Are European stocks too cheap to ignore?

European stocks have enjoyed a surprisingly strong start to the year, with investors piling in despite the many problems facing the continent.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Europe finds itself “in the midst of a perfect storm”, says The Economist. Growth faces “stiff headwinds” and electorates are “routinely tossing their leaders overboard”. Donald Trump is planning tariffs. Europe’s catalogue of problems is long, says Simon Nixon in the Financial Times. Growth has “stalled”, regulation is “burdensome”, energy prices are “high” and manufacturing is under pressure from China.

Yet with so much pessimism around, there is a “very low bar” for positive surprises that could boost stocks. So what might go right? Unexpectedly large interest-rate cuts by the European Central Bank (ECB) would help. On the political front, an end to the war in Ukraine could improve sentiment. Finally, German elites are slowly coming around to the idea that the country must reform its self-defeating “debt brake”, which has long been an obstacle to higher growth.

A large Chinese stimulus in 2025 would also boost European equities, says Frédérique Carrier of RBC Wealth Management. The Middle Kingdom is a “key export destination” for the continent’s goods.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

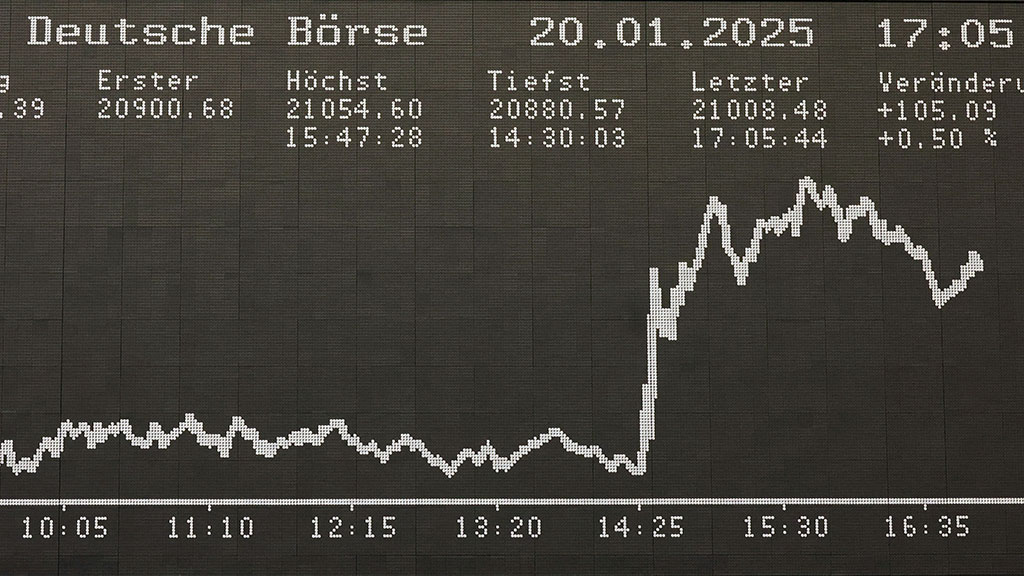

A strong start to 2025 for European stocks

Economic sentiment is “on the floor” in Germany, yet European stocks have enjoyed a surprisingly strong start to the year, says John Authers on Bloomberg. The DAX index is up 7% already this year, with France’s CAC 40 not far behind. Bank of America’s latest monthly survey shows global fund managers have raised their “European weighting… by the most in any month since 2015”. It seems the continent’s stocks have simply become too cheap to ignore, giving a substantial “margin of safety” for investors. As Andrew Lapthorne of Société Générale notes, MSCI Europe is trading at a record 40% discount to US stocks on a forward price/earnings basis.

Germany has been in recession for the past two years, yet the country’s stocks have been the best-performing major European market over that period, says Pierre Briançon for Breakingviews. The blue chips of the DAX are large multinationals geared to global growth. Only a fifth of the DAX’s sales actually originate in the home German market, with 24% from America and 18% from China.

But a looming tariff war with Trump could soon choke off that release valve. Escaping Germany’s “grim economic reality” is becoming harder and harder for investors. DAX earnings look to have fallen by 9% for the full year 2024, according to a note from Deutsche Bank, with declines driven mainly by plummeting car-industry earnings.

Nevertheless, earnings look set to enjoy a “strong recovery” in 2025, with 11% year-on-year growth powered by technology, industrial and financial shares. Analysts’ year-end target for the DAX is 23,000 points, a further 7% gain from the current level.

This article was first published in MoneyWeek's magazine. Enjoy exclusive early access to news, opinion and analysis from our team of financial experts with a MoneyWeek subscription.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

One million more pensioners set to pay income tax in 2031 – how to lower your bill

One million more pensioners set to pay income tax in 2031 – how to lower your billHundreds of thousands of pensioners will be dragged into paying income tax due to an ongoing freeze to tax bands, forecasts suggest

-

Stock market circuit breaker: Why did Korean shares pause trading?

Stock market circuit breaker: Why did Korean shares pause trading?The fallout from the conflict in the Middle East hit the Korean stock market on 4 March, with shares forced to temporarily stop trading. What is a stock market circuit breaker, and why did the KOSPI trigger one?

-

Three Indian stocks poised to profit

Three Indian stocks poised to profitIndian stocks are making waves. Here, professional investor Gaurav Narain of the India Capital Growth Fund highlights three of his favourites

-

UK small-cap stocks ‘are ready to run’

UK small-cap stocks ‘are ready to run’Opinion UK small-cap stocks could be set for a multi-year bull market, with recent strong performance outstripping the large-cap indices

-

Hints of a private credit crisis rattle investors

Hints of a private credit crisis rattle investorsThere are similarities to 2007 in private credit. Investors shouldn’t panic, but they should be alert to the possibility of a crash.

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge

-

‘Why you should mix bitcoin and gold’

‘Why you should mix bitcoin and gold’Opinion Bitcoin and gold are both monetary assets and tend to move in opposite directions. Here's why you should hold both

-

Invest in the beauty industry as it takes on a new look

Invest in the beauty industry as it takes on a new lookThe beauty industry is proving resilient in troubled times, helped by its ability to shape new trends, says Maryam Cockar

-

Should you invest in energy provider SSE?

Should you invest in energy provider SSE?Energy provider SSE is going for growth and looks reasonably valued. Should you invest?

-

Has the market misjudged Relx?

Has the market misjudged Relx?Relx shares fell on fears that AI was about to eat its lunch, but the firm remains well placed to thrive