Nvidia overtakes Apple as world’s second biggest company – should you invest?

The chipmaker continues to soar. How long until Nvidia overtakes Microsoft and should you invest in its stock?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

A few years ago, many people had never even heard of Nvidia, but yesterday (5 June) it overtook Apple as the second largest company in the world.

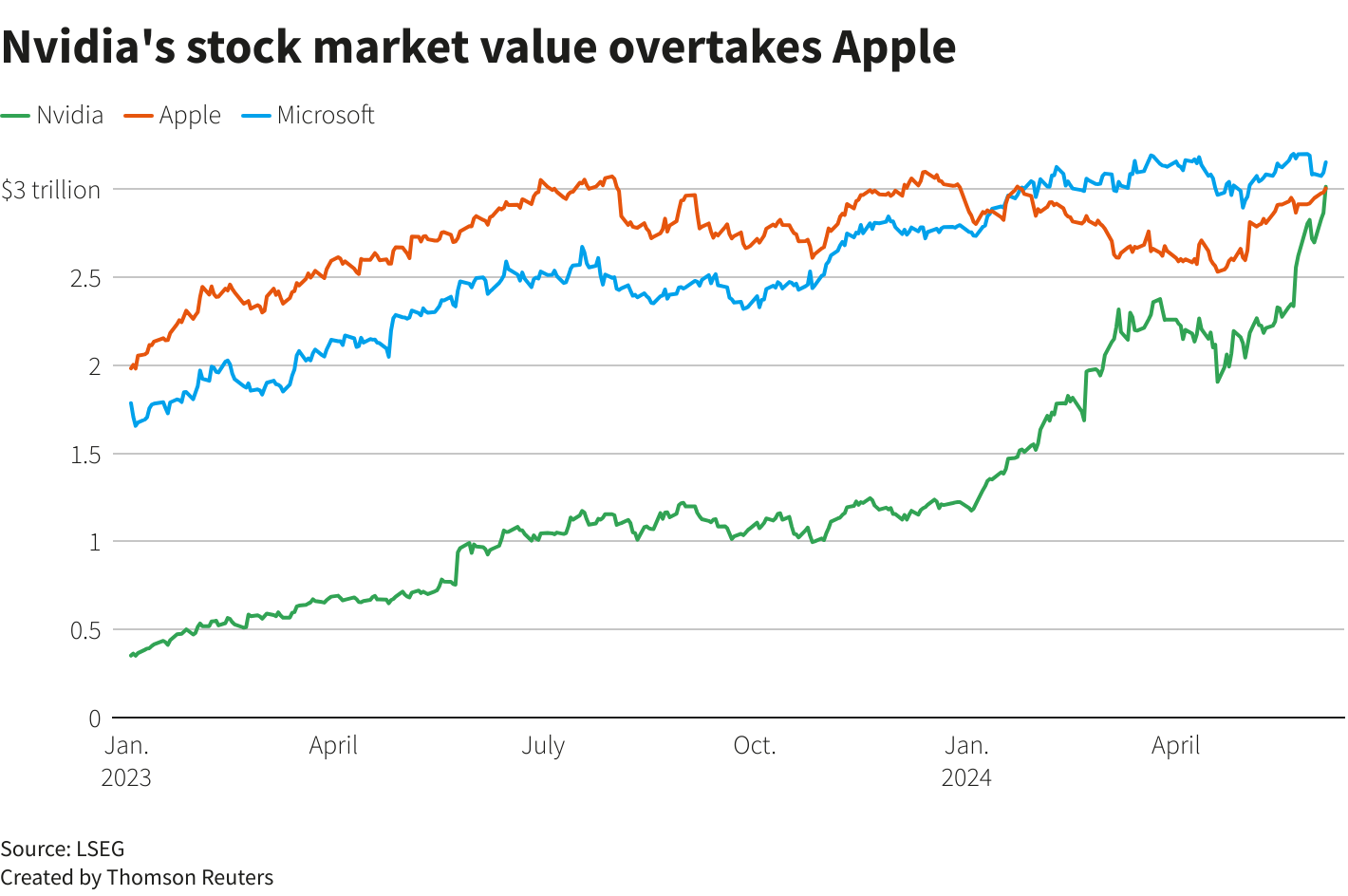

The artificial intelligence (AI) boom has given the company’s share price a ticket to ride in recent years, and it has soared to meteoric heights. Nvidia’s market value (share price multiplied by the total number of shares) has now hit the $3 trillion mark – only Microsoft ranks higher in terms of market capitalisation.

"Such stratospheric share price rises can come with a drawback," says Richard Hunter, head of markets at interactive investor. "The bar has now been raised, meaning that the shares could be vulnerable to disappointment, with increasing pressure on the company to surprise to the upside."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Despite this, he acknowledges that there is "little sign of that for the moment", as the chipmaker continues to go from strength to strength.

We look at what has driven the rise of this tech giant. Will it overtake Microsoft and should you invest in Nvidia stock? Plus, what will Nvidia’s planned stock split on Friday 7 June mean for investors?

Nvidia’s share price – what’s behind its meteoric rise?

Nvidia has easily been the best performing of the Magnificent Seven tech stocks in recent years. Its share price has climbed by more than 150% year-to-date. Meanwhile, over the past five years, it has grown by more than 3,000%. These are glittering returns.

Investors looking to profit from the rising tide of AI have been snapping up the stock, making it one of the most popular investments on DIY platforms. This, combined with a string of impressive results, has propelled its rise.

The company reported its most recent earnings on 22 May – and they were impressive. First-quarter revenue was $26 billion, up 18% from the previous quarter and up 262% compared to a year ago.

In addition to its chips, growth in the company’s data centre business has been driving its strong performance. Data centres made up 87% of overall revenues in the first quarter.

The company’s ascent is “remarkable”, says Russ Mould, investment director at AJ Bell, “particularly as it is now considered to be more valuable than one of the most lauded electronic device makers in the world”.

He adds: “There is a feeling that as long as Nvidia’s share price is rising, investors are happy and everything is fine on the markets.”

As far as the S&P 500 is concerned, this has quite literally become the case in recent years. Nvidia has accounted for around a third of the S&P 500’s overall return so far this year. This makes concentration risk a concern for many investors – something we have explored elsewhere when looking at whether it’s time to ditch tracker funds.

Will Nvidia overtake Microsoft?

Nvidia now isn’t far behind Microsoft, which has a market capitalisation of around $3.15 trillion (compared to Nvidia’s $3.01 trillion). But given the rapid rate at which Nvidia is growing, the company might not be in Bill Gates’s rear-view mirror for long.

The below chart from Reuters shows the trajectory the stock is on.

That’s not to discount the outlook for Microsoft, which remains strong. The company has shown its ability to deliver consistent returns over the long term. What’s more, it has embraced AI and has a strong plan for what it means for its business.

“The path to AI monetisation is clearest for Microsoft,” says Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown. “Its substantial AI investments have driven gains in its formidable cloud business, and its other products are also easily kitted out with AI additions.”

“While there are rumblings of tech-spending pullbacks, the overriding message is that Microsoft remains potentially the biggest beneficiary of AI demand over the longer-term, when compared to its immediate peers,” she adds.

Should you invest in Nvidia?

Nvidia’s share price continues to reach record highs – and investors on the sidelines will be disappointed they didn’t snap it up earlier. But there are risks associated with investing at the top of the market. This begs the question, will Nvidia continue to soar?

The investment case all rests on the group’s “cutting edge”, “market leading products” and “hugely dominant market share,” according to Lund-Yates. “Nvidia relies on a small number of customers for the bulk of its revenue, but these are high calibre names, who have a lot to lose by dabbling with lesser proved chip technology,” she adds.

Indeed, generative AI requires enormous computing power to work, and Nvidia’s chips facilitate this. They can carry out technical processes faster and with greater energy efficiency than many competitor chips. The company describes itself as having “pioneered accelerated computing to tackle challenges no one else can solve”.

Some valuation-focused investors might worry that Nvidia – and Big Tech in general – has entered a bit of a bubble. But investors believe AI will revolutionise the world around us. It’s these future opportunities that they are pricing in.

Of course, there are risks associated and a regulatory clampdown could create headwinds. There are also concerns that AI is too energy-hungry, and that electricity grids might not be able to cope. We explored this topic in a recent MoneyWeek article: Should you invest in the US stock market and will Big Tech crash?

Another risk for Nvidia investors is that the market becomes more competitive – a challenge Tesla is facing at the moment.

As the AI revolution wages on, other chipmakers will continue to invest in their technology in an attempt to snap at Nvidia’s heels, even if they’re not quite there yet. Competitors include the likes of Intel, Advanced Micro Devices and Qualcomm.

What’s happening with Nvidia’s stock split?

As well as hitting the $3 trillion mark, Nvidia is in the headlines this week with a stock split. On Friday 7 June, common stock investors will see each of their shares divided in ten.

The company explains that this should “make stock ownership more accessible to employees and investors”. At the time of writing (prior to the split), a single share costs more than $1,200.

Once the stock split is carried out, Nvidia’s share price will fall – but Mould points out that investors shouldn’t panic. “The market value of the business won’t change, just its share price,” he explains. It is a technical event.

Sometimes, stock splits can encourage a period of outperformance as they attract a wider pool of investors by making shares more affordable. That said, many trading platforms have offered fractional shares in recent years, helping get around the affordability problem.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Katie has a background in investment writing and is interested in everything to do with personal finance, politics, and investing. She previously worked at MoneyWeek and Invesco.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how