The investments to buy when markets start to crack

Rising inflation has central bankers between a rock and a hard place. Here’s how to protect your wealth, says Philip Pilkington.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The debate over whether inflation is transient or not is coming to an end. Most economists and central bankers have woken up to the fact that it may stick around for longer than they first thought. Price rises and shortages now seem to be building on themselves. Even The Daily Star recently highlighted arbitrage in the eBay market for Walkers crisps under the headline “Crisps Crisis”. Central banks are bracing themselves accordingly.

A few months ago, the inflation debate was all about whether inflation was “transient” and due to short-term price increases driven by economic reopening; or structural and caused by deep economic disruptions caused by government responses to the pandemic. I had thought it was the former, but by September, I had changed my mind. Since then even more evidence has emerged to back the “structural” case.

Team transient is on the ropes

The first thing we would expect if inflation were being driven by government responses to the pandemic is that supply chains would be disrupted. That is, the smooth flow of goods through the market would be impeded by various interventions and regulations, resulting in shortages and price rises. This is exactly what we are seeing.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Consider the Baltic Dry index (BDI). This tracks the prices paid for the transport of dry bulk materials across the global economy – this is the beating heart of global supply chains. The BDI first spiked in May, with the index surging by more than 400% year-on-year. This sounds extreme, but it’s not unusual when the global economy enters and then exits a recession – in November 2009, as the global economy began rallying from the financial crisis, the BDI rose by more than 320%.

Yet today, the BDI remains stubbornly high – up more than 150% on last year. And global supply disruptions can be clearly seen just by looking at the ships queueing to enter ports in the US.

Vaccine mandates could drive wages much higher

There are also early signs of a wage-price spiral. These occur when prices rise, and workers bid wages higher to maintain their spending power. Companies then raise prices even further to offset rising wage bills. This is how inflation becomes deeply ingrained in the economy.

In the US, small businesses are now facing spiralling input costs plus record numbers of planned pay rises, reports the NFIB Small Business Association. This is no surprise given that the producer price index, which tracks the prices faced by producers (also known as “pipeline” inflation) is rising at its fastest rate since 1981, while the consumer price index rose at an annual rate of 6.2% in October, the highest since 1990.

The situation looks set to get worse. I recently asked some economist acquaintances based in the US about the impact they thought the Biden administration’s vaccine mandate would have on the labour market. They guessed that only around 1% of the workforce would be affected. But when public sector workers became subject to mandates in New York at the end of last month, nearly 10% of them were still unvaccinated.

As these mandates spread through the private sector, the disruption could be catastrophic. With large numbers of workers effectively “locked out” of work in certain sectors, wages are almost certain to rise.

Mr Market forgets the long cycle

After slumbering through the initial inflationary signs, markets are starting to react – and quickly. At the start of September, markets expected the US Federal Reserve to have raised the key US interest rate to 0.5% by August 2023. By the end of October, the market had pulled that forward to December 2022, with a rate of around 1% predicted for August. In short, markets are pricing in faster central bank responses almost every few days.

Yet – as anyone who has observed markets for more than a few months will know – markets have short memories. Talk of inflation is in vogue these days. But back before the pandemic, the hot topic was the fragilities that low interest rates had introduced into markets. The economic cycle had lasted a long time. In the first quarter of 2020, before the virus became an all-consuming obsession, the US economy had seen ten years of consistent growth.

To put that in perspective, the previous cycle had only lasted six years. Low interest rates along with this long cycle gave financial markets ample time to load up on borrowing. Private debt-to-GDP in the US rose from its cyclical low of 204% in 2014 to 218% in 2019 – not far off its peak of 225% in 2009. There was talk of an “everything bubble”, generated by the long cycle and low rates.

A generous assessment of the market’s seeming forgetting of this entire period is that we had our recession in 2020. But in a proper recession, you expect to see financial markets crash, bankruptcies soar and borrowing rates crater. That’s not what happened last year. Financial markets briefly slid, but quickly rallied. Bankruptcies rose, but not to levels typically seen in recessions. Meanwhile, borrowing grew substantially; US private debt-to-GDP hit a new record high of 235%.

A central banker’s dilemma

Central bankers meanwhile seem less keen on rate rises than markets imply. Historically speaking, this is unusual. Central bankers (in theory at least) view their main job as being to control inflation. This usually leads them to overreact to inflation, not under-react.

So why are they apparently relaxed today? Some argue that after a decade of stagnation, central banks have become fixated on the prospect of deflation and are ignoring the risk of inflation. There may be some truth to this. But it’s probably more accurate to say that central bankers understand only too well what an extended period of low interest rates has done to the financial system. Any sober assessment leads to an obvious conclusion: markets have become overextended due to low borrowing costs and are now very fragile.

In short, central banks are between a rock and a hard place. A decade of unrestrained monetary easing has encouraged markets to throw one of the wildest parties in memory. But now, because of government responses to the pandemic, supply chains are collapsing and inflation ticking up. Do central banks raise rates to try to choke off inflation – but risk a financial crisis? Or do they sit tight and wait for supply disruptions to heal themselves – but risk potential spiralling inflation?

So far, they have opted for the latter, vaguely signalling that they will end the most aggressive monetary easing of the pandemic period, but remaining wary of promising too much by way of higher rates. How long can they maintain this stoic but somewhat insincere posture? Probably not long.

Wait until the yield curve inverts, then buy bonds

How should investors react? An environment of rising rates is best viewed as one of rising risk. As rates rise, the risk of the economy falling into recession or markets blowing a gasket rises too. If risk is rising, the answer for investors is to become more conservative. As the old investing adage has it: the best way to make money is to first ensure that you don’t lose it.

Becoming more conservative in a riskier environment should not be viewed as a cop out, however. Stuffing money under the mattress might be better than aggressively borrowing it and throwing it at the most overvalued stocks – but it is still less than optimal. The ideal would be to find an asset class where investors can shelter and profit while waiting for the storms to pass. Played properly, US government debt – Treasury bonds – can do just that.

That may come as a surprise. After all, Treasury bonds will initially lose value as interest rates rise – bond prices and rates move inversely. But at a certain point, rates will hit a maximum (which is probably not that high given current levels of debt). Typically, this happens around about the time that the economy and markets start to stutter. At this point, the central banks will switch toward easing.

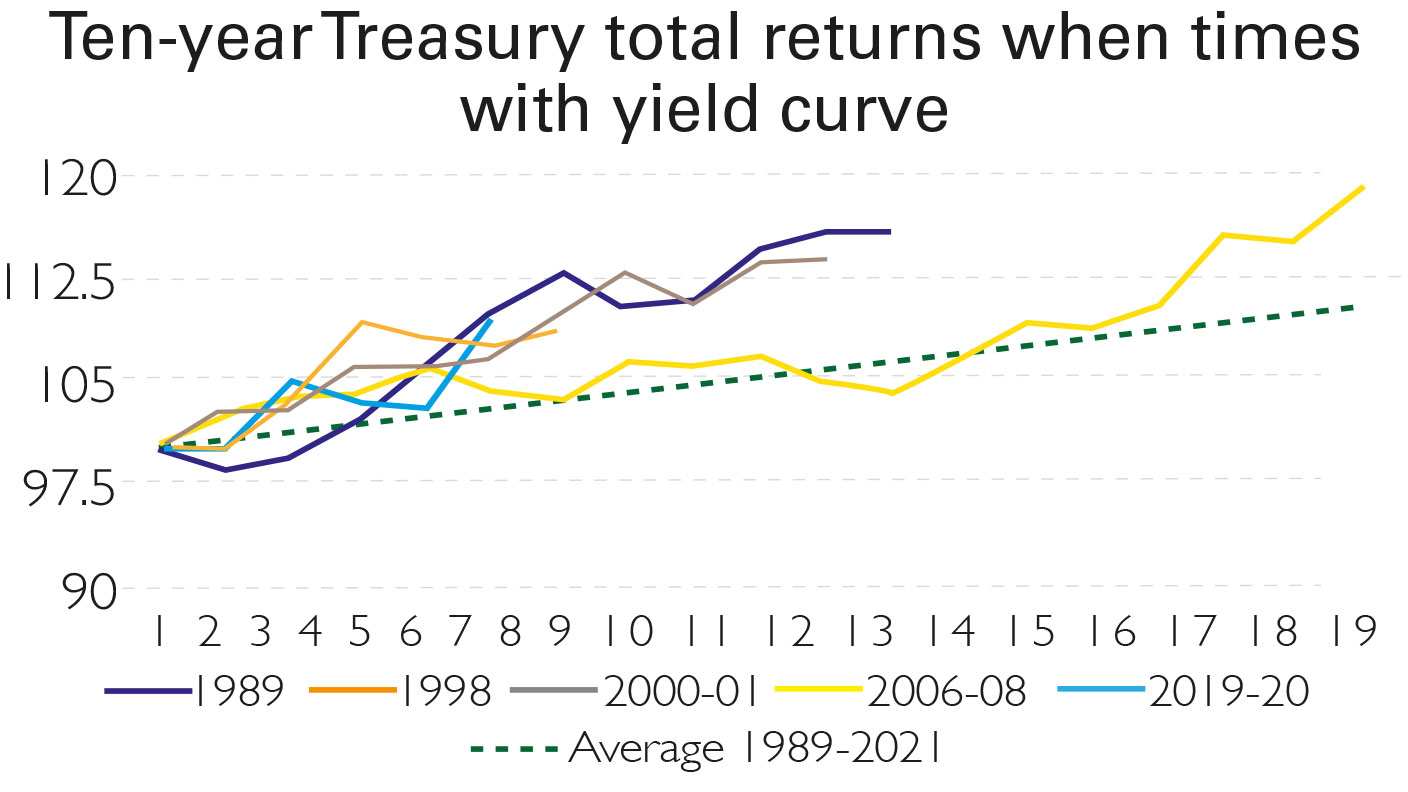

Timing markets is usually a mug’s game. But in this case, historical data shows us an unusually clear signal as to when this takes place. It is at the point at which the yield curve inverts. A yield-curve inversion takes place when interest rates on short-term bonds rise above interest rates on long-term bonds, implying that markets believe a recession is coming. Investors usually pay closest attention to the gap between the three-month Treasury bill rate and that on the ten-year bond. The chart below shows what has happened on the last five occasions that investors bought ten-year Treasuries in the first month of the yield curve inverting.

As you can see, returns on US Treasuries when bought on this signal are typically higher than they otherwise would be (dotted line). Within six months of a yield curve inversion, returns on ten-year Treasuries are usually around 10%. After a year, they are typically around 15%. To get even more dramatic effects – albeit while running more risk if the strategy does not work – an investor can buy even longer-dated Treasuries; say, 30-year bonds. Note that this strategy is far more reliable in US government bond markets than in the UK.

Using US bonds also gives investors exposure to the US dollar, which usually rises in value when financial turbulence raises its ugly head. Past returns do not guarantee future returns – history is never a perfect guide. But using a yield-curve-led strategy to buy US Treasuries is logical and has paid out in previous cycles.

Philip Pilkington is a macroeconomist and investment professional. He is the author of the book The Reformation in Economics and blogs at Fixing the Economists and on Twitter @philippilk

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Philip Pilkington is a macroeconomist and investment professional. He is the author of the book The Reformation in Economics, and blogs at Fixing the Economists and on Twitter @philippilk

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton