Robinhood opens up UK arm

American trading app Robinhood has finally set up shop in the UK today and claims it will save US stock enthusiasts hundreds of pounds in fees - here’s what you need to know about the American trading app’s expansion

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Following an aborted UK launch in 2020, American trading app Robinhood is to finally open its door to UK investors.

The investing app, well known for being tangled up in the meme stock mania involving GameStop in 2021 and was forced to pause trading of the stock, started a waitlist for UK investors last year.

As of today, 19 March, customers will be rolled off the waitlist and be given access to 6,000 US-listed stocks such as Apple (AAPL) and Nvidia (NVDA), allowing them to invest with no commission and no foreign exchange fees.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Robinhood’s doors open at an apt time as investors continue to favour US stocks with record amounts being shovelled into US equities. According to data from the London Stock Exchange Group, investors purchased $4.93 billion of US equity funds, in the week ending 15 March - the largest net weekly purchase since 14 February.

Here’s everything you need to know about Robinhood’s UK launch and how the stock-trading platform will work.

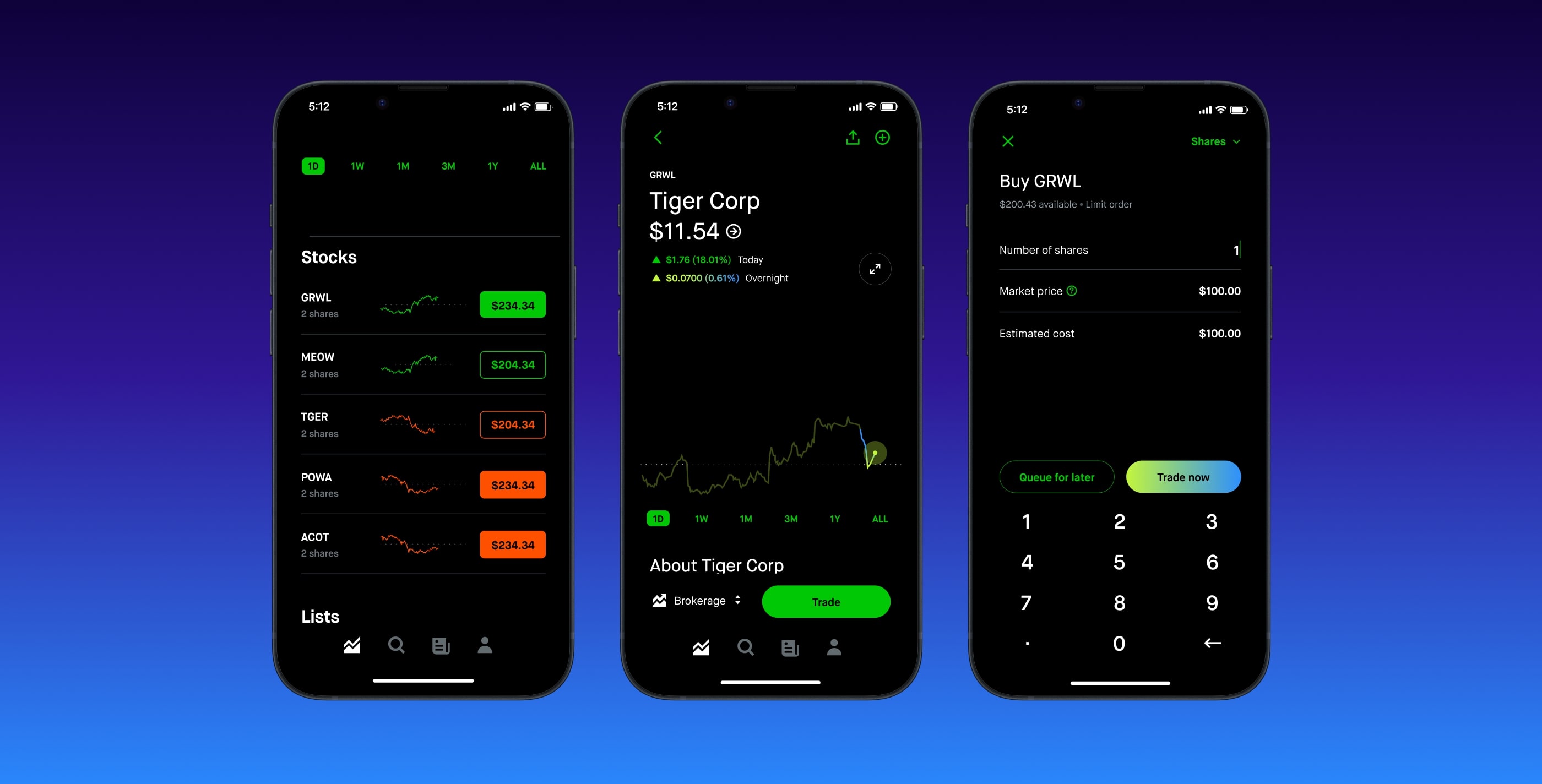

Robinhood UK - how will it work?

Robinhood claims to give UK investors more bang for their buck by scrapping commision FX charges on trades for over 6,000 global companies listed on the US markets. UK brokers usually apply a fee when making US trades, which can add up over the course of the year.

Robinhood claims that by eliminating these fees, an investor with a £10,000 portfolio who makes 10 trades a year would typically save £240 a year when investing in US stocks. Over 10 years, this could save you thousands in trading fees.

Some of the most popular stocks on the platform in the last few months include Apple (AAPL), Google (GOOGL), Amazon (AMZN) and Nvidia (NVDA). There is no minimum needed to get started on the app, so even those with a small amount can invest.

What else does Robinhood offer?

5% interest on cash

While its fee free trading is the most attractive offering, Robinhood says it will also pay 5% AER to those holding uninvested cash on the platform, beating the current rate of inflation of 4%. It is also close to some of the best buy rates for cash easy access and fixed rate savings accounts.

The interest on cash could be a welcome move after a MoneyWeek investigation revealed some investment platforms pay less than 2% interest on cash holdings. Robinhood’s cash account does not have a cap and it is easy access.

Refer a friend reward

You can also earn a fractional share reward worth between $7 and $175, when referring a friend or family to the app. To be eligible, you must be new to Robinhood and meet the criteria for the reward.

Robinhood says around 70% of trades are fractional shares, which give customers access to high value equities, and 30% are for whole shares.

Research tools

Playing on education, the app says it has also created a number of tools to help investors research an investment and make informed decisions.

Is Robinhood UK safe?

Your money will be protected via the Securities Investor Protection Corporation (SIPC), which protects up to $500,000 (including $250,000 for claims for cash) of your money should the brokerage firm go bust. Robinhood said it has also purchased an additional insurance policy for accounts held at Robinhood to supplement SIPC protection, which becomes available to customers if SIPC help is limited.

For those holding cash earning 5% interest, up to $2.25M is protected by the Federal Deposit Insurance Corporation (FDIC).

This protection is higher than the UK’s £85,000 by the Financial Services Compensation Scheme.

The platform also boasts 24/7 customer support, unlike competitors who only operate working hours Monday to Friday, meaning customers who cannot access the app would be left out in the cold.

As well as the app service, Robinhood will also be available via a web browser, giving customers another way to access their account other than their phone.

Should you invest with Robinhood?

The platform has around 23 million users and this is its first international expansion. But whether investors will bite is yet to be seen, especially after two failed attempts to launch in the UK, alongside a scrapped takeover of Ziglu, a British cryptocurrency firm.

Plus, despite launching in the UK with a polished UK website, the firm is still tarnished with allegations that it used gamification strategies to draw young people into making risky trades. It has also faced fines over system outages.

But, Robinhood claims it has been listening to customers and believes it UK offering will disrupt the UK market with its attractive proposition. “We’ve been actively gathering feedback and engaging with customers since our waitlist launch at the end of last year and have been so encouraged by the reception we’ve received thus far,” Jordan Sinclair, president of Robinhood UK, said. “Today’s general availability marks the start of a new chapter for Robinhood, and we’re excited to continue challenging the status quo by delivering more local products and services that resonate with our customers and meet their needs.”

It is worth noting that Robinhood does not currently offer ISAs and other products UK investors are attracted to, such as ETFs - but told MoneyWeek it plans to introduce this over time. It is also currently unable to provide margin investing, a risky strategy where customers borrow money to enable them to make bigger trades.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Kalpana is an award-winning journalist with extensive experience in financial journalism. She is also the author of Invest Now: The Simple Guide to Boosting Your Finances (Heligo) and children's money book Get to Know Money (DK Books).

Her work includes writing for a number of media outlets, from national papers, magazines to books.

She has written for national papers and well-known women’s lifestyle and luxury titles. She was finance editor for Cosmopolitan, Good Housekeeping, Red and Prima.

She started her career at the Financial Times group, covering pensions and investments.

As a money expert, Kalpana is a regular guest on TV and radio – appearances include BBC One’s Morning Live, ITV’s Eat Well, Save Well, Sky News and more. She was also the resident money expert for the BBC Money 101 podcast .

Kalpana writes a monthly money column for Ideal Home and a weekly one for Woman magazine, alongside a monthly 'Ask Kalpana' column for Woman magazine.

Kalpana also often speaks at events. She is passionate about helping people be better with their money; her particular passion is to educate more people about getting started with investing the right way and promoting financial education.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how