Nvidia stock jumps after topping earnings estimates

Nvidia stock rallied after the group reported second-quarter earnings that blew away already sky-high expectations.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Nvidia stock reached a new all-time high today after the company reported its earnings for the second quarter.

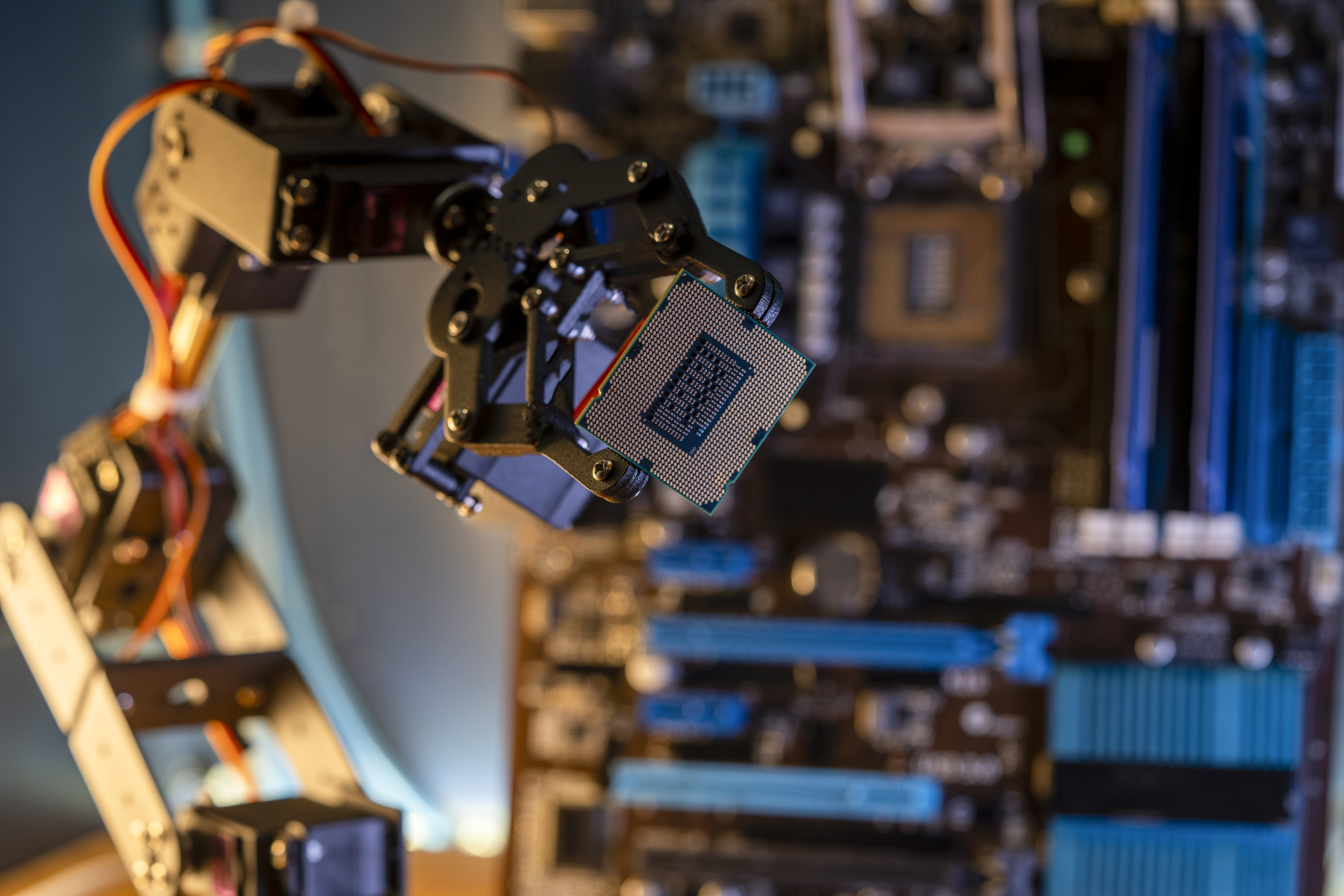

The chipmaker's sales jumped to a record $13.5 in the second quarter, up more than 100% year-on-year amid skyrocketing demand for its high-powered graphics processing units (GPUs) that power artificial intelligence (AI) systems like ChatGPT.

Adjusted earnings came in at $2.70 per share, up 429% from last year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Nvidia stock surges

The chipmaker has benefitted from the boost in AI interest across the board,

As companies push for more advanced tech to streamline their services, companies with exposure to the AI sector are experiencing growth - not just Nvidia.

“A new computing era has begun. Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI,” says Jensen Huang, founder and CEO of Nvidia, in a press release about the second quarter earnings.

The microchip manufacturer also approved another $25bn in share buyback, having already repurchased $3.3bn during the second quarter.

“There is nothing an investor could ask more,” Ipek Ozkardeskaya at Swissquote Bank says.

“The market expectations were sky-high, the results went to the moon, the forecasts for this quarter are as stunning,” she adds. “Magic is happening for Nvidia.”

Nvidia stock has tripled this year with the company becoming the first chipmaker to achieve a $1tn market capitalisation. That made it the fifth publicly traded US company to join the so-called ‘Trillion dollar club’, along with Apple, Microsoft, Alphabet and Amazon.

“Given the scale of the upside surprise on both counts – guidance for the next quarter’s sales and profits are a fifth higher than the consensus before the release of the figures on Wednesday night – shareholders could almost be forgiven for being disappointed with the ‘mere’ 10% jump in the share price in after-hours trading,” says AJ Bell investment director Russ Mould.

“However, the shares are up by more than 50% since May’s first-quarter results and the company now has a market cap of $1.1tn, a lofty price tag that means expectations for growth are already extremely high indeed,” he adds.

Nvidia expects fiscal third-quarter revenue of about $16bn, higher than the $12.6bn forecast by analysts. This guidance suggests sales in the current quarter will grow 170% compared to the same time last year.

"Bears will be arguing that at some point, the valuation will start to appear full. Luckily for Nvidia, a cursory glance would suggest there aren’t many bears around,” says Hargreaves Lansdown analyst Sophie Lund-Yates.

Big Tech stocks to profit from AI

Nvidia is leading the AI boom but the other major players like Microsoft and Alphabet are still in the race.

“Software and computing giant Microsoft is also at the heart of the AI revolution and thus likely to be a leading beneficiary as the megatrend develops over coming years,” says Stephen Connolly, managing director of consultancy Plain Money.

Microsoft doesn’t design microchips like Nvidia. It provides software applications such as Microsoft Office, and has a data storage arm called Azure.

The tech giant is busily integrating OpenAI into its own products, including its cloud offering, sales and programming applications.

There is also Google’s parent company Alphabet. It is also carving out a leading space in AI, says Connelly.

This year it has often been viewed as falling behind competitors, which could create an opportunity for investors.

“The bouts of negative sentiment are probably an opportunity, again for the long-term. Alphabet has, in fact, made been making significant investments in AI over the years, too. The future outlook for traditional search engines and the advertising model that provides the bulk of Alphabet’s revenues is murky, and the prospect of difficulties on that front should not be lightly dismissed,” Connolly says.

In 2022, the global AI market size was valued at $136.5bn and it’s projected to grow by 37.3% from 2023 to 2030, according to GrandView research.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Pedro Gonçalves is a finance reporter with experience covering investment, banks, fintech and wealth management. He has previously worked for Yahoo Finance UK, Investment Week, and national news publications in Portugal.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how