Invest in Grainger: a landlord with growth potential

Grainger is putting years of uncertainty behind it and investing for expansion

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The private housing rental market in the UK used to be dominated by small-time landlords, but this has changed over the past decade as large companies have spent billions developing purpose-built rental homes. According to Savills, in 2015 there were just 5,000 built-to-rent (BTR) homes in the UK. At the end of September, that number was 120,000, with a further 150,000 in various stages of development.

BTR professional landlords have substantial economies of scale and can leverage huge balance sheets to advance housing projects. These projects are built around communities of hundreds of homes, lowering construction and maintenance costs. The largest listed player in the sector is Grainger (LSE: GRI) and its latest results illustrate the scale of the opportunity in the BTR market.

For the year to the end of September 2024, the company reported net rental income growth of 14% year on year, helped by the addition of 1,236 new homes across its portfolio. Like-for-like rental growth across the portfolio was 6.3% during the year, with the company pushing through hikes of 6.8% on lease renewals signed during the period. It ended the financial year with an occupancy rate of 97.4%, showing that, despite the rent hikes, with a structural shortage of homes in the UK, demand hasn’t taken a hit.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Grainger leans into market opportunity

This is the second year in a row the group has registered net rental income growth in the low teens, which is below the market average. Headline rent inflation, according to the Office for National Statistics, is around 7.5%, suggesting Grainger can push through rent rises in 2025 (the company has confirmed it expects rents to grow above the long-term average of 3%-3.5% in the year).

Grainger is leaning into the market opportunity. At the end of September, it had an operational portfolio of 11,069 private rental properties with a further 4,730 new homes in its build-to-rent pipeline. On top of this organic growth, management has been selectively acquiring assets in cities where it already has a strong presence. In July, the group acquired the 135-home property The Astley in Manchester for £31 million from M&G Real Estate, using cash from the recent sale of an 80-apartment asset in London for £27 million. City analysts believe Grainger has the potential to do a lot more of these deals as sub-scale operators move out of the sector.

Grainger’s edge is its scale. The company has a 75% gross rental margin, with the other 25% being reinvested back into the portfolio. Grainger could instantly boost its margins by cutting spending, but it is taking a longer-term approach. By reinvesting, it’s able to maintain the quality of its assets and, as a result, the market value of those assets.

Analysts at Panmure Liberum recently noted that thanks to this “constant capex”, Grainger’s older assets can still command rents comparable to the newer units (97%, despite the asset being over a decade old in one case). This means the company has a “constantly economically relevant and competitive asset” and investors do not have to factor in the risk of “inheriting a capex liability”.

This “constant capex” aside, the company is also forecasting significant additional benefits from increasing scale over the coming years. “The investment and focus we have placed on creating the UK’s leading build-to-rent operating platform means that we can leverage our planned growth using our central platform and deliver significant margin gains,” says CEO Helen Gordon in the company’s full-year figures. Earnings before interest, tax, depreciation and amortisation (Ebitda) margins are set to grow by six percentage points to more than 60% by the financial year of 2029. Part of this will be achieved by converting Grainger into a real estate investment trust (Reit), something the group has been working towards for years.

To convert to a Reit, a company must generate 75% of its income from property rental income, a hurdle Grainger has just surpassed (81% at the end of the last fiscal year). The cost savings from the shift could be worth as much as £10 million, and it will give the group more flexibility by opening up the field to a wider range of investors and lowering the cost of capital to fund growth.

Under the Reit structure, the company must also distribute 90% of its rental property income every year to investors. Management has been moving the company towards this goal since it outlined its Reit plans. Grainger’s dividend was increased 14% to 7.6p in the last fiscal period, and analysts have pencilled in a distribution per share of 9.9p per annum by 2026, a dividend yield on the current share price of 4.2%. These forecasts are based on management’s growth projections, which have Epra earnings (a measure of operational performance and net income) rising 50%, even after accounting for higher interest rates on the firm’s debt.

Buy Grainger as shares go cheap

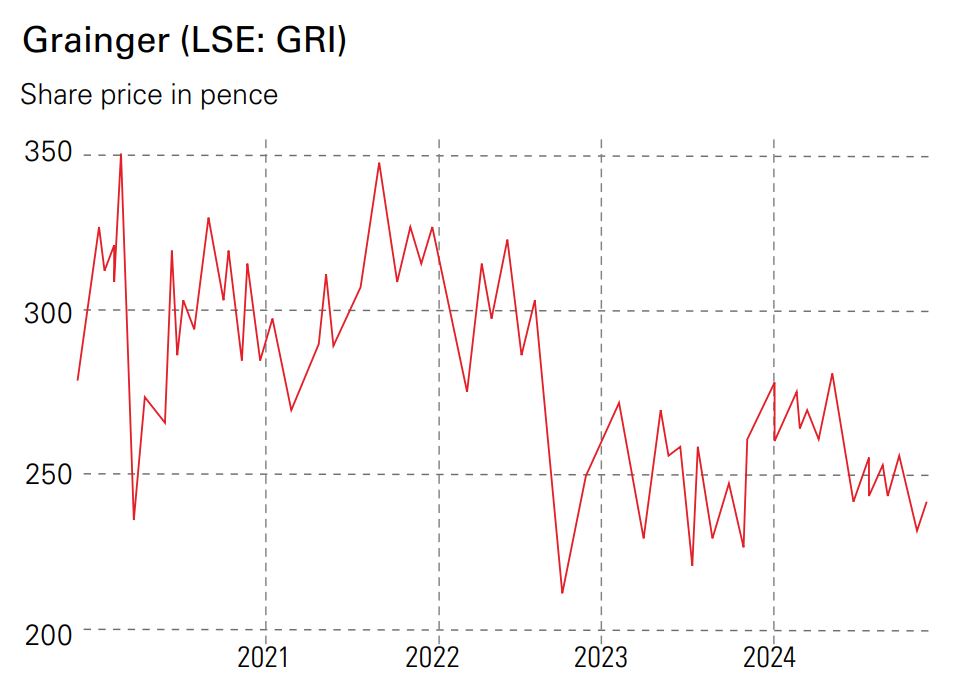

For the past five years, the group has been working towards its Reit transition and it’s been difficult for investors to determine where the group will end up in the medium term. Much of this uncertainty is now in the rear-view mirror. Grainger has built a solid platform as an established BTR player with multiple growth catalysts on the horizon. So there’s scope for the stock to re-rate. At present, Grainger is trading at a discount of around 22% to its September Epra net tangible asset value (NAV) of 298p. That seems cheap for a business that is likely to see mid- to high-single-digit earnings growth over the coming years, as well as substantial dividend growth.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

8 of the best properties for sale with beautiful kitchens

8 of the best properties for sale with beautiful kitchensThe best properties for sale with beautiful kitchens – from a Modernist house moments from the River Thames in Chiswick, to a 19th-century Italian house in Florence

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?