Carbonados: the enigma of black diamonds

Chris Carter reports on the extremely rare black diamonds that fetch millions at auction.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Provenance is usually one of the first things auction buyers want to know. But when it comes to the Enigma, a 555.55-carat Fancy Black Natural Colour diamond that went on sale with Sotheby’s earlier this month, that is a mystery. The prevailing theory is that it came from outer space, either from a meteoric impact or from a diamond-bearing asteroid that collided with Earth, says Sotheby’s. That event probably took place some time between 2.6 billion and 3.8 billion years ago. What we do know is that it is big. The Guinness Book of World Records certified the Enigma as the world’s largest cut diamond in 2006.

Black diamonds are only found in two places on Earth – Brazil and the Central African Republic. Both locations were once connected on the supercontinent of Rodinia. The diamonds are also known as carbonado, after the Portuguese word meaning burnt or carbonised – the first miners to find them in eastern Brazil in the 1840s named them for their sooty appearance. That these rare diamonds come from such a localised area adds credence to the meteor theory. They also contain traces of osbornite, a mineral only found on rocks that originated far off in space.

Not everybody subscribes to the interstellar theory, says Maya Wei-Haas in National Geographic. But the presence of sponge-like holes, found in all carbonados, suggests the diamonds couldn’t form deep in the Earth’s mantle, like most diamonds, as they would be crushed by the enormous pressure. Others contend that the cavities were once filled with other minerals that have since washed away, or that they are, in fact, fossils of the creatures that first inhabited our planet. Either way, black diamonds are certainly tough, which is why they have been used as drill bits and industrial abrasives.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

It took three years to shape the Enigma’s 55 facets in a process that Sotheby’s describes as “near impossible”. Such a unique diamond was sold by Sotheby’s without reserve. It sold for almost £3.2m.

Generally, though, it’s the more colourful diamonds that fetch the highest bids – and blue diamonds, in particular, really sparkle. Take the De Beers Cullinan Blue, a Fancy Vivid Blue diamond, as graded by the Gemological Institute of America (GIA), the highest possible colour rating. Blue diamonds are already the rarest of coloured diamonds. Of these, only 1% are awarded the coveted grading, and the Cullinan Blue, at 15.1 carats, is big too. No blue diamond over 15 carats has ever appeared at auction, which is why Sotheby’s expects it to make around $48m in late April. It could even overtake the $48.5m fetched by the 12-carat the Blue Moon of Josephine in November 2015, when it became the most expensive diamond per carat.

Napoleon’s trinkets

A jewel-encrusted sphinx talisman (above), purported to have belonged to Napoleon, is to be auctioned in the US on 4 March, with a “jaw-dropping” estimate of $150m-$250m, says Ben Davis on Artnet News. Art historian are sceptical.

The story, according to an official website, begins in late 2004, when the present owner, Glenn Randall “Randy” Jensen, came across it listed on eBay. The seller’s father had dug it up in the Netherlands as a teenager and Jensen was able to obtain it in exchange for a set of golf clubs. Jensen set about decoding the Rosicrucian (referring to the spiritual movement holding that a “secret wisdom” has been handed down through a brotherhood since antiquity) symbols on the sphinx. The 114 precious stones, plus the quartz crystal sphinx, can be expressed as “114 + 1”, with the central “14” representing the 14th letter of the alphabet, N. The 1s either side added together equal two, representing the second letter of the alphabet, B – the initials of Napoleon Bonaparte.

The website calls on a number of “experts” to back up the claim, including 1950s singer Pat Boone. Another is mathematician Shih-Chuan Cheng of Omaha’s Creighton University. His probability analysis produced 27 factors listing the arguments that tie the talisman to Napoleon, under the heading “It’s a mathematical impossibility to disprove the authenticity of the Talisman of Napoleon Bonaparte!” Then, two weeks ago in a press release, the sellers announced “a remarkable twist” – the “discovery” of a Rosicrucian medal that had belonged to Napoleon, stolen from The Briars Museum in Australia in 2014, with a number of similarities to the talisman. “The two treasures are connected beyond mere coincidence,” notes the release. Never mind what happens at the auction, says Davis – “what a story!”

Auctions

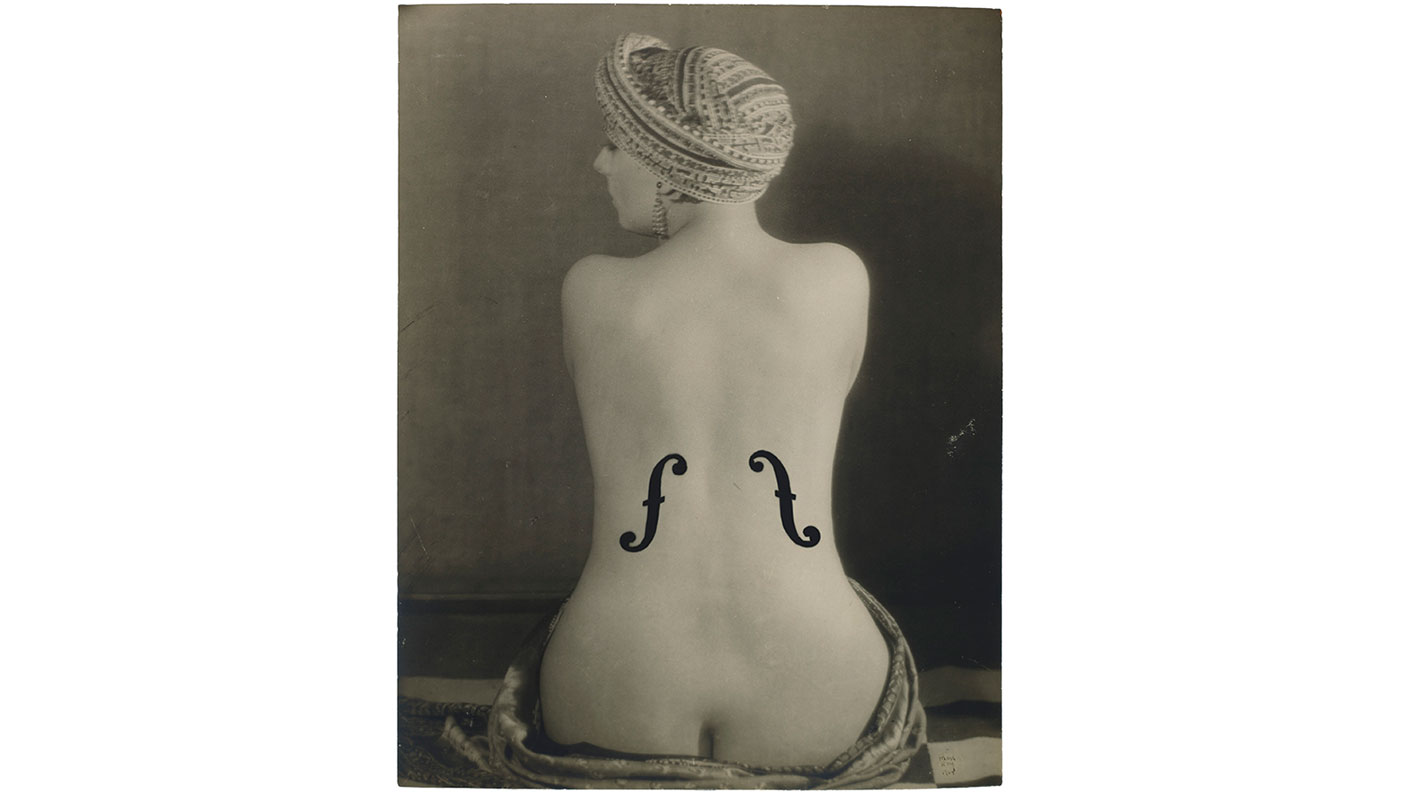

Going… The original photograph of Le Violon d’Ingres (pictured), surrealist artist Man Ray’s masterpiece from 1924, of a nude woman whose back is adorned with violin markings that emphasise her hourglass figure, is to be sold with Christie’s in May, says The Wall Street Journal. The title of the photo is a French idiom for “hobby”, referring to painter Jean-Auguste-Dominique Ingres’s famous wish to be known for his violin-playing. How it fares at auction “should offer a fresh test of demand for surrealist works and vintage photography overall”. It is expected to sell for at least $5m.

Gone… A rare photograph of a teenage Princess Elizabeth and her sister, Princess Margaret, in costume for a pantomime at Windsor Castle, sold at auction for £800 with Cambridgeshire auctioneers William George last month, says ITV News. The future Queen, then aged 18, was acting the part of Lady Christina Sherwood in a 1944 performance of Old Mother Red Riding Boots, which had been put on for the benefit of the armed forces and local children. Princess Margaret, aged 14, played the Honourable Lucinda Fairfax. The photograph and accompanying programme and ticket had belonged to Stanley Williams, the former superintendent of Windsor Castle.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Three key winners from the AI boom and beyond

Three key winners from the AI boom and beyondJames Harries of the Trojan Global Income Fund picks three promising stocks that transcend the hype of the AI boom

-

RTX Corporation is a strong player in a growth market

RTX Corporation is a strong player in a growth marketRTX Corporation’s order backlog means investors can look forward to years of rising profits

-

Profit from MSCI – the backbone of finance

Profit from MSCI – the backbone of financeAs an index provider, MSCI is a key part of the global financial system. Its shares look cheap

-

'AI is the real deal – it will change our world in more ways than we can imagine'

'AI is the real deal – it will change our world in more ways than we can imagine'Interview Rob Arnott of Research Affiliates talks to Andrew Van Sickle about the AI bubble, the impact of tariffs on inflation and the outlook for gold and China

-

Should investors join the rush for venture-capital trusts?

Should investors join the rush for venture-capital trusts?Opinion Investors hoping to buy into venture-capital trusts before the end of the tax year may need to move quickly, says David Prosser

-

Food and drinks giants seek an image makeover – here's what they're doing

Food and drinks giants seek an image makeover – here's what they're doingThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

How a dovish Federal Reserve could affect you

How a dovish Federal Reserve could affect youTrump’s pick for the US Federal Reserve is not so much of a yes-man as his rival, but interest rates will still come down quickly, says Cris Sholto Heaton