Fever-Tree will recapture its fizz

The mixer-maker has branched out into new drinks and the shares are now reasonably priced.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The anthropologist Joseph Campbell believed that there were common themes to heroic quest stories found in societies around the world. He outlined his idea of The Hero’s Journey, which influenced George Lucas before he wrote the original Star Wars screenplay.

There’s more than a hint of The Hero’s Journey in Fever-Tree's creation story, which involved treks to the British Library to research recipes and adventures in the African jungle looking for the perfect tonic. Like other heroic quests hunting for and returning with a highly prized elixir, this has captured consumers’ imaginations, with the brand now selling in over 85 countries and the company, listed as Fevertree Drinks (Aim: FEVR), growing revenue 18-fold to a forecast £385m in 2023. The story is not over, though, with the brand now facing a new mix of challenges.

Fever-Tree’s asset-light business model shares some similarities with US-listed Coca-Cola (KO) and Monster Beverages (MNST). KO and MNST don’t invest in bottling plants, which have high capital costs. Instead, KO earns revenue by selling concentrates to bottling companies such as Coca-Cola HBC (CCH), which has a much lower EBIT margin (Sharepad shows 10% for CCH versus 33% for KO). Instead of physical equipment and tangible assets, KO and MNST invest in intangibles, such as branding, marketing and sponsoring sporting events. MNST may be less familiar to readers, but the Nasdaq-listed stock has built a global brand in energy drinks. It has risen by a factor of 625 over the last two decades and now has a market value of almost $60bn. Fever-Tree has followed a similar strategy. UK production and bottling has been outsourced to a company called Brothers Drinks, based in Shepton Mallet in Somerset.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That asset-light business model meant that Fever-Tree was reporting a return on capital employed (ROCE, a key gauge of profitability) of 48% and operating margins of 33% in 2017. At the same time, the group was growing revenue and profits by 66%. It is unusual to find a high-margin business able to grow the top line at such a pace. Management suggests that it is benefiting from long-term demographic tailwinds: as populations age, they tend to drink more premium spirits, and hence use premium mixers.

While the brand is most well known for its original tonic to make a “G&T”, Fever-Tree now also sells colas, ginger ales and ginger beers for pairing with dark spirits. Management has identified two adjacent opportunities to expand into: lower-sugar “adult soft drinks” and non-carbonated mixers for creating simple cocktails. With such a good story it’s understandable that investors bid the price up to a peak valuation of 50 times earnings at above £40 per share in 2018, more than triple the 2014 flotation price.

A decline in profit margins

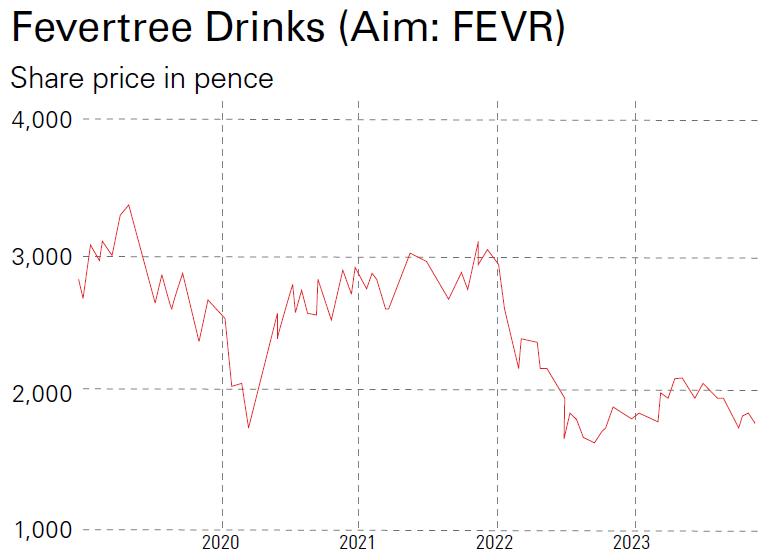

Paying a high multiple for the shares meant that investors had implicitly assumed that high-margin, capital-light growth could continue. That has proved over-optimistic. Following a spate of profit warnings, Fever-Tree’s shares have now derated, but at £10.40 still trade on around 30 times 2024’s forecast earnings. That compares with KO on 21, but it lacks top-line growth. MNST has trebled revenues over the last decade to over $6bn and trades on 30 times 2024 profits.

Although Fever-Tree has been able to grow rapidly without having to spend lots of money on fixed assets such as bottling machines, it did have to invest in warehouse facilities to help with distribution in the US. Spending on property, plant and equipment was below £10m, or just 3% of revenues in 2021, but more than doubled the following year to £26m as the company had to invest in warehouses in the US. That US expansion has been paying off, though, with first-half sales up by 40% this year (32% on a constant-currency basis).

The group’s gross margin has also fallen to 31% in the first half, versus more than 55% five years ago. One reason for this is that the price of glass has hit margins as energy costs have increased. You would expect a premium brand to pass on rising commodity prices to consumers, but Fever-Tree hasn’t been able to do that without losing market share to the likes of Schweppes or Fentimans. The first-half results also revealed that sales growth has been disappointing in the UK and the rest of the world. The upshot was a 92% drop in first-half profits. The stock has slid by 25% this year.

The largest shareholder is Lindsell Train, with 15.4% of the shares, followed by Capital and Smithson Investment Trust. The two founders have sold down their shares, but are still benefiting from generous long-term incentive plans (LTIPs). Charles Rolls, the current deputy chairman, owns 5.5%, having sold down his stake from 29% of the company before the initial public offering (IPO) and Tim Warrillow, the current CEO, has a stake of less than 5%. The “core” LTIP pays out nil-cost options worth up to 300% of salary, while an additional LTIP with awards of up to 150% of salary was introduced in 2021 to reward the board for achieving international revenue targets.

Following the decline in margins, the price-to-sales ratio has derated from 15 in 2018 to below three. The business does have £76m of cash, which means that even if profitability remains under pressure, it is unlikely to face financial difficulties from higher interest rates. So today’s price of 1,040p looks like an attractive entry point. Even if we don’t see a return to 2017 levels of profitability, management clearly understands how telling a good story can increase the value of its brand.

This article was first published in MoneyWeek's magazine and information was correct at the time of writing. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Related articles

- Eternal growth: how to invest in the future of the drinks industry

- Reap long-term rewards from consumption and technology stocks

- Profiting from classic English recipes

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Bruce is a self-invested, low-frequency, buy-and-hold investor focused on quality. A former equity analyst, specialising in UK banks, Bruce now writes for MoneyWeek and Sharepad. He also does his own investing, and enjoy beach volleyball in my spare time. Bruce co-hosts the Investors' Roundtable Podcast with Roland Head, Mark Simpson and Maynard Paton.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?

-

How to invest as the shine wears off consumer brands

How to invest as the shine wears off consumer brandsConsumer brands no longer impress with their labels. Customers just want what works at a bargain price. That’s a problem for the industry giants, says Jamie Ward