Chemring Group: an explosive investment opportunity in defence

European states are raising their military spending, and Chemring Group looks well placed to profit

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The scale of additional military spending planned across Europe over the coming years is set to deliver a windfall for the continent’s defence industry. According to research compiled by Goldman Sachs, defence spending by EU member states is expected to rise by 1.8% of GDP in 2024 to 2.4% by 2027, an extra €80 billion a year. The UK has outlined a commitment to spend 2.5% of GDP by 2027, an extra £13.4 billion a year, taking total annual spending to £80 billion by 2027.

The bulk of this will end up in the hands of the sector’s biggest players, the national champions and defence giants, such as BAE Systems, Rheinmetall, Leonardo, Safran and Thales, but a good chunk will also trickle down to the smaller players. One such business that could benefit more than any other is Chemring Group (LSE: CHG).

Chemring could benefit from a captive defence market

On the face of it, Chemring doesn’t look to be one of Europe’s most important players in the defence sector. It has two main divisions, sensors and information, which accounts for around 40% of revenue, and countermeasures and energetics, which makes up 60%. The latter contains the firm’s advanced plastic explosive business, which is one of the most important in the whole European defence sector.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Chemring only has one major competitor in advanced plastic explosives in Europe, France’s Eurenco Group, which is owned by the French state. It’s difficult to ship explosives around the world, so governments like to buy from local suppliers. With the European market dominated by just two players, that doesn’t give the rearming European nations much choice.

Sales are already benefiting from increased demand from European nations. With Ukraine firing around 10,000 shells a day, resupplying the country with explosives has become a priority for the country’s military backers. Chemring noted it had recorded “unparalleled demand for our specialist capabilities” in its full-year results for the year to the end of October, as it recorded a £932 million order backlog, up 24% year-on-year and roughly equivalent to more than three years of revenue.

In response to the increased demand (which is almost certain to continue), the company has outlined plans to invest £200 million to expand manufacturing capacities in Norway, the US and the UK. On top of this, the firm has been awarded a £90 million grant to support investment in its Norwegian site.

Unfortunately, while the countermeasures and energetics side of the business is doing well, the group’s sensors and information division struggled last year. A shift in order patterns translated into a 30% decline in order intake and a 37% decline in the division’s order book, even as revenue increased 14% to £213 million. But Roke, the leading business in sensors and information, is a key player in electronic warfare, and this is being noticed. Russia’s invasion of Ukraine and Hamas’s attack on Israel have both highlighted the increasing role of technology on the battlefield.

Last year Roke booked orders from customers in Sweden, Lithuania, Latvia, the United Arab Emirates and Japan – the latter its first in the East Asia region. So, while the division might have encountered some turbulence last year, it’s well positioned to grow in the new era of defence spending.

Chemring's shares look cheap

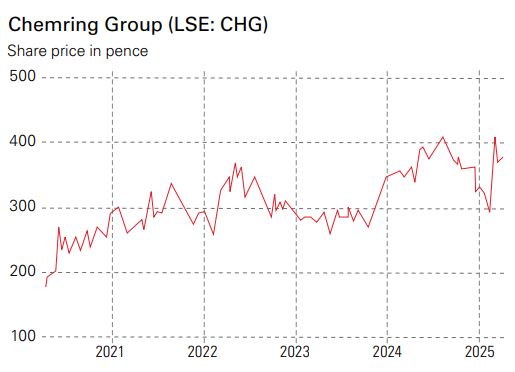

Considering its position in the market, it’s no surprise that Chemring has attracted takeover interest. Earlier this year it was rumoured that US private-equity giant Bain Capital was looking at offering 390p a share for the group, although no hard offer emerged.

In reality, it could be difficult for a private equity company that’s not based in Europe to take control, considering the national-security implications and the pivotal role the group plays in European defence. Still, the rumoured bid price does give a rough indication of what the business could be worth.

As the private-equity playbook often involves breaking up businesses and selling the component parts to the highest bidder, Panmure Liberum has crunched the numbers for each of Chemring’s four main business divisions to calculate the enterprise’s valuation on a sum-of-the-parts basis. Based on projected 2029 revenue (multi-year order backlogs make these figures relatively reliable), the broker put a value of £810 million on Roke as it’s set to have the second-largest revenue (£304 million) behind the Energetics business in 2029. Energetics could be worth as much as £680 million based on the projected 2029 revenue of £334 million, with companies such as BAE and Eurenco most likely to make an offer. The remainder of the enterprise could be worth around £250 million, according to the broker. Overall, on a sum-of-the-parts basis, Panmure Liberum has put the value of Chemring at 747p per share, more than double the current share price.

This underscores the value of the business, but it’s also worth touching on some of the issues that have held back growth at the company. The biggest of these is a legacy US government contract for the supply of countermeasures, signed in 2016 and extended into 2025. The contract has produced virtually no profit for the group. Last year, it also encountered production issues “due to adverse weather conditions”, and there were delays in its plans to expand automation. Both of these issues hit margins at a time when the company should have been celebrating the shifting winds in the defence sector.

If it can put these issues behind it and successfully ramp up production to meet growing demand, Chemring could be one of the best ways to play the European rearmament trade – assuming it’s not bought out before shareholders can reap the full benefits.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Rupert is the former deputy digital editor of MoneyWeek. He's an active investor and has always been fascinated by the world of business and investing. His style has been heavily influenced by US investors Warren Buffett and Philip Carret. He is always looking for high-quality growth opportunities trading at a reasonable price, preferring cash generative businesses with strong balance sheets over blue-sky growth stocks.

Rupert has written for many UK and international publications including the Motley Fool, Gurufocus and ValueWalk, aimed at a range of readers; from the first timers to experienced high-net-worth individuals. Rupert has also founded and managed several businesses, including the New York-based hedge fund newsletter, Hidden Value Stocks. He has written over 20 ebooks and appeared as an expert commentator on the BBC World Service.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton