Chart of the week: UK households’ aversion to equities

Personal share ownership in the UK stands far below other countries, and this could be holding back the country’s growth.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The British obsession with cash savings and property means many are missing out on stock market returns and are seeing their wealth eroded by inflation.

Many of us will have exposure to the stock market through our pensions, but when it comes to investing directly in equities, the UK is behind its international counterparts.

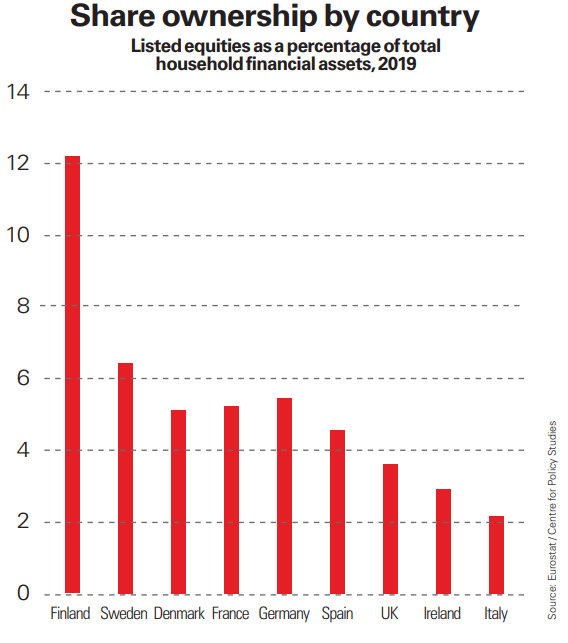

UK households have less than 4% of their financial assets in shares, according to an analysis by the Centre for Policy Studies (CPS).

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That compares with around 5% in many other European countries such as Denmark, France, Germany and Spain.

Across the pond in the US, an estimated 36% of household financial assets are in equities, which is seen as a reason its stock market is so huge.

Britain’s weak equity culture means FTSE-listed companies are starved of investment, plus the CPS report by Nick King warns the £1.8 trillion that is instead held in savings accounts is being eroded by inflation.

Retail investors control just 21% of UK assets under management, the lowest percentage in Europe, according to the CPS.

Even with the chance to invest in the stock market and earn returns tax-free through a stocks and shares ISA, more are opting for the cash tax wrapper.

There were eight million Cash ISAs taken out in 2020/1 compared with just 3.5 million Stocks and Shares ISAs.

“We need to educate about investing, provide more options, reduce fees, and encourage competition among advisers through open banking,” says Stuart Crispe, of financial services directory Sunny Avenue.

And there is a precedent for encouraging the public to invest.

A new generation of retail investors was born in the 1980s when Margaret Thatcher sold off British Gas and the public was encouraged to buy shares as part of the firm’s public listing in the famous “Tell Sid” advertising campaign.

The CPS suggests a modern version of this could get savers excited about shares again.

It also suggests a proportion of new equity offered through initial public offerings should always be made available to retail investors, while rules around financial disclaimers should be revised to emphasise and embrace personal responsibility.

Ross Lacey, director at Fairview Financial Management says it is key to understand the differences between investing in a handful of company shares compared with a diversified portfolio across different countries and industries.

“Investing in shares also comes with the inevitable periods where their values will fall significantly and without warning,” he says.

“Being prepared for this, both in terms of knowing what's ‘normal’ to expect, and also how to structure a financial plan that allows for these periods are the keys to successful investing.

“Ultimately the reason we encourage our clients to invest is so they can retire earlier, spend more money and do more of what they love and less of what they don't.”

Join us at the MoneyWeek Summit on 29.09.2023 at etc.venues St Paul's, London.

Tickets are on sale at www.moneyweeksummit.com

MoneyWeek subscribers receive a 25% discount.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Marc Shoffman is an award-winning freelance journalist specialising in business, personal finance and property. His work has appeared in print and online publications ranging from FT Business to The Times, Mail on Sunday and the i newspaper. He also co-presents the In For A Penny financial planning podcast.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how