Commodity prices spike on supply fears

The price of commodities including oil, gas, metal and wheat are soaring because of Russia's invasion of Ukraine.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

“The global oil market is suffering what’s starting to look like the biggest disruption since the 1990-1991 Gulf War,” says Javier Blas on Bloomberg. Brent crude oil prices hit $110 a barrel early this week, their highest level since 2014, and other signs of strain are appearing. Russian oil usually trades at a few dollars discount to the Brent benchmark, but that has since widened to more than $18. Oil refineries are thought to be “self-sanctioning” – refusing to deal in Russian oil for fear of legal complications even if they are technically allowed to do so. That could see as much as two million barrels per day of Russian oil drop off world markets, worsening the existing shortage.

Meanwhile, Russian gas continues to flow to Europe through Ukrainian pipelines, says Adrien Pécout in Le Monde. At the outbreak of hostilities “the market anticipated that everything would suddenly cut off, then it calmed down, because the fundamentals of supply and demand are still there”, says Nicolas Leclerc of broker Omnegy. However, prices remain “very volatile”. European wholesale gas prices spiked towards €135 per megawatt hour last week but have since fallen to around €117, still short of December’s €188 record high.

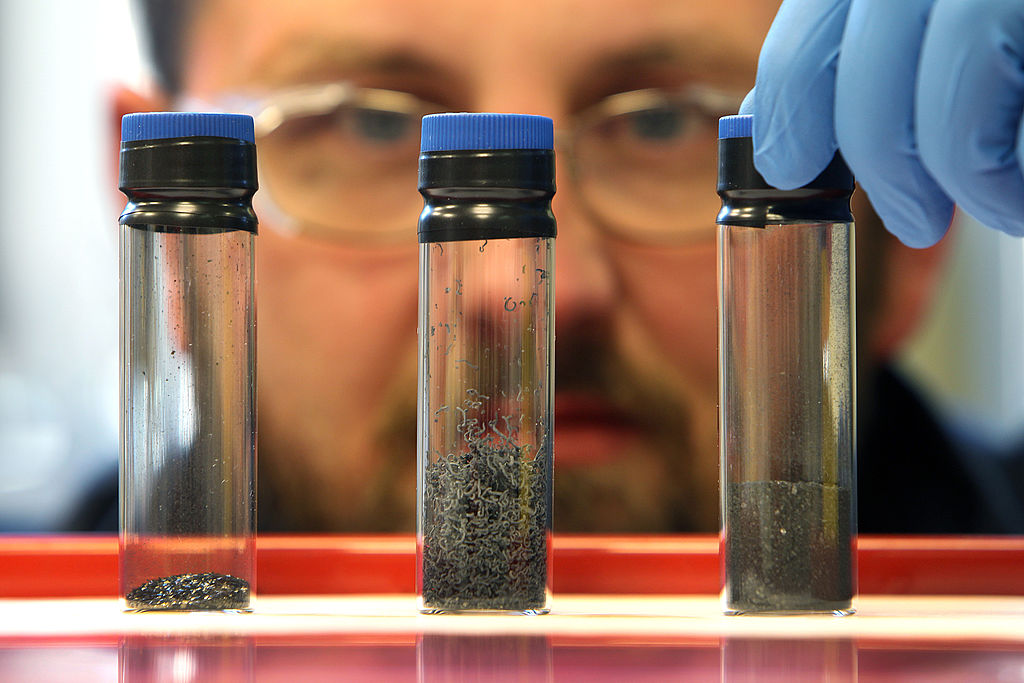

Russia is also a “big supplier of aluminium and nickel, and produces about 40% of the world’s palladium”, says Jon Yeomans in The Sunday Times. That explains why aluminium hit a record high of $3,525 a tonne this week. Some other disruptions are more surprising: Ukraine, is a major supplier of “neon gas, used in microchips”. Russia is the world’s biggest wheat exporter, with Ukraine in fourth place. Wheat prices traded in Chicago are up 30% this year. Higher food prices are “certain to make day-to-day life harder for ordinary people across the world”.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn

-

Silver has seen a record streak – will it continue?

Silver has seen a record streak – will it continue?Opinion The outlook for silver remains bullish despite recent huge price rises, says ByteTree’s Charlie Morris

-

'Investors should brace for Trump’s great inflation'

'Investors should brace for Trump’s great inflation'Opinion Donald Trump's actions against Federal Reserve chair Jerome Powell will likely stoke rising prices. Investors should prepare for the worst, says Matthew Lynn

-

The state of Iran’s collapsing economy – and why people are protesting

The state of Iran’s collapsing economy – and why people are protestingIran has long been mired in an economic crisis that is part of a wider systemic failure. Do the protests show a way out?

-

Why does Donald Trump want Venezuela's oil?

Why does Donald Trump want Venezuela's oil?The US has seized control of Venezuelan oil. Why and to what end?

-

The graphene revolution is progressing slowly but surely – how to invest

The graphene revolution is progressing slowly but surely – how to investEnthusiasts thought the discovery that graphene, a form of carbon, could be extracted from graphite would change the world. They might've been early, not wrong.

-

Stock markets have a mountain to climb: opt for resilience, growth and value

Stock markets have a mountain to climb: opt for resilience, growth and valueOpinion Julian Wheeler, partner and US equity specialist, Shard Capital, highlights three US stocks where he would put his money

-

Metals and AI power emerging markets

Metals and AI power emerging marketsThis year’s big emerging market winners have tended to offer exposure to one of 2025’s two winning trends – AI-focused tech and the global metals rally

-

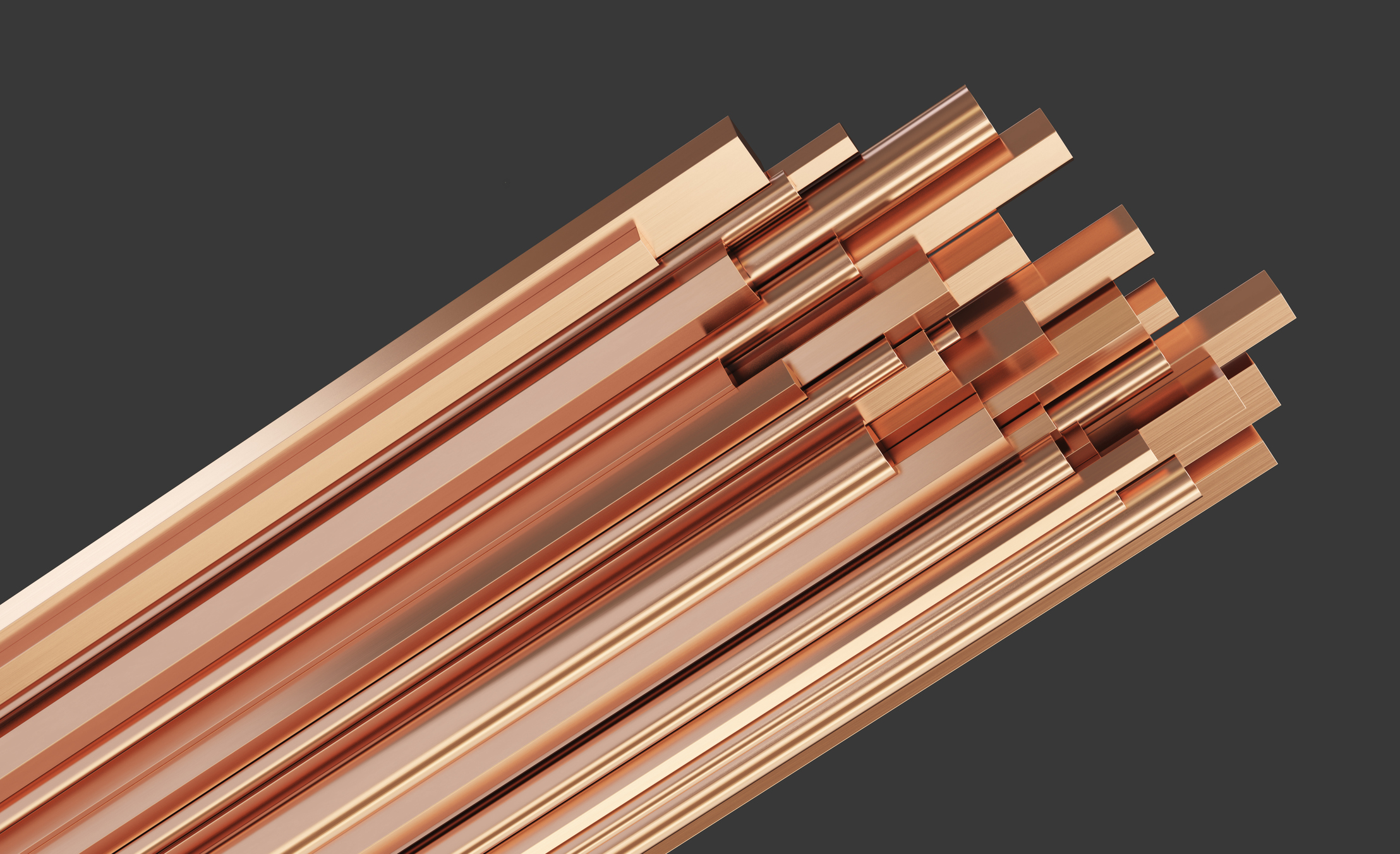

King Copper’s reign will continue – here's why

King Copper’s reign will continue – here's whyFor all the talk of copper shortage, the metal is actually in surplus globally this year and should be next year, too