on capital projects, share repurchases ($2.6 billion), dividends ($500 million) and debt repayments ($1.2 billion). It boosted its dividend by 20% and plans to grow it by about 10% per year from the 2025 level of $2 per share. The yield is only 0.9% at present, but the total shareholder yield (including share repurchases and debt repayments) was just shy of 9% last year.

With a market capitalisation of $48 billion, the targets suggest the business will generate cash equivalent to 42% of its market value over the next two years. That gives no value to the group’s cash-flow potential in the years after. With demand for LNG set to increase over the rest of the decade and Cheniere aiming to more than double its output, there’s a considerable amount of future growth potential that doesn’t appear to be reflected in the stock’s current valuation.

* Cheniere owns its Sabine Pass facility via Cheniere Energy Partners LP – a listed business structured as a partnership. This is typical in the US for firms that want to raise capital and limit liability. Income flows through the partnerships to shareholders and they usually offer higher payouts to attract investors. The parent company, Cheniere, owns 100% of the general-partner interest and a 48.6% limited-partner interest. The rest of the limited-partner units are traded on the NYSE, but due to the quirks of US-UK tax law, they’re not suitable for the average UK investor.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn